Our Blog

Recent:

Modern Migration Patterns: Where and Why People Are Relocating

In our rapidly evolving world, the concept of 'home' has transformed in more ways than one. As individuals contemplate the next chapter in their residential journey, understanding the reasons behind these shifts and the desired destinations becomes essential. Delving into a recent Gravy Analytics report, we unpack the reasons influencing today's migratory patterns in the real estate sphere.

1. Affordability Takes Center Stage

It's no secret that the financial aspect is paramount when making any significant decision, and housing is no exception. Buyers are gravitating towards areas where their money stretches further, allowing them to secure better homes without burning a hole in their pockets. In this scenario, smaller cities are emerging as beacons of promise.

Hannah Jones, an Economics Data Analyst at Realtor.com, encapsulates this trend, stating:

"Affordability remains the star of the show...many potential buyers find themselves priced out of their preferred markets, prompting a search for value in alternative locales."

For Future Movers: If price points are your primary concern, broadening your search to incorporate budget-friendly cities could be a game-changer.

2. Vacation Spots Turned Permanent Residences

How does the idea of transforming your vacation dreams into everyday reality sound? An increasing number of homeowners seem to be echoing a resounding 'yes' to this proposition. The allure of waking up to a beach sunrise or breathing in the crisp mountain air daily is driving many to redefine their living spaces.

Gravy Analytics underscores this trend, noting:

"Locations traditionally seen as holiday getaways are now emerging as preferred residential spots."

What This Means For You: If you've cherished certain holiday destinations, it might be worth exploring them as potential long-term homes. Additionally, leveraging your current home's equity can potentially smooth the path to securing your dream residence.

3. Embracing the Remote Work Revolution

As the lines between work and home blur, the significance of geographical proximity to offices diminishes. People are now prioritizing other factors, be it proximity to family or a preferred lifestyle, when determining their residence.

Backing this observation, the McKinsey Global Institute highlights:

"The detachment from office locations due to remote work has reshaped residential preferences, with 55% of recent movers relocating farther from their workplaces."

Insight for Homebuyers: If remote work is part of your professional life, it's time to consider its implications on your housing choices. The liberty of location is a perk waiting to be maximized.

In Conclusion

The undercurrents shaping migration patterns today are multifaceted. From financial considerations to lifestyle choices and professional flexibility, various factors are influencing decisions. If you're on the cusp of a move and seek expert advice to wade through these dynamics, let's embark on this journey together.

8-30-2023

Home Sale Phenomenon: 11,000 Houses Daily

In the realm of real estate, the rhythm of the market can often be a complex dance. It sways with demand, pirouettes with economic influences, and occasionally waltzes into periods of seemingly dormant activity. For homeowners hesitating to list their property due to perceived market lethargy, here's an eye-opening revelation: The housing market is still alive and bustling!

Contrary to the common misconceptions held by many homeowners, the housing market, although not as frenetic as a couple of years back, is far from stagnant. Homes are being snapped up, contracts are being inked, and "Sold" signs are being proudly displayed.

Drawing insights from the National Association of Realtors (NAR), let's journey into the intriguing metrics of home sales and uncover the vibrant activity concealed beneath the surface.

Crunching the Numbers: Daily, Hourly, and by the Minute!

If we were to dissect the annual statistics from NAR, projections point towards an impressive number of over 4 million homes finding new owners this year. But what does this overarching figure translate to in terms of day-to-day sales?

- Annually: 4.16 million homes find their match.

- Daily Breakdown: 11,397 homes switch owners every 24 hours.

- Hourly Insight: 475 homes are sold each hour.

- The Minute View: About 8 homes are clinched every 60 seconds.

To sum it up, the American landscape sees approximately 11,000 homes changing hands daily. And while this number might sound abstract, it presents a reality check on the palpable momentum in the real estate arena.

The Localized Picture: Beyond National Metrics

While national statistics offer a broad overview, the true pulse of the market often beats at the local level. Teaming up with a real estate aficionado can provide you with a granular snapshot of the sales frequency in your specific neighborhood. From understanding the perks currently favoring sellers to gauging the preferences of contemporary buyers, a localized analysis becomes an invaluable tool to fine-tune your selling strategy.

Conclusion: Time Awaits No Home Seller

Hesitation often costs opportunity. For those lingering on the sidelines, awaiting an overt sign of market resurgence, the data reveals the truth: homes are selling at a remarkable pace. By the time you've perused this article, eight homes have been purchased, echoing the market's continued vibrancy.

Remember: Hesitation can sometimes mean missed opportunities. With 11,000 homes being snatched up daily, the market waits for no one. When you feel the pull towards selling, it's time to step into the real estate ballet and make your move.

8-28-2023

The Unsung Hero in New Construction Home Purchases: The Real Estate Agent

The allure of a new construction home is undeniable. The pristine features, untouched spaces, and the thrill of being its very first occupant make it a compelling choice for many prospective homeowners. But the journey from the foundation's first brick to the final touches can be intricate. This is where the presence of a seasoned real estate agent can become your most cherished asset.

For the uninitiated, it might seem that purchasing a home under construction is a straightforward process. After all, there's no previous owner to negotiate with, no wear and tear to consider, and the opportunity to design it precisely as per your vision. But beneath this simplicity lies a maze of decisions, intricacies, and potential pitfalls.

An article from The Mortgage Reports aptly highlights the significance of a realtor in this context:

“Venturing into new construction homes? Your real estate agent is your compass, guiding you through the labyrinth of decisions with expertise.”

The Local Area and Market Expertise:

An adept agent possesses in-depth knowledge about evolving neighborhoods and the potential developments in the vicinity. Imagine settling into your dream home, only to discover plans for a bustling motorway just beyond your serene backyard? Such scenarios underline the importance of an agent who can steer you away from such surprises. Their familiarity ensures that you don't just buy a house, but a home in a community that mirrors your envisioned lifestyle and long-term aspirations.

Deciphering Builder Reputation and Construction Caliber:

With multiple builders in the market, each promising the pinnacle of quality, how do you differentiate between genuine quality and mere marketing spiel? An experienced agent, having interacted with numerous builders over their career, becomes your encyclopedia on builder reputations, their history of customer satisfaction, and the finer nuances of their construction methodologies. It's a safety net ensuring you affiliate only with the best in the business.

Guidance on Customization and Value-Adding Upgrades:

The beauty of new constructions is the blank canvas they offer, allowing homeowners to imbue them with personal touches. However, understanding which upgrades will bolster the house's future value can be puzzling. With an agent by your side, you gain clarity on where to channel your investments, ensuring that every customization not only resonates with your taste but also augments the home's value.

Decoding Builder Contracts and Championing Negotiations:

Unlike regular home purchases, new construction contracts come with their own set of intricacies. The prowess of a real estate agent shines here, offering you a lucid understanding of the terms, ensuring your interests are safeguarded, and even wielding their negotiation skills to fetch you those extra perks or cost-saving deals.

Conclusion: Crafting Dreams with Expert Guidance:

Navigating the realms of new construction homes is akin to embarking on an adventurous voyage. The vision of the perfect dwelling awaits at the end, but the journey can be riddled with unexpected twists. Having a seasoned real estate agent as your guide assures a smoother, more informed, and rewarding journey.

Your dream home deserves the expertise of an adept real estate agent. If you're gearing up to plunge into the world of new constructions, let’s collaborate to turn those architectural blueprints into your dream abode.

8-25-2023

Tapping into the Goldmine: Unlocking the Potential of Home Equity

Over time, homeownership doesn't just provide a roof over your head—it becomes a treasure trove of potential wealth, often referred to as home equity. As years go by and markets ebb and flow, this equity can grow considerably, particularly if you've been a homeowner through prosperous market periods. This wealth can be harnessed in various strategic ways, enabling homeowners to leverage their assets to meet various life goals and needs.

According to the Equity Insights Report recently published by CoreLogic, the average equity amassed by homeowners presently stands at an impressive $274,000. A treasure of such magnitude opens a myriad of opportunities. As a recent Bankrate article astutely observed:

“The pandemic, while globally challenging, inadvertently fattened the equity wallets of homeowners. Mastering the art of strategically leveraging this equity is vital for informed homeownership.”

Here’s an expansive dive into four ways you can use your home equity to enrich your life and secure your future.

1. Transitioning to Your Dream Abode

For many, changing family dynamics, life events, or evolving tastes can render their current home unsuitable. Perhaps the walls of your home feel increasingly constraining, or conversely, its vast spaces echo with emptiness. Leveraging your home equity can empower you to make the necessary down payment on a new house, perfectly tailored to your evolving needs. By collaborating with a seasoned real estate agent, you can ascertain the exact value of your equity, providing you a robust foundation to plan your next purchase.

2. Beautifying and Upgrading Your Existing Home

If the thought of moving feels premature, yet you yearn for a rejuvenated living experience, renovations beckon. Infusing your home with enhancements not only aligns it with your unique tastes and requirements but can also elevate its market value. However, ensure you don’t embark on this journey blindly. Some renovations promise better returns on investment than others. Consulting a real estate expert can illuminate which projects would offer optimal value increments, safeguarding your future selling prospects.

3. Igniting Personal Dreams and Aspirations

Beyond bricks and mortar, your home equity can metamorphose into the wings of your ambitions. Ever dreamt of launching that startup? Or perhaps you envision a picturesque retirement? Maybe you're passionate about furthering your education or that of a loved one? With prudent management, home equity can finance these ventures. A note of caution: while the potential is vast, it's paramount to channel this wealth responsibly, focusing on impactful, life-enriching endeavors rather than fleeting indulgences.

4. Navigating Through Financial Storms

Life’s unpredictability can sometimes cast dark financial clouds. Although the current foreclosure rates are reassuringly low, some homeowners still grapple with this distressing possibility. If you find yourself navigating such turbulent waters, comprehending your equity and its potential can be a lifeline. Think of equity as a financial buffer, ready to cushion unexpected hardships or events that might jeopardize your timely mortgage payments.

An insight from Freddie Mac articulates this perspective:

“Should you find yourself needing to exit your home, equity might facilitate a graceful exit strategy. By selling at a value surpassing your mortgage debt, the accrued equity can liquidate the outstanding mortgage, providing financial relief.”

In Conclusion: The Power of Home Equity

The accumulated value in your home isn’t just a passive asset; it’s a potent tool, brimming with potential. Whether it's metamorphosing your living space, realizing long-held dreams, or safeguarding against unforeseen financial challenges, equity is your ally. However, the key lies in knowing your exact equity value and leveraging it judiciously.

Are you pondering over your equity and its potential? Engage with us, and let’s chart a course to optimize your home’s latent wealth.

8-23-2023

Why Your Home Sold Guaranteed Realty - The Watson Group is the Best Choice for Sellers

In the swirling storm of real estate jargon and over-promises, one brand stands out not just for its name, but for its guarantee - Your Home Sold Guaranteed Realty - The Watson Group. Let’s unpack this.

Predictability in an Unpredictable World

While most real estate agencies play a numbers game, The Watson Group emphasizes certainty. The name isn't a mere marketing gimmick; it's an iron-clad commitment. In an era of uncertainty, especially in the volatile property market of 2023, a guaranteed sale is more than just reassuring; it's a game-changer.

Decades of Track Record

History often dictates the future. The Watson Group has sculpted a rich legacy in the real estate sector. Our heritage isn't just a testament to our endurance but an endorsement of our excellence. In an industry where many fade away, our prolonged presence is a badge of trust.

Direct Response Marketing

Borrowing techniques from the maestros of marketing,The Watson Group embraces the power of direct response. Instead of passively listing homes and waiting for potential buyers, we actively engage, enticing a dedicated audience and driving action. The result? Faster sales, happier clients.

2023 Ready

We're not just living in the present; we're crafting the future. As 2023 continues, we're at the forefront, deploying cutting-edge technology, sophisticated analytics, and innovative showcasing methods. When your property is with The Watson Group, it's not just seen; it's remembered.

Our Network = Your Net Worth

In the real estate world, connections matter. Our vast network, cultivated over the years, is a gold mine of potential buyers, sellers, and market influencers. Every property we list immediately garners attention, not just from casual browsers but from serious, interested parties.

The No Stone Unturned Policy

Attention to detail is not our strategy; it’s our ethos. Every process, every communication, every negotiation is handled with meticulous care. This ensures that when you're with The Watson Group, you’re not just another client; you’re a priority.

Education is Empowerment

Information is power. At The Watson Group, we believe in empowering our clients. This means you're always informed, always updated, and always in control. We don’t just sell homes; we build informed homeowners.

Testimonials Don’t Lie

Promises can be empty, but results echo. Dive into our client testimonials, and the recurring themes are clear – satisfaction, trust, and success. These aren't just reviews; they're endorsements of our unwavering commitment.

Competitive Edge with Comprehensive Analysis

Proper valuation is a delicate balance. Using our proprietary market analysis tools, we ensure your home isn't just priced right, but poised for a quick, profitable sale. No inflated figures, no lowballing, just precise, data-driven valuations.

Flexibility with Integrity

While we adapt to the ever-evolving real estate landscape, our core principles remain unyielding. The Watson Group is founded on transparency, honesty, and client-centricity. In 2023, as always, we stand tall, steadfast in our mission and values.

Conclusion

Your Home Sold Guaranteed Realty - The Watson Group is more than a name. It's a promise, a legacy, and your best bet in 2023. Don’t just sell your home; guarantee its sale.

8-22-2023

Decoding Inflations Ripple Effect on Mortgage Rates

As daily headlines are awash with updates about the Federal Reserve (commonly referred to as the Fed), understanding their decisions might seem daunting. Dive in to grasp the subtle dance between inflation and mortgage rates and how it shapes your home-buying journey.

The Federal Reserve and the Balancing Act

The pivotal mission for the Fed is managing inflation. Despite a 12-month span witnessing a cooling inflation trend, the figures are still soaring above the Fed's benchmark of 2%.

Even as progress seems evident, the Fed remains wary. The apprehension? Halting their countermeasures prematurely might propel inflation back to challenging heights. This sentiment was captured in the recent remarks of Jerome Powell, the Fed’s Chairman:

“Our unwavering mission is to steer inflation back to the 2% marker and ensure long-term inflation expectations remain stable.” Elaborating on the intricate relationship between a buoyant economy and persistent inflation, Greg McBride, a noted figure from Bankrate, remarked:

“Despite the resilience of the economy and a robust labor landscape, these very strengths might be bolstering the persistent inflation. The Fed's strategy? A slight application of the brakes.” Now, while the Federal Fund Rate's uptick might not inherently determine the fate of mortgage rates, it undeniably exerts influence. As deciphered by a Fortune piece:

“Think of the federal funds rate as an intra-bank interest rate... In the face of mounting inflation, the Fed hikes rates, essentially making borrowing pricier and tempering the economy's pace. Conversely, during sluggish periods, they slash rates to rejuvenate the economic machinery.”

The Direct Implication for Prospective Home Buyers

Put simply, a surge in inflation mirrors in lofty mortgage rates. But, a successful effort by the Fed in tempering inflation can herald reduced mortgage rates, amplifying your home affordability.

A visual representation, indicated in the attached graph, underlines this phenomenon. Historically, as inflation (represented by the blue curve) descends, mortgage rates (captured by the green curve) have been observed to echo this descent. Offering a prognostic glimpse, McBride predicts:

“Given the easing inflationary winds, we anticipate a more uniform dip in mortgage rates as the year unfolds, especially if noticeable deceleration engulfs the economy and the labor sphere.”

In a Nutshell

Mortgage rates dance to the tune of inflation. A subdued inflation heralds potential drops in mortgage rates. Engage with us to gain insightful counsel on the ever-evolving housing landscape and strategize your next move.

8-21-2023

The Dramatic Inventory Decline: Why Now Is an Ideal Time to Sell

The dynamic world of real estate is ever-evolving, influenced by numerous factors such as economic conditions, global events, and housing demand. As of 2023, one of the most profound trends underpinning the market is the startlingly low housing inventory. For homeowners mulling over the idea of selling, understanding this trend is crucial.

You might have come across casual mentions about the low housing inventory or had fleeting discussions about it over a coffee conversation. However, it's time to delve deeper and truly grasp the magnitude of this phenomenon and what it means for sellers today.

A Historical Perspective on Housing Inventory

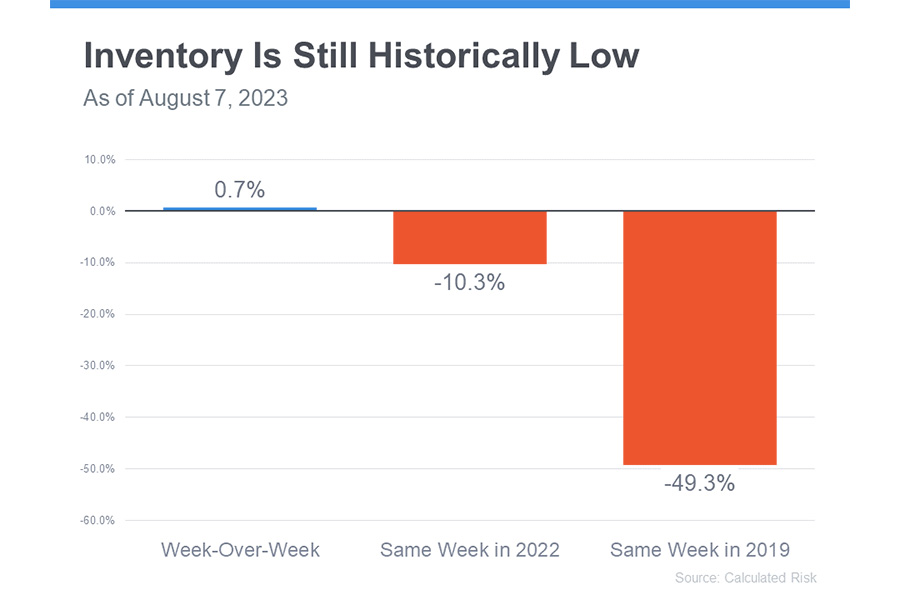

Before diving into today's scenario, it's essential to frame the discussion within a historical context. A graph from Calculated Risk offers a revealing glimpse into the current landscape of housing inventory. While there's been a minute uptick in housing inventory on a week-to-week basis, the broader picture reveals a stark shortage in supply. To draw a parallel, when juxtaposed against the same week from the preceding year, the current supply is dwindling by about 10%. And remember, even last year, the consensus was that inventory levels were far from adequate.

However, the real jaw-dropper comes when we travel back to 2019, often termed as the last 'normal' year in the housing realm. A comparative analysis between the current week and the corresponding week in 2019 indicates an approximately 50% decline in available homes. To break it down succinctly, for every two homes available in 2019, there's just one in today's market.

What Does This Mean for Potential Sellers?

The housing market, in its essence, thrives on a delicate balance between demand and supply. Ideally, a balanced market presents an equal playing field for both buyers and sellers. However, the current 50% plunge in inventory decidedly tilts the scales in favor of sellers.

In the words of Lawrence Yun, the Chief Economist at the National Association of Realtors (NAR):

“The market is parched for available homes. There's room to comfortably accommodate a twofold increase in inventory.”

For those contemplating selling, this presents an unprecedented opportunity. A lower inventory doesn't just mean reduced competition. It magnifies the spotlight on the available homes, often culminating in multiple offers and potentially higher selling prices.

Navigating the Inventory Desert

For sellers, the dramatically reduced inventory landscape is akin to being a prominent oasis in a vast desert. Buyers, parched for options, are more likely to gravitate towards the few available homes, enhancing the chances of swift, lucrative deals for sellers.

In Conclusion: Seizing the Window of Opportunity

The world of real estate, like many other domains, is shaped by the law of supply and demand. With current inventory levels mirroring half of what they were in a 'normal' year, sellers find themselves in an advantageous position. If you've been sitting on the fence regarding selling, now might be the opportune moment to leap.

Remember: In a market starved for choices, your property stands tall. If selling has been on your mind, let's join forces and capitalize on this unique market trajectory.

8-19-2023

Navigating Homeownership Readiness: A Guide to Self-Assessment

Taking the leap into homeownership is a significant decision. Beyond the intricacies of the housing market, factors intrinsic to your life and financial health play a pivotal role. But how do you discern whether the timing aligns with your preparedness?

Distilling insights from NerdWallet:

"The compass guiding you to homeownership isn’t just about market trends. Your financial readiness and life ambitions crucially influence your readiness for such a commitment." To unravel this, consider these illuminating queries to gauge your homeownership readiness:

1. The Stability of Your Professional Path

The bedrock of your financial standing is your job. Embarking on homeownership entails a long-term financial commitment, which means the stability of your employment is paramount. As encapsulated by NerdWallet:

"Taking on a mortgage demands unwavering commitment. Ensure your job scenario is steadfast before contemplating homeownership."

2. Have You Crunched the Numbers?

Engage with a seasoned lender to gain clarity on your financial bandwidth. From understanding the pre-approval process to the dynamics of current mortgage rates, getting an in-depth picture is essential. Contrary to popular belief, the traditional 20% down isn’t always mandatory. As cited by Down Payment Resource:

"While a 20% down payment is commendable, many mortgage frameworks demand merely 3% to 5%. Furthermore, tailored loans and grants can cushion these upfront costs."

3. How Deeply Are Your Roots Planted Here?

Homeownership is often synonymous with rootedness. The appreciation of your property's value coupled with loan repayment contributes to equity accumulation. Swift transitions can potentially erode the financial viability of your investment. An insight from CNET sheds light on this:

"Homeownership resonates if you're anchored for a minimum of three years. With home values inching upwards between 2% and 5% annually, a premature move could drain more in transaction costs than potential gains."

Ponder over your impending life choices. Are you eyeing a shift to a new locale or foresee familial obligations that could entail relocation? Weigh these factors judiciously.

The Key to Unlocking Your Readiness

Central to this introspection is the support structure you build. Have you enlisted a team of real estate aficionados? Embarking on your journey with seasoned professionals significantly amplifies your insights and confidence.

In Summation

Your journey to homeownership is interwoven with personal milestones and financial readiness. These guiding questions serve as your North Star. But the compass guiding you through this maze is the expertise of trusted real estate professionals. Let's collaborate to craft your path.

8-18-2023

Overcoming Seller Hesitations: Break Free from the Dual Dilemmas

Present-day homeowners contemplating a sale often grapple with two intertwined reservations: the daunting shadow of rising mortgage rates and the apprehension about finding a new abode amidst a limited inventory. Delving into these concerns, let's chart out strategies to traverse these hurdles.

Dilemma #1: Hesitation Amidst Rising Mortgage Rates

Contemporary data from the Federal Housing Finance Agency (FHFA) highlights a fascinating trend: a majority of homeowners are currently relishing mortgages with rates below 4% (refer to accompanying graph).

Contrastingly, current homebuyers are typically encountering 30-year fixed mortgage rates nudging the 7% mark. Such a disparity nudges several homeowners to continue in their current homes, steering clear of a new, pricier mortgage— a phenomenon coined as the mortgage rate lock-in effect.

Navigating the Maze: Act, Don't Await While some experts anticipate a downward trend in mortgage rates as the year progresses and inflation decelerates, pinning hopes on this prognosis could be precarious. The mortgage landscape is notoriously volatile and unpredictable. Also, with home prices showing a bullish trend, selling now could offset future price surges for your next purchase. And, should the speculations about rates dropping materialize, refinancing could always be an option down the lane.

Dilemma #2: The Quest for the Next Home

The reluctance to transition to a higher mortgage rate translates to fewer homes being listed, perpetuating the challenge of low inventory. Lawrence Yun, the Chief Economist at the National Association of Realtors (NAR), offers an insight:

"The housing stock will remain constricted in the foreseeable future, with homeowners unwilling to shuffle their properties after securing favorable mortgage rates in recent times." While such an environment can make your property an irresistible magnet for potential buyers, it can also foster apprehensions about securing your next dwelling.

Navigating the Maze: Expand and Explore If the uncertainty about locating your subsequent home is anchoring you, recalibrate your horizons. Embrace diverse housing options, spanning condos, townhouses, and even brand-new constructions. Moreover, if the pandemic has liberated you from geographical constraints with flexible work modes, it's worth venturing into previously uncharted territories. A broader geographical scope could unveil more affordable prospects.

In Conclusion

Navigating challenges demands perspective. By shifting the focus from hurdles to tangible solutions, the path becomes clearer. Collaborate with seasoned professionals who can guide you through this dynamic landscape. Let’s bridge the gap between reservations and resolutions. Connect today.

8-16-2023

Strategic Home Pricing: The Power of Hitting the Market Sweet Spot

Gone are the days of the super-heated housing market dubbed the 'unicorn' years. Yet, in the current landscape, strategically priced homes continue to garner significant attention, often inciting multiple bids. The reason? A palpable shortage of listed homes. According to recent data from the National Association of Realtors (NAR), a whopping 76% of homes were snatched up within a month, with an average home drawing 3.5 offers in June.

To leverage this dynamic, it’s crucial to hit the pricing sweet spot. And who better to guide you than a seasoned real estate agent?

The Price Paradigm: Understanding Buyer Perceptions

The asking price isn't just a number; it's a potent message to prospective buyers. Undershoot, and you might inadvertently seed doubts regarding your home's condition or quality. Moreover, an underpriced home potentially erodes your future purchasing power by leaving hard-earned money unclaimed.

Conversely, overshooting can be equally detrimental. An overpriced listing can deter potential buyers, making them bypass your property altogether. If your home languishes unsold, you might be compelled to slash the price, which can be perceived negatively, further deterring potential buyers.

NerdWallet encapsulates this balance aptly:

"Striking the right balance in your initial listing price is pivotal. Overpricing risks obscurity, with buyers overlooking your property... while underpricing may raise unnecessary concerns and possibly compromise your returns." The aim is precise calibration: setting a price that mirrors the market's pulse, neither soaring too high nor sinking too low.

The Power of Precise Pricing

Imagine home pricing as archery. Hitting the bull's eye means pricing your property precisely at market value.

Appropriately priced homes inherently magnetize a broader spectrum of interested buyers. Consequently, the probability of eliciting multiple offers escalates. And a home with a well-researched price point usually culminates in a swift sale.

For a clearer perspective on the pitfalls of overpricing or underpricing, and the benefits of accurate market value pricing, consider the following chart:

Navigating Price Points with a Trusted Realtor

Why is an agent indispensable in this equation? An adept local agent will skillfully navigate the housing market's nuances to derive your home's genuine market value. They'll meticulously assess various factors, including:

- Comparable recent sales

- Prevailing market trends

- Your home's dimensions and condition

- The location and neighborhood allure

Final Thoughts

Pricing isn’t mere guesswork—it requires nuanced understanding and expertise. Let’s collaborate and ensure that your home’s pricing perfectly aligns with the current market landscape.

8-14-2023

Homebuyer Enthusiasm: Still A Strong Player in 2023s Market

While the adrenaline-pumped real estate days of the past couple of years have simmered down, this certainly doesn't spell stagnation in today's market. In fact, the pulse of buyer activity remains vigorous and vivacious.

The ShowingTime Showing Index provides insights into the frequency of house showings, acting as a barometer for buyer enthusiasm. A deeper dive into its historical data paints a more nuanced picture of current market dynamics.

A Trip Down Memory Lane: Analyzing Buyer Patterns

Historically, real estate has always showcased seasonality. During what can be termed 'standard' or 'normal' years, there's a pronounced ebb and flow. Spring tends to be a crescendo of buyer activity, which gradually tapers as the year progresses.

Come March 2020, the onset of the pandemic threw this predictable pattern into disarray, manifesting as a pronounced dip (highlighted in blue). Subsequently, the real estate landscape entered the 'unicorn' phase, characterized by rock-bottom mortgage rates and skyrocketing buyer interest. While the seasonality persisted, it occurred at significantly heightened levels.

Fast-forward to 2023. While we're observing a dip from the dizzying highs of the 'unicorn' era, this isn't a dramatic plummet. Instead, it's a gradual shift towards the more traditional real estate rhythms. As elucidated by the ShowingTime report:

"Although May witnessed a 10% drop in showing traffic, this mirrors the age-old seasonal trajectory, which, after the pandemic's disruption, is reverting back." Further emphasizing the relative robustness of today's market is a snapshot of May's data over the past half-decade. It's evident that buyer interest remains hearty and steadfast.

Implications for Sellers

The market might not be as feverish as it was, but it's important to realize that the appetite for homes is far from waning. In fact, May 2023 witnessed more activity than May 2022, when the real estate market was grappling with the initial jitters induced by rising mortgage rates.

The existing dynamism could be even more pronounced if it weren't for the scarcity of available homes. U.S. News succinctly summarizes the sentiment:

"While housing markets have tempered a bit, the appetite remains undiminished, primarily because of the dearth of listed homes."

Concluding Thoughts

Today's market remains ripe with potential, driven by an active pool of enthusiastic buyers. If you've been contemplating selling, there's no better time to present your property to this eager audience. Ready to make a move? Let’s join forces and maximize your selling success.

8-11-2023

Navigating Home Offers: Strategies for Success in 2023s Market

While the frenetic pace of the 'unicorn' housing era is now a chapter of the past, today's housing landscape remains competitive due to a shortage in property listings. If you're embarking on the home buying journey, it's essential to prepare for potential bidding duels and ensure your offer stands out.

Below, we explore actionable strategies to help you make a compelling offer on your dream home.

1. Engage a Seasoned Real Estate Expert

Selecting a knowledgeable real estate professional is paramount. They'll provide insights into both the local and national market dynamics, ensuring you're well-equipped with the latest trends and data. Your agent's experience will be invaluable in crafting an offer that resonates with the seller. As Forbes emphasizes:

"Establishing a rapport with a local realtor in your target buying location can provide a significant advantage in a tight property market."

2. Secure Home Loan Pre-Approval

Understanding your financial capabilities is fundamental, especially amidst current affordability challenges. Securing pre-approval for a home loan not only crystallizes your budget but also communicates to sellers your seriousness and purchasing power. This clarity can offer you a leg up, particularly when multiple offers are on the table.

3. Extend a Reasonable Offer

While everyone seeks a stellar deal, extending an offer that's egregiously low can backfire. It's crucial to strike a balance that's both competitive and respectful to the seller's valuation. As Realtor.com elucidates:

"Offers considerably below the asking price can sometimes offend sellers... An agent’s role is pivotal in guiding clients towards a price that's mutually agreeable to both parties."

4. Harness Your Agent's Acumen During Negotiations

During the zenith of the 'unicorn' housing years, some buyers opted to bypass pivotal steps like home inspections or refrained from seeking concessions to ensure their bids triumphed. However, today's environment is evolving, as an article from Bankrate highlights:

"While sellers continue to have an edge due to the inventory scarcity, buyers aren't routinely waiving inspections... Home inspections are pivotal. They not only provide insights into potential issues but also arm buyers with potent negotiation tools."

In the current climate, you might have added negotiation leverage. Trust your agent to guide you on the nuances of crafting an offer, ensuring you strike the right balance between appealing to the seller and protecting your interests.

In Summation

Making a home purchase this season? Partnering with a seasoned real estate professional can significantly amplify your chances of success. Let’s collaborate to craft an offer that not only resonates but stands out.

8-9-2023

Understanding Home Prices: The Truth Behind the Headlines

Navigating the current housing market might feel like you're trying to decipher a cryptic puzzle, especially with the bombardment of headlines around home prices. If you're contemplating buying or selling, the paramount question is undoubtedly: what's genuinely transpiring with home prices? Let’s unpack the mystery by analyzing the facts and debunking the myths.

Misleading Comparisons and Unrealistic Expectations

The media narrative is largely rooted in contrasting present-day data with the so-called 'unicorn years' - a period of soaring, unsustainable home prices. This form of comparison is inherently flawed. The dramatic increases seen during those years were anomalies. Now, as the market reverts to a more stabilized growth, headlines are portraying this transition as ominous. Rest assured, the dramatic downturns in home prices are in the rearview mirror. We are witnessing the onset of standard home price appreciation.

Decoding Seasonality and Predictable Market Patterns

Historically, the real estate market experiences discernible patterns tied to the seasons. The spring months herald the zenith of homebuying activities, continuing robustly into summer, only to taper off as temperatures drop. Correspondingly, home prices are influenced by this seasonality, appreciating most during peak demand periods.

Data spanning nearly half a century, specifically from 1973 to 2021, as evidenced by the Case-Shiller graph, elucidates the consistent monthly home price trends. For instance, the cooler months of January and February typically record subdued market activity, resulting in modest home price growth. However, as spring ushers in the homebuying frenzy, prices markedly surge. Come autumn and winter, the market mellows, and while price growth moderates, it generally remains on an upward trajectory.

Headlines vs. Reality: Grasping the Terminology

As we navigate the upcoming months, expect to encounter sensationalized or, at the least, misrepresentative headlines regarding home prices. These might bandy about terms like:

- Appreciation: A rise in prices.

- Deceleration of appreciation: Prices are still on the upswing, albeit at a more gradual pace.

- Depreciation: A dip in prices.

The critical error many headlines will commit is conflating the typical deceleration of appreciation seen during autumn and winter with actual depreciation. Such misleading narratives can easily breed unwarranted anxiety. Recognize that the market's natural ebb and flow entails periodic slowing of price growth.

In Conclusion

The key takeaway is simple: be wary of jumping to conclusions based solely on headline narratives. As the market transitions through its customary phases, ensure you're informed about the inherent nuances. For a clear understanding tailored to our local context, don't hesitate to reach out.

8-7-2023

August 2023 Newsletter

Welcome to this month's edition of our newsletter, where we delve into a variety of engaging topics designed to empower you as a homeowner. In this issue, we'll explore some unintentional habits that could be depreciating your home's value, alongside innovative strategies for passive home cooling. We'll also shed light on the evolving landscape of mortgage rates and equip you with insights to navigate the current housing market.

Before we dive into these exciting topics, we would like to take a moment to express our gratitude. Your friendship and the trust you place in us through your referrals mean the world to us. We appreciate your support and remain dedicated to providing valuable insights. Enjoy the read!

Warmest regards,

Bill Watson

President / Managing Broker

Your Home Sold Guaranteed Realty - The Watson Group

6155 S Main Street, Suite 270

Aurora, CO 80016

720-463-0002

bill@watsonrg.com

www.yourhomesoldguaranteedrealtyco.com

P.S. In the upcoming weeks, if you hear people discussing real estate, please feel free to tell them about my free consumer information! This useful resource can be very beneficial for anyone who wants to learn more about real estate.

This summer, you might come across individuals who were relocated and want to purchase a home. By sharing my Free Consumer Report "Cash Savings Guarantee," you can assist them in purchasing their ideal home at a lower cost than they anticipated. To obtain a copy for someone else, contact me at 720-463-0002.

SELL YOUR HOME FAST and for TOP DOLLAR! Get this FREE Report that

Reveals 27 Tips to Give You the Competitive Edge! www.Our27Tips.com

Going Above and Beyond for

Homebuyers and Homesellers

At Your Home Sold Guaranteed Realty - The Watson Group, we pride ourselves on making the process of buying or selling a home as seamless and stress-free as possible. Our team of seasoned real estate agents will guide you through the intricacies of the real estate market, helping you find your dream home or secure the best possible price for your property. Our unique selling point lies in our buyback and satisfaction guarantees. These offers provide buyers with confidence, knowing that if their new home doesn't meet expectations, we'll buy it back within 12 months.

See What Our Amazing Fans Have to Say

Visit www.OurAmazingFans.com

Receive Multiple Cash Offers on Your Home Today!

Are you looking to sell your home quickly and for a fair price? Look no further than our Exclusive Cash Offer Program. Our program is designed to give homeowners access to multiple cash offers on their homes in just minutes. With our cutting-edge technology, we can provide real estate investors with the data they need to make informed decisions about your property.

No Waiting To Receive an Offer

No Home Prepping For Sale

No Strangers in Your Home

No Open Houses

Don't wait any longer - sign up now and start receiving multiple cash offers!

www.GetaCashOnlyOffer.com

Subscribe to Our Newsletter

HIGHLINE EAST AT DAYTON TRIANGLE

Only 1 Home Remains!

The community has been meticulously crafted to redefine modern living, offering an exclusive blend of sophisticated architecture, considerate floor plans, and outstanding craftsmanship. With only one home left, Highline East stands as the ultimate residential destination for those who desire unparalleled comfort and wish to seize this final opportunity.

Find out the value of your home by answering a few simple questions. By providing your address and home description, the system will produce a complete market analysis through a search for similar homes sold and listed in your area.

AT MURPHY CREEK

Welcome to Elevations at Murphy Creek by Montano Homes - the perfect place to call home! This central master-planned community provides easy access to DIA, Southlands Mall's gourmet dining and shopping options, and offers stunning views of one of Colorado's finest links-style golf courses.

Now Selling from the High $400's

Find out how this changing market has affected your home value! Your home may be worth more than you think.

Visit www.AccurateHousePrice.com or Call Us at720-463-0002.

This is a FREE service with NO OBLIGATION to list.

Things that Make Your Home Look Scattered

Designing your home's décor is an art that calls for intentional planning and purposeful selections, rather than a mere focus on the monetary value of possessions. Avoid common pitfalls like oversized sofas, clutter, wrongly sized rugs, mass-produced decorative word art, flatpack furniture, inconsistent flooring, poor-quality lighting, excess furniture, and complete matching sets. Instead, adopt a minimalistic approach, declutter your space, and enrich it with personal touches like photographs and locally produced art. When choosing rugs, ensure they're large enough to touch some part of each primary furniture piece in the room, like the feet of a bed, or both a sofa and coffee table.

Not Ready to Sell? Text your address to 720-605-1268 to find out what your home will sell for today. You will not receive a phone call, just a text!

Meet Our Team of Experts

Committed to Your Real Estate Success

Your Home Sold Guaranteed Realty - The Watson Group is composed of experienced and committed real estate agents dedicated to achieving your property goals.We address your concerns, answer your questions, and equip you with the knowledge necessary to make well-informed decisions. Setting us apart are our exclusive guarantees: our buyback guarantee underscores our confidence in the homes we sell, and our satisfaction guarantee promises you'll love your new home or we'll buy it back within 12 months. Choose us for a personalized, success-focused real estate experience.

Subscribe to Our Newsletter

Not Ready to Sell? Text your address to 720-605-1268 to find out what your home will sell for today. You will not receive a phone call, just a text!

The New Normal in Mortgage Rates: A Sellers

Guide to Today's Housing Market

If you're contemplating putting your house on the market, understanding the current landscape of the housing market is essential. Recent trends have shown an interesting adaptation in buyer behavior, with potential homebuyers beginning to see today's mortgage rates as the new norm. The Trend of 30-Year Fixed Mortgage. . .

Cool Your Home Passively

To maintain a cooler home without heavily relying on air conditioning, consider implementing these steps: start by opening windows in the morning to circulate cool air, but ensure to close them as the day warms up. Incorporate bamboo shades on external windows to mitigate sun-induced indoor heating. Keep blinds or curtains shut during the day and use a fan to promote air circulation. As dusk falls, open the windows again to introduce cooler air. Ensure that any gaps in windows and doors are sealed to prevent drafts from warm air. An additional tip is to position a bowl of ice water in front of a window fan, which will generate a cooling mist for an extra touch of refreshment.

A Heartfelt Message to our Special Clients and Friends . . .

It is our pleasure to extend a warm welcome to all of the new clients we have had the honor of working with recently, and also offer special thanks to our Raving Fans.

Kylie Bearse

Daniel Strough

Brenda Childress

Rick & Cora Walkup

Robert & Cherlyn Mollitor

Our business would not be where it is today without your trust!

Recently Sold Properties

by The Watson Group

Lower Highlands

Sold for $1,125,000!

Shenandoah

Sold for $650,000!

Willow Creek

Sold for $900,000!

Independence

Sold for $590,000!

Highline East

Sold for $625,000!

Foxdale Condos

Sold for $275,000!

Crystal Valley Ranch

Sold for $644,900!

Sunflower

Sold for $285,000!

Creekside Eagle Bend

Sold for $800,000!

Real Estate Corner . . .

Q: Can I use a financial gift from a friend or relative as a down payment on buying a home?

A:Yes, one in four first-time homebuyers utilizes a gift to fund their down payment. As of 2023, tax laws permit gifts up to $17,000 annually without incurring tax implications for either the giver or receiver (though this amount is subject to yearly adjustments, so it's advisable to check IRS.gov for the latest "gift tax" figure). Thus, one could receive a combined gift of $34,000 from two separate individuals without triggering a gift tax. Such a gift can facilitate home buying, even for properties that aren't FHA-approved. Therefore, it's highly recommended to engage a knowledgeable REALTOR® early on and discuss this strategy before commencing your home search.

Want to learn more? Read our six strategies “Negotiating Tips: Get the Highest Price You Can when You Sell Your Home” to help you secure the right price when selling your home.

Do you have a real estate question you want answered? Feel free to call me at720-463-0002. Perhaps I’ll feature it in my next issue!

8-7-2023

CATEGORIES: Newsletter

Foreclosure Trends 2023: Setting the Record Straight

Recent headlines on the uptick in foreclosures might have caught your eye, potentially igniting concerns about the stability of today’s housing market. However, looking beyond the surface level of these headlines and understanding the broader context is crucial to discern the true state of affairs.

Decoding The Numbers: A Comprehensive View

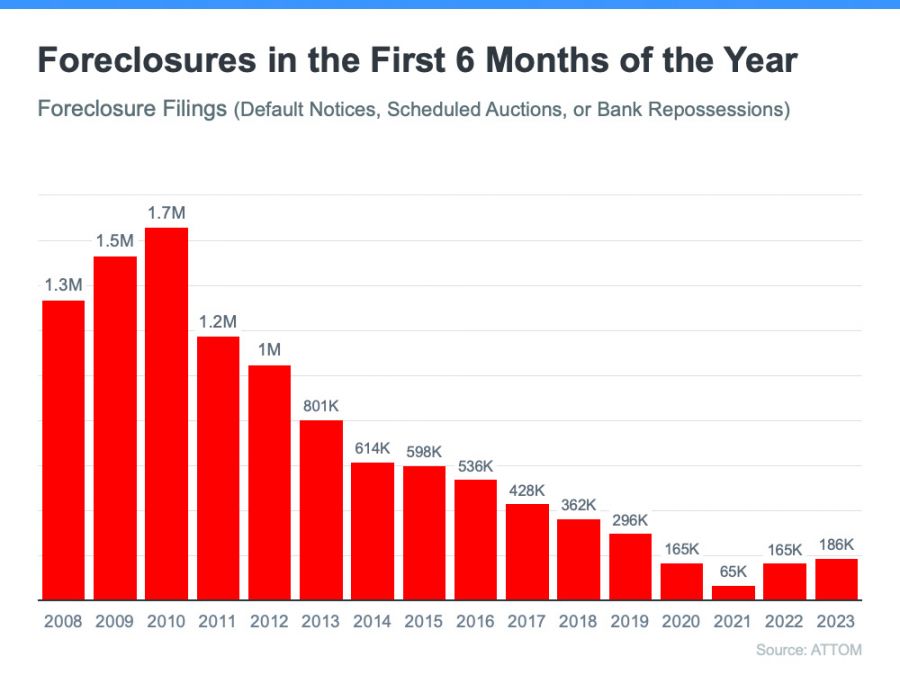

Recent data from ATTOM, a reputable property data aggregator, indicates a 2% rise in foreclosure filings from the previous quarter and an 8% increase year over year. At a glance, such figures might sound alarming. Yet, when set against a backdrop of historical data and other economic indicators, the story told is markedly different and far less concerning.

Today’s Foreclosure Landscape vs. The 2008 Crisis

Foreclosure numbers have recently been at historical lows. Significant contributors to this decline include the forbearance program and other homeowner relief initiatives implemented in 2020 and 2021. These interventions played a pivotal role, helping countless homeowners weather the economic challenges and retain their homes. Additionally, with appreciating home values, many homeowners could cash in on their home equity, sidestepping foreclosure altogether. It's anticipated that equity will remain a protective barrier against surges in foreclosure rates.

Post-moratorium, an uptick in foreclosures was anticipated. However, Clare Trapasso, the Executive News Editor at Realtor.com, offers an enlightening perspective:

“The rise in foreclosures doesn’t symbolize a wave of homeowners suddenly incapable of mortgage upkeep. It represents a backlog. The majority of these foreclosures might have materialized during the pandemic but were postponed due to a slew of moratoriums. It's more of a catch-up rather than a new phenomenon.” Echoing this sentiment, a recent piece by Bankrate notes:

“Contrary to the post-2008 era, when foreclosures inundated the market, causing property value nosedives, today’s scenario is different. The majority of homeowners have substantial equity cushions. Pandemic-induced halts meant foreclosures were at an all-time low in 2020. Today’s slight rise pales in comparison to those dark days.”

A simple look at the graph showcasing foreclosure filings from the first half of each year since 2008 reinforces this sentiment, underscoring that today’s foreclosure activity is a far cry from the crisis levels of yesteryears.

Today's Homebuyers: A Sturdier Foundation

Another distinction from the 2008 crash is the profile of today's homebuyers. Modern-day purchasers are generally more qualified and have exhibited a lower tendency to default, further bolstering the market's resilience.

In Conclusion

Foreclosures are indeed seeing an uptick. However, understanding the nuanced reasons behind this rise is essential. When evaluated against the backdrop of the 2008 crash and considering the more robust profile of today's buyers, it's evident that today's housing market remains on firm ground.

8-4-2023

The Power of Homeownership: A Stepping Stone to Wealth Building

In today's fluctuating real estate climate, you might often come across the debate: Is it more financially savvy to rent or to buy? While there's no one-size-fits-all answer, the scales often tip in favor of homeownership when considering long-term wealth accumulation.

The Wealth Differential: Homeowners vs. Renters

One of the undeniable financial perks of owning a home is its contribution to your net worth over an extended period. A compelling point that emerges from various analyses is that homeowners, irrespective of their income brackets, consistently demonstrate a higher net worth than renters with comparable incomes. The insights from First American serve as a testament to this observation.

Why Do Homeowners Amass More Wealth?

At the heart of this disparity lies the concept of home equity. A succinct explanation from Realtor.com sheds light on this:

"Homeownership is intrinsically linked to wealth creation, and it's not hard to see why. Rather than dissipating funds on monthly rent that you'll never see again, owning a home enables the accumulation of home equity. Over the years, this equity metamorphoses from mere mortgage debt to a substantial financial asset."

Simply put, the financial gains associated with homeownership are largely rooted in equity. As you steadily repay your mortgage and as the market value of your home increases, your equity grows. Conversely, renters don't have this advantage, as Mark Fleming, the Chief Economist at First American, elucidates in a recent discussion:

"While homeowners reap the rewards of rising home prices in the form of growing wealth, renters find themselves on the sidelines. Any appreciation in property value directly benefits the landlord, not the tenant."

Contemplating Your Next Move: Rent or Buy?

Before auto-renewing your lease or diving into another rental commitment, it's worth pausing to evaluate the long-term ramifications of your choice. Is it time for you to consider stepping onto the property ladder? A candid conversation with a seasoned real estate expert can offer clarity. They can appraise your situation, weighing the pros and cons, and guide you towards an informed decision on homeownership.

In Summation

If you're at the crossroads, deliberating between continuing to rent or embarking on the homeownership journey, always remember: Owning a home is a proven catalyst for wealth accumulation, irrespective of your income level. Ready to explore the potential of homeownership? Let's connect and embark on this transformative journey together.

8-2-2023

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans