Our Blog

Recent:

Mortgage Rates & The 10-Year Treasury Yield: A Glimpse Into The Future

Mortgage rates have always been a topic of intrigue for homebuyers and financial experts alike. The fluctuations in these rates can significantly influence your decision when considering a mortgage, and predicting their movements is both a challenge and an art. In this article, we delve deep into understanding the crucial relationship between the 30-Year Mortgage Rate and the 10-Year Treasury Yield and what it may imply for the future of mortgage rates.

The Historical Indicator of Mortgage Rate Movements

Since Freddie Mac began recording mortgage rate data in 1972, there has been a discernible correlation between the 30-Year Mortgage Rate and the 10-Year Treasury Yield. Over the past five decades, the average difference or 'spread' between these two rates has been approximately 1.72 percentage points (or 172 basis points).

An examination of historical trends reveals a striking synchronicity: when the Treasury Yield rises, mortgage rates usually climb in tandem, and when the Yield drops, the mortgage rates tend to follow suit. This synchrony, however, doesn't always imply uniformity. For many years, the spread between the two metrics has steadfastly hovered around the 1.72 percentage point mark. Yet, recent data indicates a divergence, with the gap widening noticeably.

Understanding The Widening Spread

A naturally arising question is, "What's causing this divergence beyond the historical average?" The crux of the answer lies in the financial market's prevailing uncertainty. Several variables play a role here:

-

Inflation: As prices of goods and services increase, uncertainty in the financial markets often rises, impacting mortgage rates.

-

Economic Drivers: Broader economic factors, including employment rates, GDP growth, and consumer confidence, can also affect the spread.

-

Federal Reserve's Actions: Decisions and policies from the Federal Reserve (often referred to as The Fed) significantly influence the state of mortgage rates.

What This Means for Homebuyers

While the interplay between the 30-Year Mortgage Rate and the 10-Year Treasury Yield might seem esoteric, it holds tangible implications for potential homebuyers. The current spread suggests there's potential for mortgage rates to become more favorable.

Odeta Kushi, the Deputy Chief Economist at First American, articulates this sentiment, stating, "We can anticipate the spread, and by extension, mortgage rates, to ease off in the latter half of the year if the Fed adopts a more lenient monetary stance. However, expecting the spread to revert to the 170 basis point historical mean might be optimistic given the enduring economic uncertainties."

In a similar vein, a piece from Forbes provides insights suggesting that although mortgage rates might remain on the higher side due to ongoing economic ambiguity and The Fed's stance on inflation, a decline in these rates later this year is plausible unless unexpected events disrupt this forecast.

In Conclusion

For prospective homebuyers or current homeowners mulling over relocating, staying abreast of mortgage rate trends and expert projections is paramount. Understanding the relationship between the 30-Year Mortgage Rate and the 10-Year Treasury Yield offers a lens into potential future movements and can inform your home buying decisions.

7-31-2023

The New Normal in Mortgage Rates: A Sellers Guide to Todays Housing Market

If you're contemplating putting your house on the market, understanding the current landscape of the housing market is essential. Recent trends have shown an interesting adaptation in buyer behavior, with potential homebuyers beginning to see today's mortgage rates as the new norm.

The Trend of 30-Year Fixed Mortgage Rate

To paint a more detailed picture, let's dive into the numbers. The graph representing the 30-year fixed mortgage rate trend since last October, as provided by Freddie Mac, reveals a consistency with rates lingering between 6% and 7% for the past nine months.

This steady pattern has far-reaching implications for both buyers and sellers, which we'll explore further.

The Influence of Mortgage Rates on Buyer Demand

What makes these numbers significant? Lawrence Yun, the head economist at the National Association of Realtors (NAR), emphasizes the crucial role mortgage rates have in shaping buyer demand, and consequently, home sales.

"Home sales' direction is largely swayed by mortgage rates. The stable nature of these rates in recent months has paved the way for successive periods of uniform home sales."

This news is encouraging for potential sellers. It signals that buyers are actively engaged in the market, offering a promising environment for those looking to sell.

Understanding the Shift in Buyer Perception

It's helpful to remember the context in which this adaptation is taking place. Last year saw a surprising surge in mortgage rates, jumping roughly from 3% to 7%. This dramatic escalation initially startled many potential buyers, causing them to postpone their purchasing plans.

But time heals, and the initial astonishment has dissipated. Buyers have grown more comfortable with the current mortgage landscape, recognizing that the once record-low rates are now part of history.

Doug Duncan, Senior VP and Chief Economist at Fannie Mae, expressed a similar sentiment:

"Consumers are gradually adjusting to the notion that elevated mortgage rates are likely here to stay for the foreseeable future."

This shift in perception isn't merely anecdotal. A recent survey conducted by Freddie Mac shows that nearly 18% of respondents are likely to buy a home within the next half-year. Translated, almost one in five people surveyed are planning an imminent purchase.

Beyond Mortgage Rates

It's imperative to recognize that mortgage rates are just a piece of the puzzle. Regardless of where these rates stand, individuals continually find reasons to move, whether for job transitions, evolving family needs, or personal reasons. Sellers can take solace in knowing that a market exists for their homes today, and the demand remains robust as buyers acclimate to the current rates.

The Bottom Line

Today's buyers are reshaping their understanding of mortgage rates, adjusting to what appears to be the new standard. This stabilization is fostering strong buyer demand, culminating in steady home sales.

As a seller, this is a golden opportunity to place your house in front of eager buyers. The environment is ripe for a successful transaction, and the team at Your Home Sold Guaranteed Realty is here to guide you through every step of the way.

Understanding the market is key, and now's the time to capitalize on this new normal. Let's connect and start the journey of getting your house in front of those ready and willing buyers. Your next chapter awaits, and the market is ready for you.

7-28-2023

Navigating the Home Price Narrative: A Comprehensive Look at Current Market Trends

In the age of constant news updates and information overload, deciphering the real story behind home prices can feel like an insurmountable task. With anxiety-inducing headlines and a focus on the negative, one might be led to believe that the worst is yet to come. However, a closer examination of the data tells a far more optimistic story.

When comparing year-over-year data, it's crucial to remember that the past year, often referred to as the 'unicorn' year, was an anomaly with housing prices peaking significantly. To draw a more accurate comparison, we should analyze month-on-month data, which gives a clearer picture of the market trajectory.

The Ups and Downs of Home Prices

As we dissect the past year's housing market, we can divide it into two main periods. The first half of 2022 was characterized by a rapid ascent in home prices. However, the trend took a downward turn around July, with prices falling until approximately August or September. But the good news is, current data for 2023 indicates that home prices are on the rise again.

This trend has been consistently represented in three separate monthly reports, suggesting that the worst of the home price decline is in the past. These reports collectively highlight an upward shift in home prices for three or more consecutive months, signaling a promising shift in the housing market.

Craig J. Lazzara, Managing Director at S&P Dow Jones Indices, succinctly captures this trend, stating, "April's data bolsters the argument that the decline in home prices that began in June 2022 had definitively ended in January 2023."

High Demand Keeps Prices Afloat

Several experts posit that the lack of a catastrophic price crash, as some feared, can be attributed to a simple economic principle: supply and demand. Even with current mortgage rates, the demand for homes still surpasses the available supply.

Mark Fleming, Chief Economist at First American, elaborates on this theory: "Historically, higher rates may slow the escalation of prices, but they don’t cause them to crash. This holds particularly true for today's housing market, where demand consistently outstrips supply, exerting upward pressure on house prices."

Further backing this claim, Doug Duncan, Senior VP and Chief Economist at Fannie Mae, attributes the steady growth in home prices to this persistent demand. He asserts, "Housing prices continue to exceed previous expectations, a testament to the strength of demographic-related demand."

How Does This Impact You?

For potential buyers who've been sitting on the sidelines for fear of depreciating home values, the rebounding home prices should serve as a source of relief and a green signal to make a move. Homeownership not only offers stability but also provides an asset that generally appreciates over time.

If you're a homeowner considering selling, the fear of fluctuating home prices may have held you back. The latest data, however, indicates a favorable shift. Teaming up with a knowledgeable real estate agent could be a wise decision to navigate this market effectively.

Bottom Line

If concerns about dropping home prices have been holding you back, the latest data suggests the worst is over. Home prices are appreciating nationally, signaling a good time to reevaluate your real estate plans. Get in touch with us today to understand what's happening with home prices in our local area.

7-27-2023

Leveraging Remote Work to Expand Your Home Search: A Guide for Modern Professionals

As we navigate through the era of remote work, a novel paradigm has emerged, altering the way professionals view their career and lifestyle. This shift not only provides work flexibility but also opens up a wealth of new possibilities when it comes to home buying. Expanding your residential search beyond the traditional parameters of commuting distances can make the quest for the perfect home much more achievable and affordable. This blog explores how to navigate these new opportunities effectively.

Recent surveys reveal an interesting trend: the majority of professionals prefer remote or hybrid work models (a blend of office-based and remote work). This trend extends a lifeline to prospective homebuyers who are grappling with current affordability and housing inventory challenges.

The Freedom to Choose Beyond Geographical Limits

Working remotely provides the opportunity to explore residences outside bustling city centers or distant from office locations, where real estate often carries a more affordable price tag. This increased flexibility, which allows for the consideration of farther suburbs or even different regions, becomes particularly significant as higher mortgage rates pose affordability challenges for some homebuyers. An insightful piece from the New York Times underlines this:

"Remote work has presented the opportunity to move to more affordable communities, either farther out in the suburbs, or in another part of the country."

This increased scope also tackles another issue plaguing the housing market: the limited inventory of homes for sale. Finding a home that checks all your boxes might prove challenging in today's landscape. However, remote work, with its inherent geographical flexibility, enables you to cast a wider net, thus increasing the odds of finding a property that meets your criteria without straining your budget.

Making Remote Work Advantage Work for You

It's crucial to remember that while remote work offers an exciting spectrum of possibilities, it also demands a unique set of needs for your living space. Dedicated work areas, strong internet connectivity, and a serene environment conducive to productivity become paramount in a work-from-home arrangement. Thus, while expanding your search radius, consider these factors to ensure your new home truly supports your work-life balance.

Additionally, understand that even in remote work situations, location matters. Choosing a home in a community with a robust economy and a healthy job market can provide a safety net should your remote work situation change. Local amenities, quality of schools, and lifestyle compatibility also remain critical considerations.

Bottom Line

Remote work doesn’t just offer job flexibility—it presents a unique opportunity to expand your home search and explore new horizons. This dynamic shift can pave the way to a home that accommodates both your professional and personal aspirations, without exceeding your budget. Ready to harness this potential and find your perfect home? Let's connect and discuss your options.

7-24-2023

Navigating the Intricacies of Short-term Rentals versus Selling Your Home

For homeowners contemplating their next move, the decision to lease out their current residence as a short-term rental (STR) instead of selling can be tantalizing. Indeed, STRs, commonly perceived as hotel alternatives, have been on the ascendancy in recent years, piquing the interest of many property owners. However, the reality of managing an STR can quickly become overwhelming, necessitating careful consideration of the challenges involved before taking the plunge.

The Demanding Side of Short-term Rentals

There's no denying the potential attractiveness of short-term rentals as an income source. However, managing such a property is far from a walk in the park. To run an STR smoothly, you will be juggling numerous responsibilities such as handling bookings, coordinating guest arrivals, and ensuring your property is spick-and-span after each rental term. All these tasks demand a considerable time and energy investment.

Additionally, short-term rentals typically experience a high turnover rate due to the nature of brief stays. This increased flux of guests can cause accelerated wear and tear on your property, potentially leading to more frequent maintenance, repairs, or even replacements of furnishings and appliances.

It's worth pondering if you are genuinely prepared to shoulder this level of commitment, especially if you plan on advertising your rental property on popular platforms that often have stringent host requirements. As emphasized by Bankrate, a reputable personal finance company:

"Property rental management can be both time-intensive and challenging. Assess your ability to conduct minor repairs independently. If that's not feasible, do you have a network of budget-friendly contractors to rely on when needed? Ponder over whether you're ready to shoulder the landlord's role, including tenant screening and handling issues. Otherwise, would you prefer to incur the cost of a third-party management service?"

Navigating Short-term Rental Regulations

With the short-term rental market's burgeoning growth comes an increase in regulations. Many regions, particularly bustling cities and popular tourist destinations, have enacted rules limiting the number of STRs allowed. This move aims to mitigate potential overcrowding and ensure sufficient housing options for permanent residents. Furthermore, certain regulations may dictate the property types eligible for short-term rentals.

Moreover, a growing number of cities require homeowners to obtain specific licenses or permits prior to listing their homes as STRs. Nick Del Pego, the CEO of Deckard Technologies, offers valuable insight on this matter:

"The majority of local governments classify short-term rentals as businesses, mandating owners to comply with workplace regulations and business licensing rules established within their local communities."

Before even considering venturing into the short-term rental market, it is crucial to thoroughly research any applicable regulations or prohibitions imposed by your local government or homeowners association (HOA).

Is Selling a Better Option?

The decision to convert your home into a short-term rental requires a thorough understanding of what it entails and the potential challenges that lie ahead. If the intricacies of STR management seem too daunting, selling your property might prove to be a better alternative.

In a seller's market, homeowners have the opportunity to maximize their profits while avoiding the hurdles of property management. However, the decision between selling and renting should be made based on your personal circumstances, financial goals, and the level of responsibility you're prepared to undertake.

In conclusion, whether you opt for the short-term rental route or decide that selling is more appropriate, it is vital to make an informed decision. It's worth seeking the advice of a trusted real estate professional to ensure you're making the best choice for your unique situation. Connecting with an expert could shed light on the most suitable options available to you in your local area. Let's explore this together to make your next move as smooth as possible.

7-21-2023

Discovering the Potential in Newly Built Homes: Navigating the Current Housing Market

As a hopeful home buyer, you're undoubtedly feeling the constraints of the current real estate market. Scarcity of available homes can make it seem like your dream home is just out of reach. But, have you considered looking into new construction homes? There's a wealth of opportunities waiting for you in this sector of the market.

As you grapple with the limited housing options typically available during the busy real estate season, it's worth noting that the market for new constructions is a beacon of hope. According to recent data from the National Association of Realtors (NAR), the availability of existing homes in the market is roughly half of what it was in 2019. But when you pivot your perspective towards newly built homes, the picture looks considerably brighter.

The Power of New Residential Completions

One valuable metric to consider in your home buying journey is "new residential completions." This term refers to homes that are newly built, completed, and ready to welcome a new owner. It's an important gauge to understand the trends in the housing market.

The graph below depicts the historical trends of new-home completions. The black line represents the long-term average number of finished housing units.

Leading up to the housing market crash in 2008, home builders exceeded this average, resulting in an oversupply of homes (indicated by the orange in the graph). As a result, home values plummeted, contributing to the housing market's collapse.

Following this crash, the pace of new home constructions fell significantly. The amount of new homes built failed to meet the long-term average, creating a deficiency in housing inventory (highlighted in red). This deficit is a significant contributor to today's scarcity in housing availability.

However, the future looks promising. As depicted by the green on the graph, the latest data from the Census suggests that builders are now matching the long-term average. This indicates an increase in newly built homes entering the market, a trend not seen in recent years.

Adding to this optimism are the rising rates of residential starts and permits. Starts refer to homes where construction has officially begun, while permits apply to homes slated to break ground soon. With both metrics on the rise, the promise of more new homes in the market is strong.

Expanding Your Options

The increase in newly built homes offers a broader pool of options for prospective buyers. If you're ready to move now and the timing is critical, a real estate professional can help you explore recently completed homes in your area. Given that these homes are move-in ready, your transition could be seamless and quick.

Alternatively, if you're flexible with your timeline and the idea of customizing a home from scratch appeals to you, consult with your real estate agent about homes under construction in your preferred location. Buying a home that's still in progress provides you the unique opportunity to select features and finishes to suit your tastes, making it a perfect fit.

Your real estate agent is an invaluable resource throughout this process. They are equipped with up-to-date knowledge of what's available in your area and can offer recommendations based on your unique needs, preferred neighborhoods, and more.

A Look at the Bigger Picture

The scarcity of inventory doesn't mean you need to compromise on your dream home. Exploring new-home construction can open up possibilities you may not have considered before. With the right support and knowledge, you can navigate the current market conditions to find the perfect fit for your family.

Don't hesitate to explore the realm of new-home construction if you're struggling to find a home that suits your needs in the current market. Connect with a local real estate professional today and discover the possibilities that await in your local area.

7-19-2023

Maximizing Your Home Sale: Overcoming Challenges in Todays Sellers Market

In the journey of selling a house, three primary objectives shape your path - fetching the highest possible price, ensuring a swift sale, and experiencing a hassle-free process. While the current housing market conditions generally favor sellers due to the scarcity of available homes, certain factors can hinder or even prevent the sale of your house.

If you find yourself struggling to sell your home in today's sellers’ market, let's consider a few points to get things moving in the right direction.

1. Accessibility - The Key to Exposure

A common pitfall sellers often encounter is restricting the viewing hours of their homes. If your goal is to maximize your house's sale potential, it is vital to provide potential buyers with broad access to your property. Limited accessibility equates to minimal exposure, and this can be detrimental to your selling goals.

Consider that some motivated buyers may not be from your locality. For these out-of-town buyers, their schedules might not align with restrictive viewing times, potentially leading to missed opportunities. Hence, keep your home available for viewings as much as possible to reach a larger audience.

2. Pricing - Striking the Balance

The price tag attached to your home plays a decisive role in its sale. Although the temptation to mark up the price to increase profit is understandable, overpricing might deter potential buyers, causing your home to languish longer on the market.

Jeff Tucker, Senior Economist at Zillow, underscores this point, stating, ". . . sellers who price and market their home competitively shouldn’t have a problem finding a buyer."

In today's digital age, prospective buyers have access to numerous tools and resources to compare available homes in your vicinity. An excessively high price, in comparison to similar homes, could turn potential buyers away. Monitor feedback from open houses and showings through your agent. If the response is consistently negative regarding the price, consider reassessing your pricing strategy.

3. Aesthetics - First Impressions Matter

When selling your house, heed the old adage, "you never get a second chance to make a first impression." The aesthetic appeal of your home, both exterior and interior, plays a crucial role in attracting potential buyers.

Boosting your home's curb appeal by sprucing up your landscaping can significantly enhance its first impression. As an article from Investopedia highlights, "Curb-appeal projects make the property look good as soon as prospective buyers arrive. While these projects may not add a considerable amount of monetary value, they will help your home sell faster..."

But the work doesn't stop at the front door. By decluttering and depersonalizing your interiors, you allow potential buyers to envision themselves in your home. Small updates, like a fresh coat of paint or a thorough floor cleaning, can refresh the rooms, making your home more appealing.

Remember, your real estate agent is a valuable resource. They can provide expert advice tailored to your specific situation and insights gleaned from buyer feedback during the selling process.

Final Thoughts

If your house isn't getting the attention it deserves, or if the sale is taking longer than expected, it may be time to revisit your selling strategy. Seek advice from your trusted real estate agent on potential adjustments. Their expert insights can help recalibrate your approach, maximizing your chances of a successful and profitable home sale.

Connecting with a real estate professional can provide the guidance you need to navigate the complexities of the selling process. Let's connect to discuss your specific situation and chart the course for your successful home sale journey.

7-17-2023

Low Housing Inventory: Uncovering Opportunities in Todays Market

The current housing market presents an intriguing conundrum. An abundance of willing and able buyers are actively seeking properties, but there's a scarcity of homes available for sale. This imbalance between supply and demand significantly shapes the housing landscape, affecting both potential sellers and buyers.

To illustrate the severity of the housing inventory shortfall, let's delve into some of the recent data on active listings or the number of homes up for sale within a given month, and compare it to levels typically seen in a more balanced market.

A report from Realtor.com states, "On average, active inventory in June was 50.6% below pre-pandemic 2017–2019 levels." This snapshot demonstrates the stark contrast between the current market and more 'normal' times. The graph below highlights this disparity further. It leverages historical data to show the significant gap in active listings compared to the numbers we would typically see in a more balanced market.

It is important to note that the years 2020-2022, marked by the abnormality induced by the global pandemic, are not included in this graph to prevent skewed interpretation of the data.

When we compare the data for 2023 with the baseline years of 2017-2019 (which were the last 'normal' years for the housing market), we observe that the count of active listings is significantly below the average. This snapshot reveals the current deficit in housing inventory.

Implications for Potential Sellers

So, how does this impact you? If you've been considering selling your house, the current market dynamics create a favorable environment for sellers. The shortage of properties means buyers have fewer options to choose from, which significantly tilts the balance of power towards sellers.

These conditions impact several key housing market statistics. The latest Confidence Index from the National Association of Realtors (NAR) presents some heartening data for potential sellers:

- The percentage of homes that sold in less than a month rose slightly to 74%.

- The median days on the market reduced to 18 days, implying homes are still being snapped up rapidly when priced correctly.

- The average number of offers received on recently sold homes increased to 3.3 offers.

This data suggests that when inventory is low, as it is currently, your house is likely to attract greater attention. As a result, sellers are seeing their properties sell quicker and garner more offers.

Exploring the Opportunities: The Bottom Line

In a market where supply is limited, your property is likely to be thrust into the limelight. That's why sellers are witnessing their homes sell at a faster pace and attract more offers.

If you've been contemplating selling, the present market conditions offer a unique opportunity. The demand for homes is high, but the availability is low, creating an environment where sellers have the upper hand. With careful planning and professional guidance, you can navigate this market to your advantage.

Now is the time to turn your thoughts of selling into action. Let's connect to kickstart the process, capitalize on the current market dynamics, and make your home-selling journey a successful one.

7-14-2023

Decoding the Housing Market: Understanding Home Prices and Mortgage Rates

When you're on the precipice of making a significant decision like buying a home, it's natural to find yourself wading through a sea of information. The latest trends in the housing market become your primary concern, and you begin to gather knowledge from every conceivable source – news, social media, your real estate agent, friends, family, and even overheard snippets of conversation at the supermarket. Two key aspects you'll often find coming up in your research are home prices and mortgage rates.

To effectively navigate this information overload and arrive at the most valuable insights, it's essential to consult reliable data sources and ask yourself the right questions. So, here are the top two questions you need to address regarding home prices and mortgage rates when considering a home purchase:

1. What's the Future Trajectory of Home Prices?

To answer this, you can rely on credible sources such as the Home Price Expectation Survey (HPES) from Pulsenomics. This survey aggregates views from a national panel comprising over a hundred economists, real estate experts, investment gurus, and market strategists.

According to the most recent findings, the experts surveyed predict a minor depreciation for this year. However, it's important to note that significant price drops are already in the rearview mirror, and prices are climbing once again in many markets. The slight 0.37% depreciation projected by the HPES for 2023 is a far cry from the major downturn that some anticipated.

Looking ahead, the forecast indicates a positive shift in home prices from 2024 and beyond. The experts expect home prices to appreciate, reverting to a more standard growth pattern for the next few years.

So, why is this significant for you as a prospective homebuyer? It implies that if you purchase a home now, you can expect your property to appreciate in value, resulting in an increase in home equity over time. If you wait, these forecasts suggest that you'll end up paying more as home prices continue to rise.

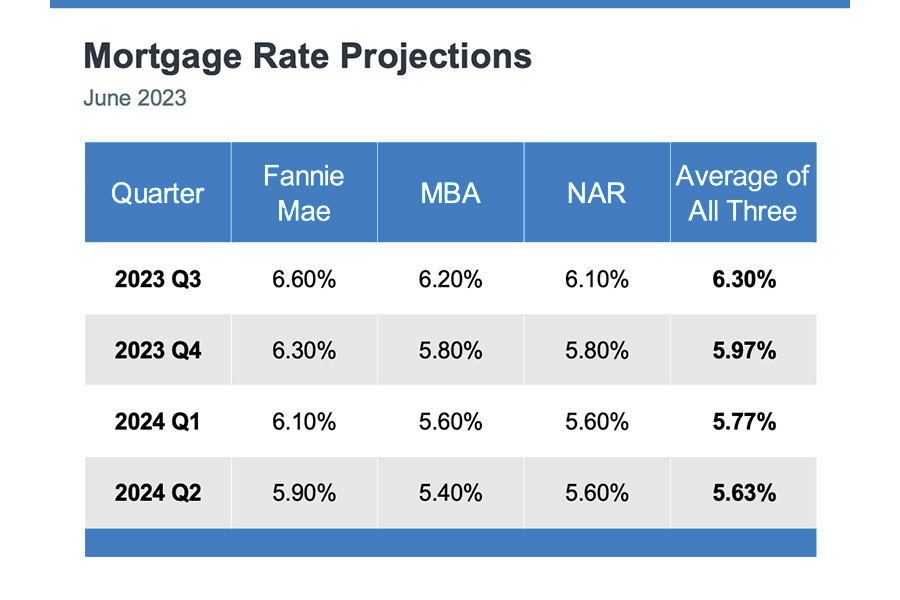

2. How Will Mortgage Rates Change in the Future?

Mortgage rates have seen an upward trend over the past year, influenced by factors such as economic uncertainty and inflation. However, recent reports indicate a slight easing off from the peak of inflation, which bodes well for the market and mortgage rates.

The logic here is straightforward: as inflation slows, mortgage rates tend to decrease correspondingly. Thus, some experts are projecting a modest pullback in mortgage rates over the forthcoming quarters, stabilizing between approximately 5.5% and 6%.

That being said, predicting future mortgage rates with total certainty is practically impossible due to the multitude of influencing factors. So, here's what you should contemplate:

- If you buy now and mortgage rates remain constant, you've made a wise move. As home prices are projected to rise, securing your home at the current price is a win.

- If you buy now and mortgage rates drop (as anticipated), you've likely made a sound decision. You've bought your home before further price appreciation, and you could potentially refinance later if rates are lower.

- If you buy now and mortgage rates increase, you've made an excellent choice. You've purchased before the home price and the mortgage rate escalated.

Deciphering the Market Trends: The Bottom Line

If you're contemplating buying a home, understanding the trajectory of home prices and mortgage rates is critical. Although absolute certainties are elusive, expert projections can offer valuable insights to keep you informed.

Buying a home is a significant milestone and requires careful consideration. As a prospective buyer, you deserve expert guidance to help you understand the dynamics of the local market and make an informed decision. Connecting with a seasoned real estate professional can provide you with valuable insights, helping you turn your dream of homeownership into a reality.

7-12-2023

The American Dream: How Homeownership Paves the Way to Success, Freedom, and Prosperity

Everyone carries a different perception of the American Dream, with a spectrum of interpretations as varied and unique as the individuals who dream them. Yet, for a considerable number of people, this dream ties into notions of success, prosperity, and freedom – all of which can be significantly linked to homeownership.

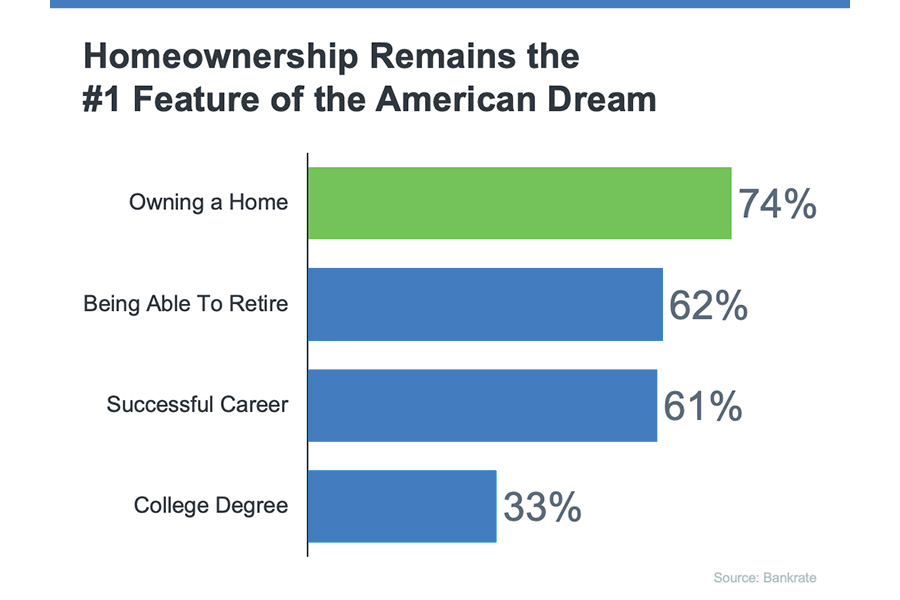

A recent survey conducted by Bankrate aimed to gauge which accomplishments most people feel embody the American Dream. The data extracted paints a clear picture – homeownership remains a vital part of the American Dream for a vast number of Americans today, ranking above other significant life milestones like having a successful career, retirement, and acquiring a college degree.

Why Homeownership Holds Value

To understand why homeownership retains such high regard, we can turn to insights provided by a recent report from MYND. The study revealed that almost two-thirds of Americans (65%) perceive homeownership as a path to building intergenerational wealth. The value of homeownership isn't merely in its physical representation, but in the financial stability it affords over time.

When you own a home, your equity and net worth build over time as you repay your home loan and as the home's market value appreciates. This growth serves as a cornerstone in creating intergenerational wealth and fostering long-term financial stability, making it one of the most sound and secure investments an individual can make.

In addition, a report from Fannie Mae underscores the importance homeownership holds in the pursuit of a good life. A staggering 87% of consumers believe owning a home is crucial to 'live the good life.' Notably, many see the benefit of 'having less stress' as an advantage of owning over renting.

Today, when economic uncertainty looms, owning a home with a fixed-rate mortgage provides a certain degree of stability. It secures your largest monthly expense, your housing cost, helping counteract the impact of rising costs due to inflation.

What Does Homeownership Mean for You?

While the current environment with higher mortgage rates and home prices might make the prospect of buying a home seem daunting, it's important to remember the long-term benefits. If the time aligns with your life stage and financial circumstances, homeownership can offer immense rewards.

Over time, a home serves as more than a roof over your head. It becomes a financial asset, a source of stability, and a symbol of personal accomplishment. It represents the achievement of an individual or a family's goal and serves as a testament to hard work, perseverance, and financial wisdom. It provides a platform for building wealth and financial stability that can span generations.

The Pursuit of the American Dream

Homeownership remains a potent embodiment of the American Dream, a beacon symbolizing personal success and financial independence. As such, the decision to buy a home is both significant and powerful, a reflection of aspiration and perseverance.

If you're considering making your homeownership dream a reality this year, it's essential to have trusted guidance. Connecting with a knowledgeable real estate professional who understands your goals can provide you with the necessary tools and insights to navigate the home buying process.

The journey towards homeownership might be fraught with challenges, but the rewards waiting at the journey's end are worth the effort. As you embark on this path, remember, you're not just buying a home. You're investing in your financial future, securing a legacy for generations to come, and turning your personal interpretation of the American Dream into a tangible reality.

7-10-2023

July 2023 Newsletter

In today's edition of our newsletter, we aim to assist you with overcoming indecisiveness, a common challenge we face when making numerous daily decisions. Inside this newsletter, you will find valuable tips to combat "analysis paralysis."

You will discover surprising symptoms associated with thyroid diseases, explore alternatives to traditional turf lawns, and gain essential knowledge about selecting and utilizing digital wallets. Alongside these informative articles, we've included fun facts, a trivia challenge, and much more to keep you engaged.

I want to emphasize that I am available for any inquiries or concerns you may have. If you come across a friend, family member, or neighbor in need of a caring and competent real estate professional for buying or selling purposes, please do not hesitate to let me know.

Your friendship and referrals are sincerely appreciated. Enjoy this edition of the newsletter!

Warmest regards,

Bill Watson

President / Managing Broker

Your Home Sold Guaranteed Realty - The Watson Group

6155 S Main Street, Suite 270

Aurora, CO 80016

720-463-0002

bill@watsonrg.com

www.yourhomesoldguaranteedrealtyco.com

P.S. In the upcoming weeks, if you hear people discussing real estate, please feel free to tell them about my free consumer information! This useful resource can be very beneficial for anyone who wants to learn more about real estate.

This summer, you might come across individuals who were relocated and want to purchase a home. By sharing my Free Consumer Report "Cash Savings Guarantee," you can assist them in purchasing their ideal home at a lower cost than they anticipated. To obtain a copy for someone else, contact me at 720-463-0002.

SELL YOUR HOME FAST and for TOP DOLLAR! Get this FREE Report that

Reveals 27 Tips to Give You the Competitive Edge! www.Our27Tips.com

Conquer "Analysis Paralysis"

We face countless choices daily, both trivial and important. Regardless of the importance, however, making decisions requires mental energy—it can be exhausting. It’s not surprising, then, that we might feel indecisive about even the smallest things.

Here are some popular decision-making tips to try if you find yourself struggling.

- Reduce your options.Choosing from ten menu items is harder than choosing among three. Reduce your potential options and you can reduce your decision stress. Try just picking items from one menu section.

- Be methodical.Following a series of steps to make sure you’re not forgetting something can be useful. Thisplan (https://www.umassd.edu/media/umassdartmouth/fycm/decision_making_process.pdf), from researchers at the University of Massachusetts Dartmouth, outlines seven steps of effective decision making.

- Create a deadline.To avoid waffling on a decision until it’s no longer relevant, set yourself a deadline. If you haven’t decided by that date, you can tell yourself what that means (i.e., if you haven’t decided that you are going to an event, decide that that means you aren’t going).

- Try out common decision-making methods.Flipping a coin or writing a pros and cons list may be just the trick you need to get you out of an indecisive rut. And, if you’re unhappy with the result of a coin toss, your gut may be pointing you toward the choice you actually want to make.

- Learn from the outcomes, good and bad.No one is perfect, and even if we follow guidelines for making sound decisions they can still not work out how we’d hoped. Review the results of your decisions later for insights to help you make better decisions in the future.

It’s important to keep in mind that overthinking a choice until the option is no longer available is a decision in and of itself—you’re choosing not to decide.

That may not seem so bad if the question is what you’d like for dinner, but it can also lead to a career or relationship stalling. Most experts agree that making the wrong decision can be better than making no decision. At least you are moving forward!

Receive Multiple Cash Offers on Your Home Today!

Are you looking to sell your home quickly and for a fair price? Look no further than our Exclusive Cash Offer Program. Our program is designed to give homeowners access to multiple cash offers on their homes in just minutes. With our cutting-edge technology, we can provide real estate investors with the data they need to make informed decisions about your property.

No Waiting To Receive an Offer

No Home Prepping For Sale

No Strangers in Your Home

No Open Houses

Don't wait any longer - sign up now and start receiving multiple cash offers!

www.GetaCashOnlyOffer.com

Subscribe to Our Newsletter

Going Above and Beyond for

Homebuyers and Homesellers

At Your Home Sold Guaranteed Realty - The Watson Group, we believe that buying or selling a home should be a seamless and stress-free experience. Our team of experienced real estate agents is committed to helping you navigate the complex world of real estate, from finding your dream home to getting the best price for your property.

With our exclusive buyback guarantee, you can feel confident knowing that we stand behind the homes we sell. We also offer a satisfaction guarantee for buyers, ensuring that you'll love your new home or we'll buy it back from you within 12 months.

As a family-owned business, we have grown to become one of the top real estate companies in the Denver Metro Area. Our commitment to providing excellent customer service and delivering results has earned us a reputation as a trusted and reliable partner in the real estate industry.

Whether you're buying or selling, you can count on Your Home Sold Guaranteed Realty - The Watson Groupto go above and beyond to help you achieve your goals. Contact us today to learn more about how we can help you with your real estate needs.

See What Our Amazing Fans Have to Say

Visit www.OurAmazingFans.com

HIGHLINE EAST AT DAYTON TRIANGLE

Only 6 Homes Remain!

Highline East has captured the interest of discerning home seekers since its grand opening earlier this year. Perfectly situated in the heart of Dayton Triangle, this community seamlessly blends luxury, comfort, and convenience. Meticulously designed to redefine modern living, Highline East offers a unique combination of elegant architecture, thoughtful floor plans, and exceptional craftsmanship, making it the ultimate residential destination for those who seek unparalleled comfort.

6 Thyroid Disorder Symptoms

Fatigue is a common symptom of a thyroid disorder, but fatigue is also a common symptom of being a busy human in the 21st century. The butterfly-shaped gland in your neck regulates thyroid hormone (TH), which is important to the proper functions of multiple systems in your body.

Thyroid disorders often go undetected until symptoms are more severe but both hypothyroidism (underactive thyroid) or hyperthyroidism (overactive thyroid) are usually not too hard to treat once identified. Here are some surprising signs that may indicate it’s time to talk to your doctor.

- Cognitive function:An underactive thyroid may cause forgetfulness, while an overactive thyroid can make it extremely hard to concentrate.

- Bowel issues:Hypothyroidism can lead to constipation while hyperthyroidism can lead to diarrhea.

- Heart problems:Too much TH may make for heart palpitations and chest pain. Too little may lead to higher blood pressure and cholesterol.

- Skin issues:Thyroid issues may cause several skin problems, including dry skin, brittle nails, or a swollen face.

- Muscle pain:Sudden and unexplained muscle pain, cramping, or weakness may be a sign of an underactive thyroid.

- Infertility:Hypothyroidism can disrupt hormones that affect ovulation and lactation.

Find out the value of your home by answering a few simple questions. By providing your address and home description, the system will produce a complete market analysis through a search for similar homes sold and listed in your area.

Want to Lose Your Lawn?

Manicured lawns might look nice, but they’re also expensive to maintain and environmentally problematic. Replacing your lawn can save time and money, not to mention be a boon to pollinating insects and birds.

Lawn alternatives vary widely by climate, so consult a local gardening expert or resources that are specifically geared toward your USDA Plant Hardiness Zone. Find your Plant Hardiness Zone by entering your zip code here:https://planthardiness.ars.usda.gov/

Remember: Plants that are acceptable in one city may be classified as invasive in another. Do your research before you start planting.

- Durable ground covers like clover, moss, Woolly Thyme, and Blue Star Creeper spread quickly, require no mowing or watering, and withstand the rigors of backyard picnics and playtime.

- Xeriscaping isn’t just applicable to the desert climates where it’s popular. It’s all about focusing on native plants that can thrive where you live with little to no maintenance.

- Garden or flower beds can eliminate some lawn areas, but you can also use decorative gravel to fill in the spaces between those beds to get rid of even more grass.

AT MURPHY CREEK

Welcome to Elevations at Murphy Creek by Montano Homes - the perfect place to call home! This central master-planned community provides easy access to DIA, Southlands Mall's gourmet dining and shopping options, and offers stunning views of one of Colorado's finest links-style golf courses. With 3 bedroom Colorado Contemporary Paired homes, you'll have plenty of space to make this your own little paradise. Experience luxury living at its finest with Elevations at Murphy Creek.

Now Selling from the High $400's

Find out how this changing market has affected your home value! Your home may be worth more than you think.

Visit www.AccurateHousePrice.com or Call Us at720-463-0002.

This is a FREE service with NO OBLIGATION to list.

Digital Wallets 101

We’ve learned to swipe, insert, and tap our credit cards in the checkout line as each new payment method was introduced. But you may not even need to dig your wallet out of your purse anymore—contactless payments through digital wallets are increasingly common.

The question of whether togeta digital wallet may be moot: If you have a smartphone, you probablyhavea digital wallet app already.Apple Wallet, Google Wallet, andSamsung Walletare each associated with the device you have, you just need to activate them.

In each case, you can store your existing credit cards to quickly pay for groceries at a local store, for instance. But, like a physical wallet, these mobile digital wallets can also store things like bus passes, plane tickets, and gym membership cards. When your phone is more likely to be in your hand than your wallet, a digital wallet can be an incredible time-saver.

There are also digital wallets (sometimes called money apps) that are not dependent on an operating system and are primarily geared toward sending and receiving money. This category includes popular apps or websites likeVenmo, PayPal, andCash App. In each case, you can link bank accounts and credit/debit cards to the app to pay for purchases online or in person (by scanning a payee’s QR code or knowing their account name). These apps also make easy work of splitting the dinner bill among friends—everyone can send their share to one person who puts down a credit card. Note that the latter form of digital wallet may add a fee for certain transactions.

Digital wallets are generally seen as more secure payment methods since security measures on your phone (like passcodes and facial recognition) make it incredibly difficult for anyone else to access your accounts. And, when you tap your phone at a store’s register, the store gets a unique and encrypted code to complete the transaction—even they don’t see your account information. As contactless payments and digital money transfers become more prevalent, digital wallets will only get more popular. Check out the one in your pocket!

Studies have shown your income and wealth are directly related to the size and depth of your vocabulary. Here is this month's word.

sanctimonious(pronounced sank-ti-moan-ee-us) adjective

Meaning:negative connotationto act morally superior

Sample Sentence:His sanctimonious attitude contrasted with his meek manners.

Not Ready to Sell? Text your address to 720-605-1268 to find out what your home will sell for today. You will not receive a phone call, just a text!

Meet Our Team of Experts

Committed to Your Real Estate Success

At Your Home Sold Guaranteed Realty - The Watson Group, we take great pride in our team of experienced real estate agents. Our team is made up of dedicated professionals who are committed to helping you achieve your real estate goals.

From first-time homebuyers to seasoned investors, we have the knowledge and expertise to guide you through every step of the buying or selling process. Our team is here to answer your questions, address your concerns, and provide you with the support you need to make informed decisions.

We also offer exclusive guarantees that set us apart from other real estate companies. Our buyback guarantee ensures that we stand behind the homes we sell, giving you added peace of mind when making one of the biggest investments of your life. We also offer a satisfaction guarantee for buyers, ensuring that you'll love your new home or we'll buy it back from you within 12 months.

Choose Your Home Sold Guaranteed Realty - The Watson Groupfor a real estate experience that is tailored to your needs and focused on your success. Contact us today to learn more about how our team can help you with your real estate needs.

Subscribe to Our Newsletter

Not Ready to Sell? Text your address to 720-605-1268 to find out what your home will sell for today. You will not receive a phone call, just a text!

Enhancing Your Homes Appeal with Energy

Efficiency: A Guide for Potential Sellers

Are you pondering the sale of your home? If that's the case, you might be surprised to learn how much potential buyers today appreciate energy-efficient and eco-conscious attributes, especially as we transition into summer. In fact, the 2023 Realtors and Sustainability Report from the National Association of Realtors. . .

![]()

Plant Tracker Apps

Keepyour plants alive with these apps for both Apple and Android phones.

getplanta.com: The free version reminds you to water your houseplants on a schedule tailored to the pot size and type and distance from windows. The paid version ($36/year) adds features like fertilization prompts, a light meter, and help from Dr. Planta for ailing flora.

blossomplant.com: This app covers both indoorandoutdoor plants with plant and disease ID, plus detailed care guides. The light meter feature is only available for Android. There’s a free trial, after which it’s $19.99/year.

picturethisai.com: The huge plant ID database (free) is the main appeal here—it includes more than 10,000 indoor and outdoor species and boasts 98% accuracy. More features come with the $30/year subscription.

A Heartfelt Message to our Special Clients and Friends . . .

It is our pleasure to extend a warm welcome to all of the new clients we have had the honor of working with recently, and also offer special thanks to our Raving Fans.

Kylie Bearse

Daniel Strough

Brenda Childress

Rick & Cora Walkup

Robert & Cherlyn Mollitor

Our business would not be where it is today without your trust!

Recently Sold Properties

by The Watson Group

Lower Highlands

Sold for $1,125,000!

Shenandoah

Sold for $650,000!

Willow Creek

Sold for $900,000!

Independence

Sold for $590,000!

Highline East

Sold for $625,000!

Foxdale Condos

Sold for $275,000!

Crystal Valley Ranch

Sold for $644,900!

Sunflower

Sold for $285,000!

Creekside Eagle Bend

Sold for $800,000!

Real Estate Corner . . .

Q: What things should I keep in mind when negotiating with a buyer?

A:Revealing too much information to buyers when you’re negotiating the sale of your home is a common, costly mistake. Here’s how to avoid it.

- Know what you want from the sale and try to determine what your buyers want, so you will make a deal that benefits you both. A professional REALTOR® knows the questions to ask potential buyers to determine their motivation for buying and what price they can afford.

- Don’t mention the “appraisal” value of your home at a showing to try to persuade a buyer to pay more for it.

- If you’re at a showing, don’t tell a buyer why you’re selling (especially if you need to sell it quickly). Just say your housing needs have changed.

Want to learn more? Read our six strategies “Negotiating Tips: Get the Highest Price You Can when You Sell Your Home” to help you secure the right price when selling your home.

Do you have a real estate question you want answered? Feel free to call me at720-463-0002. Perhaps I’ll feature it in my next issue!

Want to Win a $25 Starbucks Gift Card?

Last month's trivia question answer.

Which of these sports will make its debut at the 2024 Summer Olympics in Paris?

(a) Breaking (b) Skateboarding (c) Sport Climbing (d) Surfing

The answer is a) Breaking...but don’t call it break dancing. Skate-boarding, sport climbing and surfing debuted in Tokyo and will return to the Summer Olympics in Paris. So let’s move on tothismonth’s trivia question.

Now for this month's trivia question!

In the U.S., you’d “knock on wood” for good luck. In what country do carp scales represent similar good fortune?

(a) Poland (b) Japan (c) Madagascar (d) Jamaica

Call Me at 720-463-0002 or Email Me at bill@watsonrg.com

and You Could Be One of My Next Winners!

7-8-2023

CATEGORIES: Newsletter

Crafting Your Home Wish List: A Strategic Approach to Home Buying

In the realm of home buying, particularly in today's environment with its inherent affordability challenges, strategy and foresight become essential. Home buyers are now more than ever prompted to re-evaluate their wish list to balance their needs and wants. Such an approach allows for a more calculated borrowing plan, accommodating the current high costs associated with taking a home loan.

Re-evaluating Home Features

For example, envision a beautiful, crystal-clear pool right in your backyard. Tempting, isn't it? However, NerdWallet suggests reconsidering whether amenities like these are really essential to your daily life. Could this substantial investment be better allocated to a more functional home feature such as a garage or a home office?

Undeniably, having a pool or similar luxury amenities can enhance the attractiveness of a home, but it’s crucial to discern between what's appealing and what's essential. Ask yourself - is the pursuit of a home with a pool your primary motivation for moving? Most likely, the answer will revolve around the need for more space, a home office, or proximity to work or loved ones.

Crafting Your Essential Features List

If you're planning to buy a home, it's advisable to invest some time considering what is truly indispensable in your next dwelling. Begin by creating a comprehensive list of features you desire in your new home, and then proceed to categorize these features. Here's a helpful strategy to organize your wish list:

-

Must-Haves: These are non-negotiable features that align with your lifestyle. They could include the proximity to work or family, the number of bedrooms and bathrooms, among other factors. A house lacking these features will be unsuitable for your needs.

-

Nice-To-Haves: These are desirable features, but not deal-breakers. They aren't essential, but if a potential house includes these along with your must-haves, it certainly becomes a strong contender. Some examples may include a second home office or a garage.

-

Dream State: This category gives room to your big, aspirational dreams. While these aren't necessities, finding a house within your budget that checks off your must-haves, a good portion of nice-to-haves, and features from this list would be a clear winner. This could include extravagant features such as a pool or multiple walk-in closets.

After arranging your list accordingly, share it with your real estate agent. It’s important to have a candid discussion about what aspects of a home are non-negotiable for you and what would be a bonus. Your agent will help you refine your list further and guide you in maintaining focus during the home search, ultimately helping you find a home that satisfies your top priorities.

The Strategic Edge in Home Buying

Creating a comprehensive list of necessary features for your next home might seem like a minor task, but it plays a pivotal role in strategizing your home buying journey. By meticulously curating your list of must-haves, nice-to-haves, and dream state amenities, you're laying a solid foundation for a smoother home-buying experience.

Every buyer's wish list will be unique, influenced by their specific circumstances, preferences, and lifestyle. Therefore, it's essential to prioritize your needs and wants accurately, to maximize your chances of finding a home that is both affordable and meets your specific requirements.

So, if you're ready to embark on this journey and find a home that aligns with your curated list of requirements, it's time to connect with a real estate professional. Remember, your dream home isn't just about luxury features; it's a blend of necessary comforts, strategic conveniences, and perhaps a sprinkle of indulgence.

7-7-2023

Capitalizing on the Momentum of New Home Construction: Your Next Move Made Easier

The prospect of selling your home may seem daunting, especially given the uncertainty of finding your next abode amidst today's fast-paced market. However, take heart! An encouraging trend has surfaced that could potentially allay your fears. The rise of new home construction is changing the housing inventory landscape, offering you a wealth of new options when you plan your next move.

A Shift in Housing Inventory

The housing market is witnessing an influx of newly constructed homes contributing significantly to the total housing inventory. This trend is something we have not seen in recent years, and it is beginning to reshape how buyers, like yourself, can approach the market.

In a historic shift, newly built homes now account for a near-record 31% of the total number of homes available for sale. To put this in perspective, from 1983 to 2019, new homes made up only around 13% of total housing inventory on average. The percentage of total available homes that are newly built is now more than double the historical norm.

Implications for Home Buyers and Sellers

In a market where the supply of homes for sale is limited, it's vital to leverage all available options. The surge in new home construction has emerged as a significant factor that is increasing housing inventory. Current data indicates that this momentum is likely to continue, with more newly built homes coming to the market in the upcoming months.

Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), underscores the relevance of newly built homes for prospective buyers in today's housing market. According to Dietz, "With limited available housing inventory, new construction will continue to be a significant part of prospective buyers' search in the quarters ahead."

Failing to consider new home construction in your search might mean bypassing nearly one-third of the potential options in the housing market. Engaging the services of a local real estate agent can help ensure that you capitalize on this growing segment. These experts can guide you through the sale of your current house and help you navigate the array of newly built options in your preferred area.

Making Your Transition Smoother

Now is the perfect time to make a move and leverage the uptick in new home construction. With professional guidance, you can navigate the sale of your existing property and transition seamlessly into your newly built dream home. In a market that can often feel overwhelming, this surge in new home construction brings with it a breath of fresh air, offering you a broader range of choices and an easier transition.

So, if you've been worrying about selling your house due to concerns about finding your next home, this shift in the market offers a promising solution. With an experienced real estate agent by your side, you can sell your existing home and discover the myriad opportunities that new home construction provides.

Remember, with new homes making up an increasing percentage of housing inventory, your dream home could very well be one that is freshly constructed. Don’t miss out on these possibilities; seize this opportunity to sell your house and step into a brand new home tailor-made for your future.

Conclusion

The building momentum in new home construction offers an opportune moment for those looking to sell their house and move into their dream homes. By partnering with a knowledgeable real estate agent, you can smoothly navigate the dual process of selling your current home and exploring the newly built housing options in your area. The dream of transitioning into a newly built home can indeed be a reality. Let's connect and make it happen!

7-5-2023

Why Todays Housing Market Differs from 2008: A Look at Current Lending Standards

From time to time, concerns arise about a potential housing market crash, sending ripples of worry among potential homeowners. However, it is crucial to remember that the housing market today differs substantially from the one we witnessed back in 2008, mainly due to significant changes in lending standards. Today's market is more regulated and safer for both borrowers and lenders, contrasting the lax atmosphere that contributed to the housing crisis over a decade ago. Let's delve deeper into these distinctions to assuage any fears about the current housing market.

The Mortgage Bankers Association (MBA) sheds light on the lending landscape through its monthly Mortgage Credit Availability Index (MCAI). The MCAI serves as an instrumental metric, offering a standardized quantitative index focused exclusively on mortgage credit. It represents the ease or difficulty of securing a mortgage at a particular point in time.

Reflecting on the MCAI data since its inception in 2004, we can see a clear trajectory of lending standards. When the index is higher, which indicates lenient lending standards, securing a mortgage is easier. Conversely, when the index is lower, reflecting stricter lending standards, obtaining a mortgage becomes more challenging.

From 2004 to 2006, the index leaped from 400 to over 850, illustrating a period of relaxed lending practices. However, the aftermath of the housing crash saw the index plunge as lenders tightened their standards. Currently, securing a mortgage is notably more stringent than it was during the years leading up to the crash.

It is widely acknowledged that the housing bubble was largely fuelled by the ease with which individuals could secure a home mortgage. During the early 2000s, mortgages were frequently granted to individuals who overstated their incomes and employment statuses, many of whom were, in reality, ill-equipped for homeownership.

The graph's peak leading up to the housing crisis underscores this era of easy credit and minimal loan qualification requirements. Lenders were frequently approving loans without adequately verifying the borrowers' capacity to repay the loan, inevitably leading to an increase in loans to high-risk borrowers.

In stark contrast, the lending landscape has undergone a dramatic transformation since then. Today's lenders are far more discerning, imposing rigorous standards on borrowers. Those managing to secure a mortgage in the current climate typically boast excellent credit ratings.

The post-crash dip in the MCAI graph and its continued low standing reflects this tightening of lending standards. In fact, today's index is considerably lower than the 2004 standards and continues to decline. Joel Kan, the VP and Deputy Chief Economist at MBA, states that the MCAI has seen a consistent decrease in recent months, reaching its lowest level since January 2013.

Such stringent lending standards signify that we are far removed from the reckless lending practices that precipitated the previous housing crash.

In conclusion, the days of easy mortgages and minimal loan qualifications have become a part of history. Today's lenders are committed to a more cautious and regulated approach, ensuring borrowers have the means to repay their loans. Consequently, the risk has been substantially reduced for both borrowers and lenders alike.

The lending practices and conditions that led to the housing crash of 2008 are in stark contrast to the strict and carefully regulated practices of today. Therefore, it's important to view the current housing market through this lens, appreciating its distinctiveness, and understanding that this is not a repeat of the past. The learning curve of the 2008 housing crash has brought about necessary changes to protect both lenders and borrowers, making today's market markedly different, safer, and more stable.

7-3-2023

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans