Our Blog

Recent:

Learn 8 Critical Strategies to Help Smart Investors Avoid Costly Mistakes

As a real estate investor, it's important to always be on the lookout for ways to improve your workflow and avoid costly mistakes. In this blog post, we'll share 8 critical strategies that smart investors use to stay ahead of the game. From streamlining your research process to being more selective with your properties, these tips will help you make better investments and save money in the long run. So if you're ready to learn how to invest like a pro, read on!

Have a clear investment strategy and stick to it

When it comes to investing, having a clear strategy and sticking to it is key. Many investors make costly mistakes by jumping from one strategy to another or blindly chasing the hottest new trends. Through careful planning and staying disciplined, smart investors can use an effective strategy to maximize their returns and minimize their risk. Having a defined investment roadmap allows you to make educated decisions along your journey and have confidence in where you are headed. Knowing what your goal is and having an outline for how you plan on reaching that goal will ensure the best possible outcome in any given situation.

Do your homework - know what you're buying and why you're buying it

Smart investors know that the key to being successful is doing your homework. Know what you're buying and why - and never jump into a decision blindly. Don't rely on other people's opinions - do the research yourself and make sure the financial instrument lines up with your long-term investment goals. There are plenty of costly mistakes to avoid and there are 8 critical strategies that can help you do just that. Don't let fear or ignorance keep you from having success. Take the time to do your homework, so you can make smart investments now and in the future!

Don't over-leverage yourself financially

One of the most important tips I can offer when it comes to taking control of your financial future is to be mindful of over-leveraging yourself. Leverage, like any tool, can be used correctly and with great benefit - or misused, leading to disaster. It's all too easy for inexperienced investors to use leverage without a clear goal in mind; this can lead to taking on too much debt that cannot realistically be paid back and creating an unmanageable financial burden. The strategies outlined in the 8 Critical Strategies will teach you how to access leverage correctly and responsibly so your investments provide the best possible return.

Understand the risks involved in any investment

Investing isn’t just about earning a profit; it’s also about protecting what you have. As a smart investor keen on success, it’s important that you understand the risks inherent in any type of investment and prepare yourself for the potential losses or delays should your predictions and strategies fail. Taking the time to understand risks and develop careful strategies can help mitigate these potential issues, saving you money as a consequence. As an added bonus, carefully considering these factors ensures that any profits you make are well earned. Put simply, understanding the risks involved in an investments is crucial for any investor looking to maximize their return-on-investment without losing capital unnecessarily.

Subscribe to Our Newsletter

Diversify your investments to mitigate risk

Being a smart investor means understanding the risks associated with investing, and taking proactive steps to mitigate them. One strategy to do this is diversification - spreading your investments across multiple assets while maintaining good returns on your portfolio. This means expanding your options beyond just shares and bonds; consider different types of assets such as property, existing businesses, cryptocurrencies, and commodities. By pooling together a diverse range of assets, you can reduce risk substantially by balancing out highs and lows in the various markets. Diversifying your investments should be one of the cornerstone strategies for any successful investor looking to grow their money in a smart way without taking on too much risk.

Be patient - don't expect immediate results or try to time the market

When it comes to investing, patience is a virtue. Too often, investors rush in and try to get rich quick; they expect immediate results and attempt to time the market perfectly. Unfortunately, this rarely yields good results. In order to truly succeed in the world of investing, it's important to be patient and understand that quick returns aren't always realistic. By following the right strategies - such as those outlined in 8 Critical Strategies to Help Smart Investors Avoid Costly Mistakes - you can better protect yourself from potential losses and build wealth slowly but surely over time.

Creating and following a clear investment strategy is critical to achieving your financial goals. At Realty we can help you develop a personalized plan that takes into account your unique circumstances and helps you avoid costly mistakes. We understand that each client has different needs and objectives, which is why we tailor our services to meet your specific goals. Contact us today at 720-463-0002 to learn more about how we can help you achieve your financial dreams.

1-27-2023

Elevate Your Homes Look Without Spending A Fortune!

If you're thinking of selling your home, you'll want to make sure it shows well. After all, first impressions matter! But you may be wondering how to make your home look like a model home without spending a fortune. Don't worry - we have some tips for you. Keep reading to learn how to make your home show like a model without breaking the bank!

First impressions matter - make sure your front yard is well-manicured and that the paint on your house is fresh and in a neutral color

When it comes to making your home show like a model, first impressions are everything. Take the time to make sure your front yard looks well-manicured and that the paint on your house is fresh, bright and in a neutral color. Opting for neutral shades when repainting or wearing down harsh colors can give potential buyers peace of mind in knowing that their new home will be timeless. Not only does an upkept front yard and paint job create an inviting entrance to your home, but it also gives you leverage during negotiations, because savvy buyers know that these features add value to their purchase. So don't wait - take the steps today to get your home ready for its big debut!

The living room is usually the first room potential buyers will see - make sure it is clean, clutter-free, and has furniture that is arranged in an appealing way

When it comes time to make your living room show like a model, don't panic. It doesn't need to break the bank. Start by getting rid of any clutter and ensuring that everything is clean and tidy. Then try arranging the furniture in different ways so you can select the most aesthetically pleasing layout, while also providing useful seating or entertainment options. Make sure all cushions, throws and pillows are on point making it feel inviting and warm; not too organised but not messy either. You want potential buyers to be salivating at the thought of having this as their pride and joy - and this small-scale model will get them there without breaking the bank.

The kitchen is another important room - make sure it is clean and organized, with no dirty dishes in the sink or on the countertops

When it comes to preparing your home for showing, don't forget about the kitchen. This room is often a major selling point for potential buyers, so making sure it looks its best is essential. Put away any dirty dishes or cluttered items so that the countertops are clear and inviting. A fresh coat of paint and some simple decor can also go a long way in helping your kitchen take center stage for your next showing. Take a few minutes to make sure your kitchen shines to show off your home's true potential!

All bedrooms should be neat and tidy, with beds made and clothes put away

When it comes to impressing potential buyers, creating a neat and tidy look for all the bedrooms in your home is essential. Starting with the bed - give it that 'hotel' feel by making it up with fresh linens and adding a decorative pillow or two. Next, ensure all clothes are put away, either folded in drawers or hung up in the closet. This goes for shoes and other small items as well. With these simple steps, even the most plain bedroom can appear model-home ready!

Subscribe to Our Newsletter

The bathroom should be sparkling clean, with no mold or mildew anywhere

When it comes to making your home show like a model without breaking the bank, many homeowners forget about the bathroom. But, having a sparklingly-clean bathroom is essential! Make sure there is no mold or mildew anywhere – reseal any grout and caulk for extra protection when needed. It may take some extra attention and elbow grease to get it just right, but the efforts will certainly be worth it in the long run. Show off that spotless bathroom with pride.

Finally, take a look at your home from the outside - are there any areas that need to be repaired or updated?

Once you've renovated your home's interior to look like a model, the next step is to take a look around the outside of your house for any repairs or updates. Whether it's repainting a fence, fixing a broken window, or trimming back trees and shrubs, these small improvements can make major waves in how inviting your home looks from the outside. And best of all, with some basic DIY skills and a bit of savings, you can have your house looking beautiful without breaking the bank.

By following these simple tips, you can make your home show like a model without breaking the bank!

Are you dreaming of creating a magazine-worthy home without having to spend a fortune? It's definitely achievable! By following simple and affordable tips, you can make your home look like it came straight from the showroom. Saving money doesn't have to mean sacrificing style. With just a few easy steps, you can turn any space into a designer showcase! The best part is that all this can be done without breaking the bank. So, don't wait any longer - start transforming your house into an interior masterpiece today!

A potential homebuyer’s first impression of your property starts from the moment they drive up. If your yard is unkempt, paint is peeling, or gutters are hanging off, it will be hard to overcome that initial negative reaction. The same goes for the inside of your house – if buyers walk into a living room that is cluttered and smells bad, it will be difficult to get them to see past that and imagine themselves living there. That’s why it’s so important to take the time to make small improvements throughout your home before putting it on the market. By following these simple tips, you can make sure that your home shows like a model and appeals to potential buyers – without breaking the bank! If you need help getting started or have any questions, give me a call at 720-463-0002 or fill out the form below and I’ll be happy to assist you.

1-25-2023

Before You Wait For 3% Mortgage Rates, Consider This

In an attempt to manage inflation, the Federal Reserve made some adjustments last year which caused mortgage rates to skyrocket from their 2021 historic lows of around 7% in October. Unfortunately, this monumental leap had a detrimental impact on prospective buyers' purchasing power, leading several people to put off making any decisions.

As the rate of inflation sees a reduction, we are seeing mortgage rates hit a lower peak than they did last year. Sam Khater, Chief Economist atFreddie Mac explains:

“While mortgage market activity has significantly shrunk over the last year, inflationary pressures are easing and should lead to lower mortgage rates in 2023.”

If you are a prospective buyer raring to purchase a home, then lower mortgage rates could be the answer to your prayers. The decrease in interest rates can help jumpstart your homeownership dreams by cutting down your expected monthly mortgage payment and boosting purchasing power. Experts have predicted that this year we will see even more of such favorable market conditions for buyers like yourself - so don't wait any longer on starting those house-hunting sessions!

Subscribe to Our Newsletter

While this creates an abundance of potential for you, bear in mind that it's unlikely those rates will drop to the unprecedented lows we saw back in 2021. Financial experts all agree that buyers shouldn't count on such a low range and Greg McBride, Chief Financial Analyst at Bankrate confirms:

“I think we could be surprised at how much mortgage rates pull back this year. But we’re not going back to 3 percent anytime soon, because inflation is not going back to 2 percent anytime soon.”

It's essential to have an attainable plan for what you envision taking place this year, and that's where the expertise of experienced real estate consultants is invaluable. You may be shocked by the effect even a slight decrease in mortgage rates has on your budget! If you're ready to purchase a home right now, today's market could afford you with more cost-effective mortgages than before--enabling you not only to find your ideal house but also beat out other buyers who are vying against each other.

Final Takeaway

Now is the perfect time to take advantage of the recent decline in mortgage rates - don't delay and wait for that dream rate of 3%. Partner with a local lender to discover how today's current rates can help you reach your buying goals. Connect with me now so we can start looking into all the fantastic options available here in our area!

1-23-2023

There are 9 Key Terms You Need to Know When Buying a Home

Buying a home is one of the biggest and most important investments you will ever make in your life. As such, it’s important to be well informed before making any decisions. Knowing what terms to look out for when buying a home can help ensure that you get the best deal possible and don’t end up getting taken advantage of by unscrupulous sellers or lenders. Here are 9 key terms you need to know when buying a home so that you can make an informed decision about where to invest your money.

Appraisal

An appraisal is used to determine the estimated value of a property and it is completed by a qualified third party. Appraisals are important when buying a home because they provide potential buyers with an objective opinion of the property’s value, which can help them decide whether or not to make an offer. Appraisers may also provide additional information about the property that can be used to help inform the buying decision.

Closing Costs

Closing costs refer to the various fees related to closing on a home or completing a real estate transaction. These costs will vary depending on the specific transaction and may include things like loan origination fees, title search costs, attorney’s fees, home inspection fees and more. It’s important to be aware of these costs so that you can budget accordingly and not get surprised by any unexpected expenses when it comes time to close on the home.

Credit Score

Your credit score is a numerical representation of how well you have handled your previous debts and financial responsibilities. Your credit score will be one of the major factors that lenders consider when deciding whether or not to approve your loan application. As such, it’s important to make sure that you maintain a good credit score before looking for a loan so that you can get the best possible rate.

Interest Rate

The interest rate is the amount of interest charged on a loan or mortgage and it is typically expressed as an annual percentage rate (APR). Your interest rate will be determined by a variety of factors including your credit score, the type of loan you are applying for and the length

Down Payment

The down payment is the amount of money the buyer pays upfront for the home. Generally, buyers will have to put a minimum of 3.5%-20% of the purchase price as a down payment depending on their lender and type of loan they are getting. The higher the down payment, the less likely it is that you will end up owing more money than the house is worth.

Subscribe to Our Newsletter

Mortgage Rate

The mortgage rate is the interest rate charged for borrowing money to buy a home. It’s important to compare rates from multiple lenders and find the one that offers you the best deal.

Pre-Approval Letter

A pre-approval letter is a document that lenders provide to potential buyers showing that they have already been approved for a loan up to a certain amount. Having a pre-approval letter can help make your offer more attractive to sellers as it shows that you are serious about buying the home and have the means to do so.

Inspection Contingency

An inspection contingency is a clause in the purchase agreement that allows buyers to have a professional inspection of the property done before closing. This helps to ensure that there are no major flaws or defects with the home and provides peace of mind for potential buyers.

Affordability Ratio

The affordability ratio is a calculation used to determine how much of your income should be dedicated to housing expenses. It takes into account things like your monthly mortgage payment, property taxes and other costs associated with owning a home. Knowing what you can reasonably afford before making an offer on a property can help ensure that you don’t end up overburdened with a mortgage payment that is too high.

Equity

Equity is the difference between the value of your home and any outstanding loans or mortgages. As you pay off your mortgage, this equity increases, allowing you to borrow against it in certain situations. Knowing how much equity you have in a property can help you plan for future expenses or even use it as leverage when negotiating with lenders.

Buying a home is an involved process that requires you to understand the various costs, credit score requirements and other factors associated with financing. By familiarizing yourself with closing costs, interest rates, down payments and mortgage rates before beginning your search for a new home, you can make sure that you are prepared and have all of the information necessary to successfully complete the purchase. Additionally, having pre-approval letters in hand as well as understanding inspection contingencies and equity levels will help ensure that you get the best deal on your dream house. With the right knowledge and preparation, you’ll be able to confidently navigate the home buying process.

1-20-2023

Guide to Selling Your Own Home Quickly and Easily

Are you searching for the best way to quickly and effortlessly sell your home while gaining top dollar? Bill Watson from Your Home Sold Guaranteed Realty is here with three compelling reasons why our services can make that possible. Our team strives to provide homeowners a stress-free experience, helping them get their homes sold as fast as possible at maximum value.

As soon as the "For Sale by Owner" sign is raised, you can bet that phones will begin ringing. Unfortunately, they won't be from potential buyers; these calls are usually coming from real estate agents who want to grab your listing for a commission. While it's appealing not to have an agent fee attached when selling one's own home, there are many challenges associated with the process—which most homeowners can confirm!

Preparing for a sale is essential, and without the right research and preparation you may find that your home languishes on the market. It's in these situations buyers often become frustrated and feel like giving up their dream of selling themselves – but it doesn't have to be this way! You too can successfully sell your own property if you put forth effort into researching what works best for attracting qualified buyers.

Achieve Maximum Value for Your Home by Pricing it Right

Establishing the right asking price is of utmost importance. If you set it too high, you will experience similar repercussions as if you had set a rate that's overly low.

When setting a price for your home, it is important to take into account the current market environment and not be guided solely by sentiment or emotion. To ensure that you establish an accurate figure for your property, compare the cost, qualities and condition of similar houses from both closeby neighborhoods as well as those which have sold in recent months.

Understanding the terms of your sale is just as crucial as price in today's market. Develop a budget for selling costs, and create a net proceeds sheet to determine what money you will make from the sale of your home. It might also be beneficial to provide such an analysis for interested buyers that request it.

Subscribe to Our Newsletter

Make Your Home an Attractive with the Right Preparations

Crafting a lasting impression is key. Ensure your home makes an unmistakably positive statement by thoroughly assessing every detail and looking at it through the perspective of a prospective buyer. Avoid overlooking essential repairs or improvements, as those same buyers won’t either! It's up to you to guarantee that your house stands out from other options on the market in a favorable manner.

Ensure You're Equipped with all the Required Legal Documentation

It's no surprise that there are numerous legal contracts and documents you need to understand, compile, and complete before closing a deal with prospective buyers. Here is an incomplete checklist of the forms necessary for legal documentation:

- Contract to Buy and Sell Real Estate

- Closing Instructions

- Colorado Mold Disclosure

- Seller's Property Disclosures

- Source of Water Addendum

- Square Footage Disclosure

- Due Diligence Documents

- Off Record Property Information

- Inspection Resolution

- Agreements to Amend and Extend

Ready to make the most out of one of life's biggest investments? Get your free copy and unlock "Sell Your Own Home", a comprehensive guide on how you can take charge. Don't wait, give us a call at 720-463-0002 and start selling without stress today!

1-18-2023

Examining Historical Real Estate Trends During Economic Downturns

Even if you don't follow the economic news closely, chances are you've heard rumors of an impending recession. While there is a multitude of elements that play into making this determination, let's trust our experts and look to what history has taught us about predicting recessions. As Greg McBride, Chief Financial Analyst at Bankrate expressed:

“Two-in-three economists are forecasting a recession in 2023 . . .”

As economic instability looms, you may be pondering the impacts of a possible recession on the housing market. To illustrate why there's no cause for alarm about what could happen to real estate during this period of uncertainty, let’s take a look at previous recessions and uncover how property prices have behaved in those times.

Despite a Recession, Home Prices May Not Necessarily Decrease.

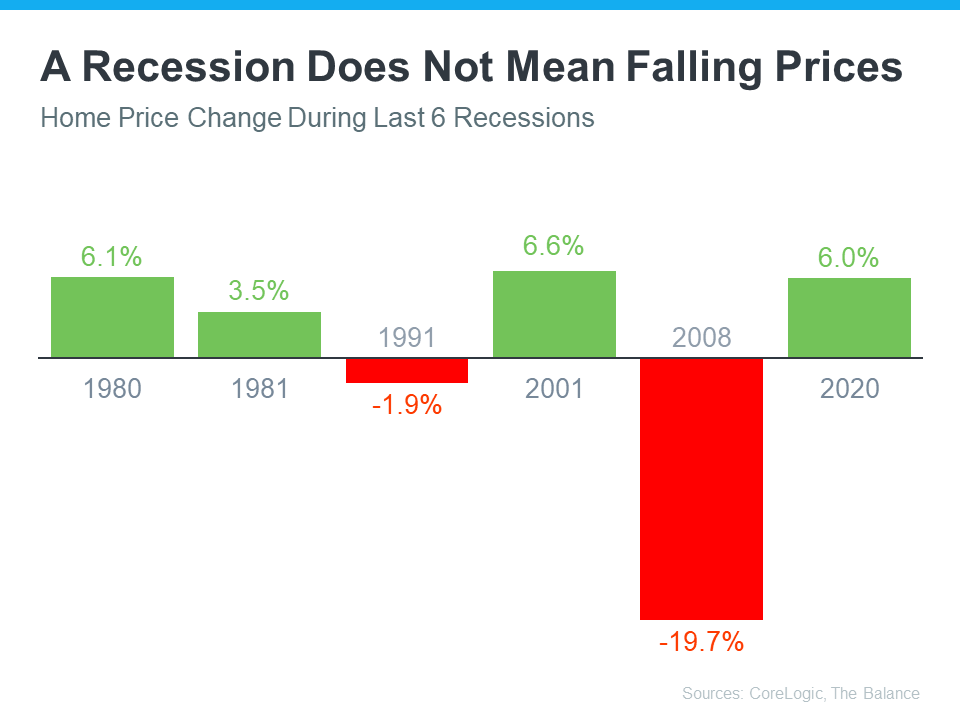

By consulting historical data, it becomes evident that home prices don't necessarily fall during a recession. The graph below displays the results of recessions going all the way back to 1980; four out of six times, there was an appreciation in housing values. This proves that when the economy slows down, one can expect their house's value not be drastically impacted and reduce significantly.

Although the 2008 housing crisis is widely remembered (as seen in the graph above), it's not likely to be a reoccurrence now. Because market fundamentals have shifted, today's housing industry isn't heading for a crash. Local areas may notice shifts in home prices, but according to experts' 2023 forecasts, overall prices will remain at an equilibrium nationally - far from its previous downfall of 2008.

A Recession Signals Dropping Mortgage Rates

Careful research illuminates how recessions might affect the cost of buying a home. As indicated in the graph below, each time there was an economic downturn throughout history, mortgage rates dropped.

Subscribe to Our Newsletter

Fortune has illuminated how mortgage rates tend to drop during an economic downturn.

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough.And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

In 2023, it is predicted by market specialists that mortgage rates will stay below the highest peak seen last year. This can be attributed to how mortgage rates usually correlate with inflation levels; recent data suggest that inflation is beginning to slow down which could lead to even lower rate numbers if this trend persists. Even though 3% mortgages may no longer be a possibility, our hope remains in the fact that there are still more ways for us to save money.

Fear not the word recession when it comes to housing. Industry professionals claim that a recession, should one occur, would be brief and the real estate market will play an essential role in facilitating economic recovery. KPMG's 2022 CEO Outlook confirms this sentiment:

“Global CEOs see a ‘mild and short’ recession, yet optimistic about global economy over 3-year horizon . . .

More than 8 out of 10 anticipate a recession over the next 12 months, withmore than half expecting it to be mild and short.”

In conclusion

Although we cannot rely solely on the past to tell us what may happen in the future, it can teach us valuable lessons. Historical evidence indicates that home values generally appreciate and mortgage rates decrease during most economic downturns.

Now is the perfect time to buy or sell a home, so if you’re considering taking the jump this year, let's connect and I will be able to provide expert advice on how the current housing market can help you reach your homeownership goals.

1-17-2023

Is It Time To Take Advantage of Your Second Homes Profits

As a result of the recent pandemic, second homes have become increasingly popular as many take advantage of their newly found flexibilities in working from home. Luxury is not simply defined by price when it comes to these homes; instead, there are several other factors that come into play such as location and features. Investopedia recently wrote an article that delved more into what this entails - for instance, having your own waterfront property or living somewhere desirable can really elevate a home's luxe qualities! With any luxury purchase, it's important to be mindful about where you invest your money: after all, if done right the perks could go beyond just feeling fancy.

The Institute for Luxury Home Marketing's (ILHM) most recent study meticulously demonstrates the tremendous effect of remote work on the appeal for second and luxury residences.

“The unprecedented ten-fold increase towards remote work since the pandemic is an historic development that will continue to fuel second home demand for many years to come.”

Have you recently purchased a second home that is no longer suitable for your changing lifestyle? If so, it may be time to let go of the property and sell it. Whether you’re transitioning back into an office or just finding other uses for your money, selling this excess asset could provide great relief!

Subscribe to Our Newsletter

Owning a luxury home is the dream of many, and with that comes buyer demand. According to The Institute for Luxury Home Marketing's report, there may even be an increased desire for these types of properties:

“. . . the last few years have left their legacy for the luxury market. While it might only represent a small percentage of the overall real estate market,luxury homeownership’s influence is growing. Not only has the purchase of homes valued over $1 million (a figure considered by the National Association of Realtors to be a benchmark for luxury) tripled from 2.6% to 6.5% since 2018, butdemand for multiple luxury properties has soared over the last two years.

This phenomenal increase has been driven by a growing affluent demographic who consider owning a luxury property a necessity in their asset portfolio.All indications are that this trend is here to stay, albeit that demand is set to return to a more sustainable level.”

Now is the perfect moment to convert that unused luxury second home into capital. There are still buyers out there in search of a residence just like yours, so don't wait any longer!

Final Analysis

Now is the perfect time to reap the rewards of selling your second home. Connect with us today and let's discuss how you can benefit from this opportunity!

1-16-2023

Uncovering the Reality Behind Negative Home Equity Reports

Home equity has been a major talking point in the realm of real estate as of late. With numerous homeowners experiencing negative equity, it's understandable if you are feeling apprehensive. Still, don't let these headlines get to you; there is help available for those struggling with their home loan payments and plenty of resources out there that can give insight into what types of options exist!

Understanding the enormity of newsworthy events can be difficult, considering headlines don't give us all the information we need. To get a broader perspective and more in-depth understanding, let's delve into one of the equity stories that have been making waves lately. By doing this, you'll obtain an informed view on what is actually transpiring and how significant it really is!

Headlines that prioritize short-term equity figures often neglect to provide the larger, long-term perspective.

As news continues to spread, one particular topic that has arisen is the percentage of homes bought in 2022 currently underwater. To put it simply, when a homeowner owes more on their loan than what the property's worth dictates and is referred to as being "underwater," which was an especially problematic issue during the 2008 housing market crash but now isn't nearly as widespread.

Currently, media reports draw their information from a Black Knight, Inc. report outlining the following:

“Of all homes purchased with a mortgage in 2022, 8% are now at least marginally underwaterand nearly 40% have less than 10% equity stakes in their home, . . .”

Let's break this down further to understand the full picture. The Black Knight report is discussing homes bought in 2022, yet headlines don't always include that time frame or give details about what an extraordinary year it was in terms of housing prices. By March-April 2022, we had reached a peak appreciation rate for home values before beginning to slow again. It's essential to comprehend these nuances when interpreting data and reports.

Subscribe to Our Newsletter

Homeowners who purchased their residence near the peak of the market or paid a premium price in its succeeding months are much more likely to be classified as slightly underwater on their mortgage. Additionally, media outlets often forget to include an essential component: "marginally". This qualifier is absolutely crucial when evaluating this scenario.

For those who acquired a home in 2022, this is an investment for the long-term. Thus, it's essential to remember that when newspaper articles focus solely on what appears profitable in the short-run without giving readers a comprehensive understanding of all circumstances involved, they are not providing you with entire context.

Generally, the longer a homeowner resides in their property, the more equity they will build by paying off their loan and taking advantage of rising home prices. However, considering current market conditions, it’s unlikely that those who recently purchased houses have earned much equity yet if they've only been residing in it for several months. Despite this factoid though-most homeowners don't intend on selling anytime soon anyways!

Let Us Assist You

It's always best to have a proper understanding of the context before making any decisions. If you're curious about real estate headlines or how much equity is in your home, we are available to help answer all your questions.

1-11-2023

5 Marketing Techniques that will Help You Stand Out and Succeed

As a real estate professional, you're always looking for ways to stand out. To up your game and make sure you remain ahead of the competition, you must use new and effective marketing techniques that help your business thrive in today’s digital world. Don’t let the market get the better of you - stay innovative with our 5 marketing techniques that will have you scaling greater heights! Read on to discover how technology is changing the face of real estate – and how it transforms your business into an industry leader.

Use online tools to get more leads

There are a number of online tools that can help you get more leads for your business. One of the most effective is Google Ads. With Google Ads, you can create targeted ads that will appear when people search for keywords related to your business. You can also use Google Analytics to track how well your ads are performing and make adjustments as needed.

Another great tool for getting leads is LinkedIn. LinkedIn allows you to create a profile for your business and connect with potential customers. You can also post updates and articles to help attract attention to your business.

Finally, don't forget about social media. Sites like Facebook and Twitter allow you to reach a large number of people quickly and easily. You can post updates about your business, offer special resources, and connect with potential buyers and sellers.

All of these tools can help you get more leads for your business. Try using them all and see which ones work best for you.

Utilize social media platforms for greater reach

There is no doubt that social media platforms are powerful tools for reaching a wider audience. By strategically utilizing these platforms, real estate agents can greatly expand their reach and connect with more potential buyers and sellers.

For example, Facebook is a great way to connect with current and potential clients. By creating a business page and posting interesting and relevant content, real estate agents can engage with their followers and build relationships. Additionally, Facebook Ads can be used to target specific demographics and interests, helping agents to connect with more people who may be interested in their service.

Twitter is also a great platform for connecting with potential clients. By tweeting about relevant topics and using hashtags, real estate agents can attract attention from people who may not have otherwise heard about them. Additionally, Twitter Ads can be used to target buyers and/or sellers, helping agents to connect with potential clients who may be interested in buying or selling a home.

LinkedIn is another social media platform that can be used to reach potential customers. By creating a company profile and publishing articles and blog posts, Realtors® can connect with potential homebuyers or homesellers who are looking for information about the real estate industry. Additionally, LinkedIn Ads can be used to target specific demographics, facilitating agents to make meaningful connections with individuals who could greatly benefit from their services.

Take advantage of technology to improve your workflow

Technology has come a long way in the last few decades, and it has completely changed the way we work. There are now countless tools and apps that can help us be more productive and efficient, which is why it's so important to take advantage of them!

One of the best ways to use technology to improve your workflow is to create a system for organizing your tasks. There are lots of different ways to do this, but one of the most popular methods is to use a task management app like Asana, Monday or Trello. These apps allow you to create lists of tasks and track their status, so you can always stay on top of what needs to be done.

Another great way to use technology to improve your workflow is to automate your tasks. For example, you can use an app like IFTTT (If This Then That) to automatically send texts or emails based on certain triggers. This can save you a lot of time and hassle, and it can help you stay organized and on top of your work.

So if you're looking for ways to improve your workflow, be sure to take advantage of the many great tools and apps that are available!

Make use of digital marketing to stay ahead of the curve

Digital marketing is one of the most important tools that real estate agents can use to stay ahead of the curve. By using digital marketing, agents can communicate with their clients in a variety of ways, including through social media, email campaigns, and website design. Digital marketing also allows agents to track their results and measure the effectiveness of their campaigns, which helps them to make changes and improvements as needed.

Subscribe to Our Newsletter

One of the most important aspects of digital marketing is using the right tools for the job. For example, if you are looking to create a social media campaign, you will need to use a tool like Buffer or Hootsuite that allows you to manage all of your social media accounts in one place. If you are looking to run an email campaign, you will need a tool like Mailchimp or Constant Contact that helps you create beautiful email newsletters.

Digital marketing is a great way for agents to stay connected with their customers and keep up with the latest trends. By using digital marketing, agents can reach a wider audience and connect with more potential home buyers and sellers than ever before.

Stay updated on the latest real estate trends

Real estate is always a hot topic, and for good reason. It can be a great way to invest your money and see a return on your investment, as well as provide a place for you and your family to live. However, like any other investment, there are risks involved in real estate. Here are some of the latest trends in real estate so that you can stay up-to-date on what's happening in the market.

One trend that's been happening lately is an increase in interest rates. This has caused a lot of buyers to back out of deals, or to buy properties they wouldn't have considered before. It's important to keep an eye on interest rates if you're thinking about buying a property, as they could rise even more in the future.

Another trend is that more people are buying properties as investments. This is especially true for millennials, who are buying more properties than any other age group. Many people are seeing real estate as a safer investment than stocks or other options, and are looking to buy property in order to rent it out or flip it for a profit.

Of course, not everyone is interested in buying property. There's also been a trend of people wanting to rent instead of buy. This is partly due to the increasing cost of buying a home, but it's also because people enjoy the flexibility that comes with renting. There are lots of great rental properties out there, so if this is something that interests you, be sure to keep an eye out for them.

Staying abreast of the current real estate trends is essential for all real estate agents. By being informed, they can provide their clients with sound advice when it comes to deciding upon a home that meets their family's needs and desires. Consequently, this helps ensure that both agent and client are satisfied with the outcome.

Real estate agents have to stay informed about the latest trends in order for them to provide their clients with the best advice and guidance. With digital marketing tools, they can reach a wider audience of potential buyers and sellers, track their results and make adjustments as needed. Furthermore, paying attention to current interest rates and rental trends are also important factors that real estate agents should be aware of when helping customers find or sell properties. By understanding these nuances of the market, real estate agents can help ensure that both themselves and their clients come out on top!

1-5-2023

January 2023 Newsletter

Exercise is a known contributor to robust health and longevity, but it's hard to know what activities are best for acheiving long life. Fortunately, the lastest edition of Service For Life newsletter has you covered: in this issue, you'll find out just which exercises experts recommend as most beneficial for living longer.

In addition to these topics, you can also expect to find helpful advice on when it's time to seek out a financial coach and what points should be considered when searching for pet health insurance. Plus, you'll discover useful tricks for making the most of your "me-time" as well as entertaining fun facts and trivia challenges!

Le me know if there is anything you need help with or have any questions about real estate, please do not hesitate to contact me. Additionally, should your family members or friends require the assistance of a knowledgeable and passionate realtor regarding buying/selling a property, feel free to let me know so I can assist them!

I'm so grateful for your friendship and referrals. I hope you get lots of value out of this issue!

Warmest regards,

Bill Watson

President / Managing Broker

Your Home Sold Guaranteed Realty - The Watson Group

6155 S Main Street, Suite 270

Aurora, CO 80016

720-463-0002

bill@watsonrg.com

www.yourhomesoldguaranteedrealtyco.com

P.S. If you ever find yourself discussing real estate, be sure to let them know about my free consumer resources so they can stay apprised of the recent market trends and make savvy investments.

SELL YOUR HOME FAST and for TOP DOLLAR! Get this FREE Report that

Reveals 27 Tips to Give You the Competitive Edge! www.Our27Tips.com

Exercises For Longer Life

It's common wisdom that regular exercise is good for our health, but what constitutes "regular?" And what kind of exercise is most beneficial? Experts often recommend at least 150 minutes of moderately intense activity each week, which they also say is best broken up into shorter sessions you can do daily. Exercising for just 20 minutes per day, can help improve your physical and mental health as well as help you live longer. Recent studies, however, indicate that longevity is even more closely linked to higher-intensity workouts and between 150-270 minutes per week, which translates to 20-40 minutes per day. There is also evidence that team sports are even better than solo activities.

But it's crucial to not turn potential roadblocks into a reason not to exercise at all—even if you don't have a gym membership or you don't like team sports, there are plenty of ways to work out at home that you'll enjoy enough to keep up with. Here are a few ideas to get your body moving daily:

- Walk: A ten-minute brisk walk is a great way to increase your heart rate, and it's short enough that you'll probably be able to squeeze in a walk on most days.

- Try a HIIT routine: High-intensity interval training (HIIT) sessions are designed to be short (typically under 20 minutes) and, as the name suggests, intense. They're an efficient way to get your heart rate up quickly while building strength and flexibility.

- Use a standing desk: Shift from sitting to standing throughout the workday with an adjustable desk and, for an added bonus, put a small treadmill under the desk so you can walk while you work.

I'ts important to remember that doing something is always better than doing nothing, so even if you aren't up for a 20-minute HIIT routine every day that doesn't mean you should throw in the towel. There's ample evidence that even a little bit of exercising on a regular basis can increase longevity. And if you don't have on already, consider getting a steps tracker. You might be surprised how much activity you do already, like mowing the lawn, vacuuming the house, shopping for groceries, and walking from meeting to meeting. Seeing the numbers go up is a great motivator.

Subscribe to Our Newsletter

HIGHLINE EAST AT DAYTON TRIANGLE

The Highline East at Dayton Triangle community by Montano Homes offers brand new paired homes that are ideal for people looking to move into a vibrant and dynamic neighborhood. With 3 bedrooms, 3.5 bathrooms, private yards and designer selected finishes combined with their affordable prices starting from the mid $600s, these Colorado Contemporary townhomes make this an incredible place to call home! Plus it's located close to Downtown Denver, DTC shopping centers and parks—what more could you want?

See What Our Amazing Fans Have to Say

Visit www.OurAmazingFans.com

Do You Need a Money Coach?

When it comes to money, most people can benefit greatly from a little bit of guidance. You probably know what a financial advisor or financial planner does. But there’s another professional you may want to add to your finance team: a money coach.

Whereas financial advisors help clients manage and invest their money wisely, money coaches look at a client’s overall financial situation and help set financial goals—like creating a family budget, figuring out a debt payment schedule, or building a nest egg.

Unlike financial advisors, financial coaches don’t need any official certification—many are social media influencers. Still, they can be helpful for people who want to have a better understanding of personal finance but don’t necessarily learn best by reading. Money coaches can turn the theoretical into practical advice focused on your specific situation. A money coach may be a good option for you if:

- Thinking about money overwhelms you or gives you anxiety.

- You’re going through a finance-changing life event.

- You’re worried you won’t achieve goals (like buying a house).

Find out the value of your home by answering a few simple questions. By providing your address and home description, the system will produce a complete market analysis through a search for similar homes sold and listed in your area.

Choosing Pet Insurance

As the cost of healthcare for pets continues to go up, having pet insurance might seem more necessity than luxury. Choosing the right pet insurance can be tricky, though, given the usual insurance fine print. Here are three of the main things to keep in mind when shopping around:

- Pet insurance typically doesnotcover preventative medicine. It’s designed to help offset the costs of treating a serious injury and/or illness, not your pet’s annual wellness exams. Some plans do cover routine care, but they’re more expensive.

- Pet insurance doesnotcover pre-existing conditions. You can still get insurance for a pet with a pre-existing condition, it will just be stipulated in your policy that it isn’t covered. Insurance companies get records from your vet to check on this.

- Pet insurance is a reimbursement system. You’ll need to pay the full veterinary bill at the time of service and get reimbursed from the insurance company based on your plan.

Ask your vet’s office for insurance recommendations. They don’t work directly with pet insurance providers, but they’ve no doubt heard positive (and negative) reviews from other customers about different providers.

AT MURPHY CREEK

Experience the perfect home at Montano Homes' Elevations at Murphy Creek. This central master-planned community grants easy access to DIA, shopping, and gourmet dining near Southlands Mall. Not only that but it is situated next to one of Colorado's finest golf courses - a links style course! With its 3 bedroom Colorado Contemporary Paired homes, you can definitely call this place your own little paradise. Welcome home to Elevations at Murphy Creek by Montano Homes!

Find out how this changing market has affected your home value! Your home may be worth more than you think.

Visit www.AccurateHousePrice.com or Call Us as 720-463-0002.

This is a FREE service with NO OBLIGATION to list.

How to Enjoy Your Own Company

Although the idea of “me time” has become more popular, there are people who equate being alone with loneliness—and no one wants that. Solitude can seem hard to find if you live in a busy city or a crowded house, but intentionally carving out time for yourself can have positive mental and physical health benefits. If, that is, you embrace being alone.

Experts say that if being alone is your choice, you’re much more likely to enjoy the solitude and less likely to succumb to loneliness. But this doesn’t mean you have to become a hermit to be happy alone. It means you’re able to find happiness in solo pursuits of your choosing— exercising, birdwatching, creating art, or even working.

If you struggle to do something you love when you’re alone, you may want to try an activity that boosts endorphin levels. After all, if you’re getting a happiness high from the activity, you’re more apt to do it again. Physical activity like gardening or beachcombing can work here (you don’t have to go to the gym to be physical), but you can also do volunteer work. Studies show volunteering makes people feel more fulfilled, and solo volunteer work may even be something you can do from home—think preparing meals for houseless people or making hats for preemie babies.

The Japanese practice of “forest bathing” is a poetic term for something research has shown time and again: Spending time in nature is very good for us. Taking a solo hike in the woods is great, but movement isn’t necessary. You could knit in the park on your lunch break or watch flickers dig for ants in the backyard. It can also be a meditative experience, immersing yourself in the natural environment to allow you to take it in with all of your senses.

Treat yourself to something special that you usually need company to justify, like dinner at a fancy restaurant or a ticket to the opera. And this doesn’t need to be expensive or even outside the home. You could cook a favorite meal, for instance, served on your good dishes. You don’t have to skimp on things you’d enjoy just because you’re flying solo.

Studies have shown your income and wealth are directly related to the size and depth of your vocabulary. Here is this month's word.

inception(pronounced in-SEP-shun) noun

Meaning: beginning, start

Sample Sentence: Anna has worn many hats since the company's inception, but that's common for startup founders.

Subscribe to Our Newsletter

Not Ready to Sell? Text your address to 720-605-1268 to find out what your home will sell for today. You will not receive a phone call, just a text!

Navigating Your Finances as a First-Time Homebuyer

Are you getting ready to purchase your first house? If so, it's essential that you address the financial planning related to this before going ahead with such a major decision. Here are some of the vital monetary points for consideration when aiming to acquire a home. Establish . . .

Kitchen Multitaskers

TV chef Alton Brown claims the only uni-tasker in his kitchen is the fire extinguisher.

Here are a few kitchen tools you may already have that can be used for other things.

- When you have rounded metal measuring spoons, you don’t need a melon baller.

- A baker’s bench scraper makes short work of cutting brownies evenly.

- Mason jars, or even clean jam and mayo jars, are ideal for shaking up homemade salad dressing.

- A spring-loaded ice cream scoop makes evenly portioned cookie dough or meatballs easy.

A Heartfelt Message to our Special Clients and Friends . . .

It is our pleasure to extend a warm welcome to all of the new clients we have had the honor of working with recently, and also offer special thanks to those who referred them. Our business would not be where it is today without your help!

Recently Sold Properties

by The Watson Group

Bel Aire Estates

Highest Closed Price for $1,165,000!

Blackstone

Sold for $1,425,000!

Tallyn's Reach

Sold for $1,015,000!

Real Estate Corner . . .

Q: What key steps should I take to make my home show like a model?

A:Look at your home through a potential buyer’s eyes. Here are three essential steps:

- Clean and repair.Your buyer’s first impression is from the street. Clean up the yard, the landscaping and check your exterior paint job. On the inside, shampoo the carpets, scrub the floors and clear off all the counters. Remove old wallpaper and paint the walls a neutral color. Fix things that need fixing, like squeaky doors, broken tiles etc.

- De-Clutter.Get rid of all that “stuff” you’ve accumulated in the garage, the backyard and the basement. And don’t forget the closets!

- “Stage” it to look like a model home.Put away your personal items and remove large pieces of furniture. Ask your REALTOR®for ways to “dress up” your home (candles, new linens etc.) to maximize your selling potential.

Do you have a question you want answered related to real estate or home ownership? Feel free to call me at 720-463-0002. Perhaps I’ll feature your question in my next issue!

Want to Win a $25 Starbucks Gift Card?

Last month's trivia question answer.

Which object does a male penguin gift to a female penguin to win her over?

(a) Ice Cube (b) Feather (c) Fish (d) Pebble

The answer is (d) pebble. When it comes to courting, a male penguin will select the smoothest of his pebble collection to present to the female with whome he would like to mate. If she approves, she will accept the pebble.

Now for this month's trivia question!

What modern technological term has etymological roots in a historic Viking leader?

(a) blockchain (b) serif (c) leading (d) bluetooth

Call Me at 720-463-0002 or Email Me at bill@watsonrg.com

and You Could Be One of My Next Winners!

1-5-2023

CATEGORIES: Newsletter

Are You Curious About How Much You Need To Set Aside For a Down Payment

As you prepare to purchase your first home, one of the foremost expenses on your mind is likely the down payment. Don't let a misunderstanding about how much you need to save deter you from this exciting milestone in life; it's easier than what some may think!

Remember That 20% May Not Always be the Norm for a Down Payment

Freddie Mac explains:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home.This myth remains one of the largest perceived barriers to achieving homeownership.”

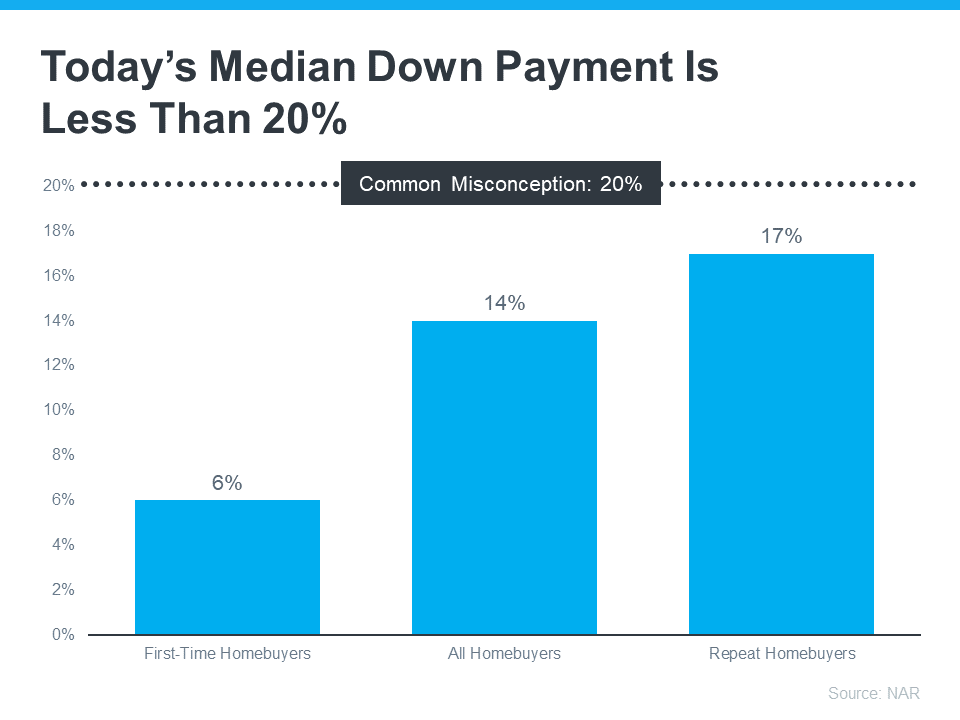

You don't have to put 20% down when taking out a loan, so you may be closer to purchasing the home of your dreams than you think. According to the National Association of Realtors (NAR), since 2005, putting more than 20% as a down payment has been uncommon and today's median is only 14%. It's even lower for first-time buyers at 6%, as seen in the graph below:

Learn about options that can help you toward your goals.

If you're still having difficulty saving for a down payment, remember that assistance is always available. A real estate expert and competent lender can demonstrate solutions to aid in accomplishing your desired milestone. The latest Homeownership Program Index from Down Payment Resource reveals there are more than 2,000 homebuyer programs in the United States designed mainly to assist with down payments. So don't hesitate to take advantage of all the help out there!

Subscribe to Our Newsletter

An FHA loan may require as little as 3.5% down, and VA or USDA loans could even be zero-down for those who are eligible! Don't miss out on these incredible opportunities to finance your dream home with minimal upfront costs.

Do your research and explore all of the available options. If you're searching for assistance with a down payment, Down Payment Resource has reliable information to help guide you. Afterwards, join forces with an experienced lender to identify what you qualify for on your home-buying journey!

Saving for a down payment on your first home doesn't have to be an intimidating process. You may not need 20% of the total cost, as many believe; in fact, the median is only 14%. There are also plenty of resources out there that can help you with financing and down payments, such as FHA loans which require 3.5%, VA or USDA loans at 0%, and more than 2,000 homebuyer programs available across America. Do your research and consult reliable sources like Down Payment Resource before enlisting the help of an experienced lender to identify what options you qualify for on your journey to homeownership!

1-4-2023

What Goals Do You Have for the Real Estate Market this Year

If owning a home is one of your goals for 2023, it's essential to understand the current housing market and set realistic objectives. Working with industry professionals will help you make your homeownership dreams come true this upcoming year! With their expertise and guidance, you can create a plan that brings your vision into focus.

In the past year, skyrocketing inflation had a significant influence on our economy, housing market, and even your pocketbook. That's why it is essential to have an in-depth comprehension of not only today’s marketplace but also what you want from it when you buy or sell property. Danielle Hale, Chief Economist at realtor.com clarifies:

“The key to making a good decision in this challenging housing market is tobe laser focused on what you need now and in the years ahead, so that you can stay in your home long enough that buying is a sound financial decision.”

As you plan for a successful 2023, here are several thought-provoking questions to help refine your objectives.

1. What Inspires you to Reach Your Goals?

There must be something driving your interest in buying a home - what is it? Despite the current market conditions, there are still plenty of powerful motives to buy right now. It could be that you have outgrown your present home, or maybe you're finally ready to take the plunge and own a space that's all yours. Use this motivation as an inspirational guide while partnering with an experienced advisor who can guarantee that your move will bring lasting pride and satisfaction.

2. Visions of Your Future Home: What Does It Look Like?

Are you planning to make a move? If so, what does your dream home look like? The housing market is booming with options right now that could make it easier for you to find the perfect fit. That said, be sure not to let your budget dreams get ahead of reality; sit down and crunch some numbers! Plus, collaborate with a reputable real estate agent who can help prioritize which features are essential and where flexibility might come into play. By understanding these dynamics upfront in detail, seeking out the ideal home will become that much simpler.

Subscribe to Our Newsletter

3. Are You Prepared To Make a Purchase?

Establishing a budget and saving money should be your priority before you delve into the home-buying process. Working with a local real estate agent or lender in advance will ensure that you are well equipped to make this purchase, such as having an idea of how much to save for a down payment, getting pre-approved for a loan, and evaluating any potential equity from selling your previous residence.

With a professional by your side, you won't have to worry about missing any steps in the process. Let an expert guide you through every step of the way and ensure that your journey is as smooth and successful as possible.

Purchasing or selling a home can be an intimidating process, especially if you don't have the proper knowledge. You're not alone in feeling this way; according to a Harris Poll survey, 20% of respondents felt that lack of information was hindering them from obtaining their desired house. This year, don't let uncertainty stop you from reaching your goals! A reliable specialist can fill in that gap and provide you with all the insight and advice needed on today's market - so make sure to get help when buying or selling your next property.

Connect with Your Home Sold Guaranteed Realty - The Watson Group today and get ready for an amazing year!

1-2-2023

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans