Our Blog

Recent:

Examining Historical Real Estate Trends During Economic Downturns

Even if you don't follow the economic news closely, chances are you've heard rumors of an impending recession. While there is a multitude of elements that play into making this determination, let's trust our experts and look to what history has taught us about predicting recessions. As Greg McBride, Chief Financial Analyst at Bankrate expressed:

“Two-in-three economists are forecasting a recession in 2023 . . .”

As economic instability looms, you may be pondering the impacts of a possible recession on the housing market. To illustrate why there's no cause for alarm about what could happen to real estate during this period of uncertainty, let’s take a look at previous recessions and uncover how property prices have behaved in those times.

Despite a Recession, Home Prices May Not Necessarily Decrease.

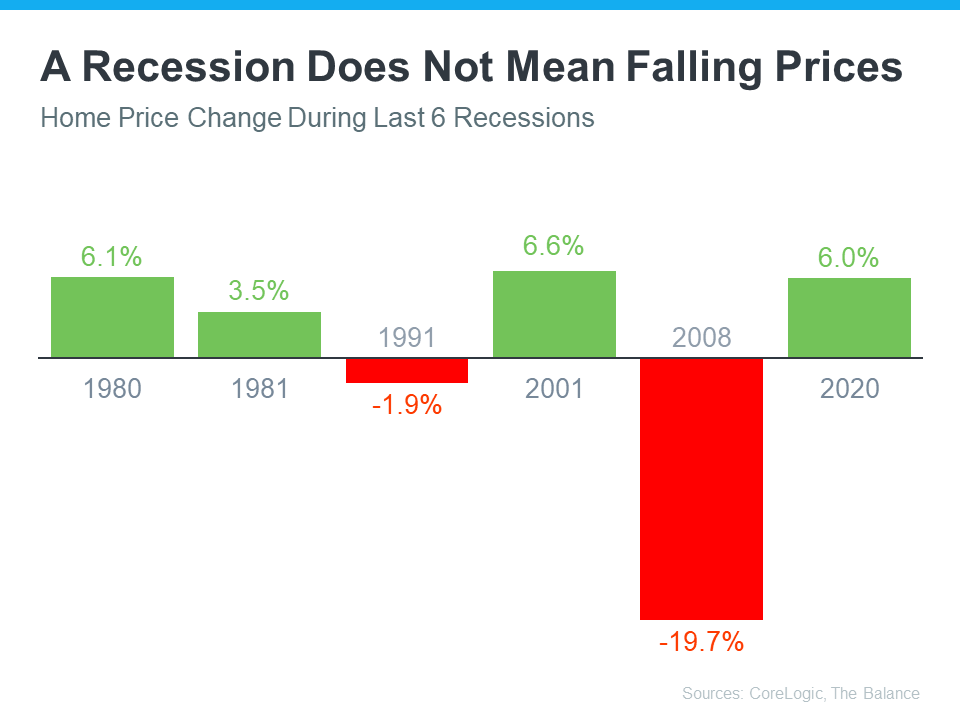

By consulting historical data, it becomes evident that home prices don't necessarily fall during a recession. The graph below displays the results of recessions going all the way back to 1980; four out of six times, there was an appreciation in housing values. This proves that when the economy slows down, one can expect their house's value not be drastically impacted and reduce significantly.

Although the 2008 housing crisis is widely remembered (as seen in the graph above), it's not likely to be a reoccurrence now. Because market fundamentals have shifted, today's housing industry isn't heading for a crash. Local areas may notice shifts in home prices, but according to experts' 2023 forecasts, overall prices will remain at an equilibrium nationally - far from its previous downfall of 2008.

A Recession Signals Dropping Mortgage Rates

Careful research illuminates how recessions might affect the cost of buying a home. As indicated in the graph below, each time there was an economic downturn throughout history, mortgage rates dropped.

Subscribe to Our Newsletter

Fortune has illuminated how mortgage rates tend to drop during an economic downturn.

“Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough.And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

In 2023, it is predicted by market specialists that mortgage rates will stay below the highest peak seen last year. This can be attributed to how mortgage rates usually correlate with inflation levels; recent data suggest that inflation is beginning to slow down which could lead to even lower rate numbers if this trend persists. Even though 3% mortgages may no longer be a possibility, our hope remains in the fact that there are still more ways for us to save money.

Fear not the word recession when it comes to housing. Industry professionals claim that a recession, should one occur, would be brief and the real estate market will play an essential role in facilitating economic recovery. KPMG's 2022 CEO Outlook confirms this sentiment:

“Global CEOs see a ‘mild and short’ recession, yet optimistic about global economy over 3-year horizon . . .

More than 8 out of 10 anticipate a recession over the next 12 months, withmore than half expecting it to be mild and short.”

In conclusion

Although we cannot rely solely on the past to tell us what may happen in the future, it can teach us valuable lessons. Historical evidence indicates that home values generally appreciate and mortgage rates decrease during most economic downturns.

Now is the perfect time to buy or sell a home, so if you’re considering taking the jump this year, let's connect and I will be able to provide expert advice on how the current housing market can help you reach your homeownership goals.

1-17-2023

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans