Our Blog

Recent:

Unraveling the Mystery of Soaring Mortgage Rates: A Comprehensive Guide

The subject of mortgage rates is a hot topic in today's housing market. As prospective homebuyers and sellers evaluate their options, two questions frequently arise: why are mortgage rates so high, and when will they decrease? To shed some light on these pertinent queries, let's delve deeper into the factors affecting mortgage rates and discuss predictions for their future trajectory.

Understanding the Surge in Mortgage Rates

The crux of understanding why mortgage rates are currently high lies in the principles of supply and demand for mortgage-backed securities (MBS). Mortgage-backed securities are investment products akin to bonds, comprising a collection of home loans and other real estate debt purchased from the banks that issued them. When you buy an MBS, you're essentially lending money to homeowners.

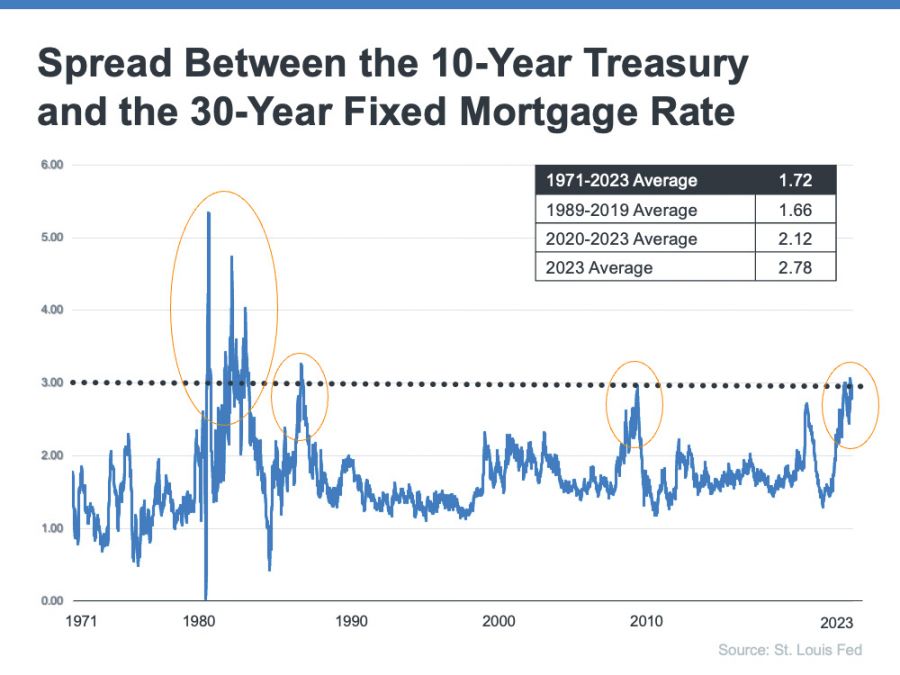

The demand for MBS largely dictates the difference, or "spread," between the 10-Year Treasury Yield and the 30-year fixed mortgage rate. The average historical spread stands at 1.72. On a recent Friday morning, the mortgage rate was at 6.85%, making the spread a substantial 3.2%. This deviation of almost 1.5% from the norm is quite an anomaly, pushing the mortgage rate higher than it would be at the historical spread, which would sit at 5.37% (3.65% 10-Year Treasury Yield + 1.72 spread).

Such a wide spread is not an everyday occurrence. The spread only expands to or beyond 300 basis points during times of high inflation or economic volatility, as observed during the early 1980s and the Great Financial Crisis of 2008-09. This historical trend indicates potential for mortgage rates to improve today.

So, what's fueling this larger spread and causing soaring mortgage rates? The demand for MBS is swayed significantly by the risks tied to investing in them. Currently, these risks are shaped by various market conditions, including inflation, fear of a potential recession, the Federal Reserve's interest rate hikes to curb inflation, negative narratives about home prices, and more.

To put it simply, when risk is perceived as low, demand for MBS rises, leading to lower mortgage rates. Conversely, when the risk associated with MBS increases, demand decreases, pushing mortgage rates higher. The current scenario, where demand for MBS is low, accounts for the high mortgage rates we see today.

Anticipating a Decrease in Rates

Predicting the future of mortgage rates isn't an exact science, but some industry insights can guide our expectations. Odeta Kushi, Deputy Chief Economist at First American, suggests that the spread, and consequently mortgage rates, may recede in the latter half of the year. However, the retreat is subject to the Federal Reserve easing off monetary tightening measures and providing investors with more certainty.

While some of the risks impacting the mortgage market may persist, causing the spread to not fully return to its historical average of 170 basis points, a reduction in investor fear should still lead to a contraction of the spread. This, in turn, should moderate mortgage rates as we move further into the year.

In Conclusion

Mortgage rates, while influenced by a multitude of factors, are primarily driven by investor perceptions of risk associated with mortgage-backed securities. Current conditions have inflated these perceived risks, leading to high mortgage rates. While no one can predict with absolute certainty the trajectory of these rates, a decrease in investor fear and an easing of monetary tightening measures should lead to a contraction of the spread and a moderation of mortgage rates. As always, it's crucial to stay informed about market trends and seek expert advice when navigating the housing market.

6-5-2023

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans