Our Blog

Recent:

What the Housing Market Has In Store for 2023

Two major factors are influenced the 2022 housing market - inflation and mortgage rates that have accelerated at a remarkable pace. This has caused a certain realignment of this industry, leaving many to wonder what comes next.

As a result of the Federal Reserve's efforts to contain inflation this year, mortgage rates have more than doubled – something never seen before in one calendar year. This had an immense influence on buyer behavior, supply and demand, and eventually home prices. Therefore, some buyers and sellers decided to pause their plans until market conditions became less uncertain.

So, what does all this mean for the upcoming year? Everyone desires to see stability in the market in 2023. To maintain that steadiness, we need to observe a drastic reduction on inflation rates by The Fed and secure it consistently. Let us now move forward with an expert opinion from remarkable housing market analysts about what is likely going to be seen next year!

What Will Mortgage Rates Look Like in 2023?

As we move further into the future, experts are predicting that inflation is still going to remain a key factor. High levels of inflation would lead to high mortgage rates and vice versa. However, there have been some indications recently suggesting that inflation could be easing up - but don't celebrate yet! Inflation should still be monitored in 2023 as it plays an important role in determining mortgage rates.

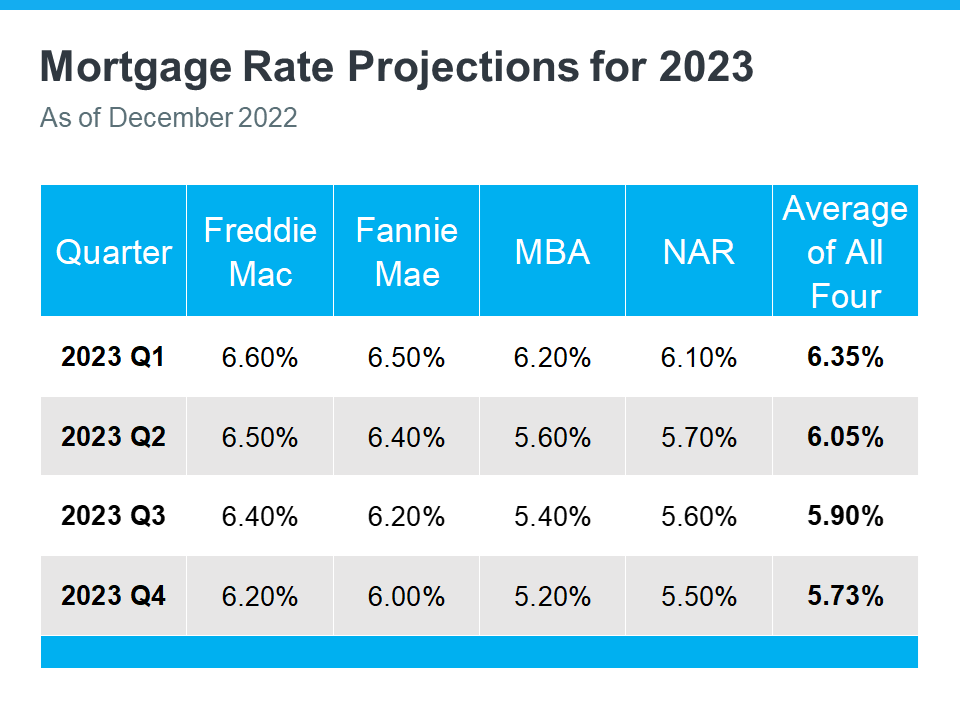

The experts have already begun to factor in all of these components for their mortgage rate predictions for the upcoming year. When we take an average of these estimates, it appears that rates should begin to plateau a bit more during 2023 between 5.5% and 6.5%. It is difficult for even the most experienced analysts to determine precisely where they will settle, yet based on our composite reading, stability seems likely (see chart below):

As a result, we can expect rates to remain stable for the time being. However, if inflationary pressures stay low, there’s potential for further rate declines in 2023. Greg McBride - Chief Financial Analyst at Bankrate - states:

“. . . mortgage rates could pull back meaningfully next year if inflation pressures ease.”

In the coming weeks, anticipate some volatility as rates could very well waver. However, if inflation is kept in check, that would be a fantastic outcome for the housing market.

What Will Home Values Do in the Coming Year?

During the pandemic, it became evident that home prices are largely dictated by supply and demand; as there were more buyers in comparison to available homes, house values went up. This is a case study on how this principle applies in real life - an expected outcome but no less impressive!

This year has been vastly different as home prices have moderated and inventory swelled due to the decrease in buyer demand resulting from higher mortgage rates. These changes are localized, particularly impacting those markets that had already become overheated. What do industry professionals think is ahead for these trends?

Subscribe to Our Newsletter

The graph below illustrates the projected home prices for 2023. As indicated by the colored bars, some specialists predict that house values will increase while others project a decrease. Nevertheless, if we take into account all of these forecasts (highlighted in green), it will give us a better understanding of what to expect next year.

It is likely that home value appreciation will remain static or neutral across the nation in 2023. Lawrence Yun, Chief Economist of NAR (National Association of Realtors), corroborates this assumption as he states:

“After a big boom over the past two years, there will essentially be no change nationally. .. Half of the country may experience small price gains, while the other half may see slight price declines.”

Final Thoughts

A reliable real estate specialist is the key to understanding what mortgage rates are in store for 2023. Throughout the year, inflation will shape how these numbers turn out - but with a trusted advisor by your side, you can keep an accurate estimate on all of this and more. Let's link up so we can stay ahead of market trends together!

12-22-2022

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans