Our Blog

Recent:

Ready to List Your Home Using a Professional is a Must

The housing market has shifted with the influx of higher mortgage rates and a lessened buyer demand, so if you plan to sell your home, it's essential that you comprehend how these changes will affect you. The best strategy to ensure that you remain informed is by partnering with an experienced real estate specialist who can provide reliable advice.

By selecting a professional, you are assured to maximize the profits of your sale. Here are five reasons why:

1. A Real Estate Advisor Is Well Versed on Market Trends

Leslie Rouda Smith, the 2022 President of the esteemed National Association of Realtors (NAR), articulates:

"During challenging and changing market conditions, one thing that's calming and constant is the assurance that comes from a Realtor® being in your corner through every step of the home transaction.Consumers can rely on Realtors®' unmatched work ethic, trusted guidance and objectivity to help manage the complexities associated with the home buying and selling process.”

As an experienced real estate advisor, I have the most up-to-date knowledge about both national trends and your local area. But more importantly, I can tell you what all of this means to you specifically so that you're able to make a decision based on reliable data analysis.

2. A Local Professional Knows How To Set the Right Price for Your Home

This year, house price appreciation has slowed down considerably. If you attempt to sell your residence without an agent, it is possible that you may overestimate its worth due to insufficient knowledge of the current market conditions. An inflated asking price can put off buyers and cause your home to stay on the market for a longer period of time than desired.

If you want to maximize the potential of your home sale, enlisting a real estate professional is essential. They will take into account numerous factors such as how well maintained and modernized your house is and compare it with homes that have been recently sold in the area for an accurate gauge on what price point would be realistic today's market conditions. Quickly selling your property relies heavily on pricing it correctly - don't overlook this crucial step!

3. Make the most of your potential buyers by enlisting help from a Real Estate Advisor!

With buyers being less active this year, agents should take advantage of the numerous resources available to them so that they can bring in more potential buyers. The power of a real estate professional lies in their ability to leverage third-party sources like social media followers and MLS listings. According to Investopedia, not enlisting an agent brings additional risks with it; thus, if you want your house seen by those looking for a purchase, partnering with an experienced Agent is critical!

“You don’t have relationships with clients, other agents, or a real estate agency to bring the largest pool of potential buyers to your home.”

Without the proper tools and marketing know-how from your real estate agent, you won't be able to maximize the potential of selling your home – as well as missing out on a larger pool of buyers.

Subscribe to Our Newsletter

4. A Real Estate Expert Will Peruse – and Comprehend – the Small Print

Selling a residence today requires an overwhelming amount of disclosures and legal paperwork, more than ever before. The National Association of Realtors (NAR) verifies this by saying:

“Selling a home typically requires a variety of forms, reports, disclosures, and other legal and financial documents. . . .Also, there’s a lot of jargon involved in a real estate transaction; you want to work with a professional who can speak the language.”

A real estate expert has an in-depth understanding of the fine print and how to move through it effectively. They'll guide you as you review documents, averting any high-cost setbacks that could occur if tackled alone.

5. A Trusted Advisor Is an Expert Negotiator

As the competition among buyers has decreased, negotiation power is once again in their hands. If you choose to sell your home without a professional real estate agent, one downside is that all of these negotiations then fall on you. To ensure a successful outcome for yourself and any prospective buyers, it's important to be able to coordinate with:

- The buyer, always on the lookout for an unbeatable deal.

- The buyer’s agent, who will use their knowledge and experience to represent the interests of the buyer.

- The inspection company, typically working for the buyer's benefit, has a tendency to discover issues with the house.

- To safeguard the lender, an appraiser is appointed to evaluate the property’s worth.

Instead of taking on these issues all by yourself, turn to a professional who understands the best strategy and approach when it comes to addressing everyone's concerns. They are well-versed in identifying which levers must be pulled, as well as determining when you will need an alternate opinion.

Our Final Thoughts

Take the stress out of selling your place this winter and get an experienced professional in your corner to help you navigate today's ever-evolving market. Reach out and I'll be there for you every step of the way!

12-30-2022

Thinking of Securing a Mortgage Common Mistakes to Avoid

Before you close on your mortgage, it's easy to get carried away with thinking about the possibilities of moving in and decorating. But there are some essential points that need to be taken into consideration first. You may not even know what needs to be avoided after applying for a home loan - so here is an exhaustive list of things you should steer clear from!

Avoid Placing Large Amounts of Cash in Your Bank Account

It is essential for lenders to know where your money comes from, and cash may be difficult to trace. Before placing any amount of hard currency into your accounts, make sure you have a conversation with your loan officer about the right protocol in documenting all transactions.

Avoid Making Huge Purchases

Don't be fooled - any big purchases can prevent you from obtaining the loan that you desire. When lenders review your credit report, they will see how much debt is related to your monthly income and decide on whether or not it's a safe investment for them. Remember this; if there's an increase in new debt, then chances are high that the lender won't approve of the loan because of its higher risk level. Keep away from buying anything extravagant such as furniture pieces or appliances until after you've been approved for the mortgage!

Avoid Cosigning a Loan for Anyone

By cosigning for a loan, you place yourself responsible for that loan's repayment and success. With such commitment comes higher debt-to-income ratios too. You may swear to your lender that none of the payments will be made by you, but they must still account them against your name nonetheless!

Don't Make the Mistake of Switching Bank Accounts!

Before you move any funds, chat with your loan officer; this way, lenders can quickly and easily locate and track all of your assets. Keeping a level consistency among the accounts will ensure that they have everything they need to make an accurate decision.

Avoid Applying for New Credit

When you are looking to acquire a new credit card, auto loan or mortgage, it is essential that your FICO® score remains in good standing. This number can determine the interest rate associated with this type of financial agreement and even if you qualify for approval. Anytime an organization runs a check on your credit report from multiple channels (mortgage, car loans etc.), it will affect your overall credit score - whether positive or negative!

Subscribe to Our Newsletter

Refrain from Closing Any Accounts

Numerous buyers may assume that possessing less accessible credit makes them more probable to be accepted and pose a lesser risk. However, this is not correct. A considerable portion of your score consists of the length of your history with credits as well as how much you have utilized out of all available credits; both are affected by shutting down accounts. Hence, it can really hurt your rating if done incorrectly!

Make Sure to Proactively Converse with Your Lender About Any Updates

When discussing your mortgage with your lender, be transparent about any potential changes to income, assets or credit. Be sure that whatever decisions you make will not impact the status of your loan application. If there have been modifications in employment recently, articulate what they are and discuss them with the loan officer before taking on new financial obligations. Open communication is key when it comes to securing a home loan!

Final Thoughts

Prior to taking any major steps related to your finances, moving money around or making life-altering decisions, it is wise to consult a lender who can guide you on how these changes might affect your home loan. To ensure that the process of purchasing your new home goes as smooth and stress-free as possible, be sure not to overlook this important step!

12-29-2022

Navigating Your Finances as a First-Time Homebuyer

Are you getting ready to purchase your first house? If so, it's essential that you address the financial planning related to this before going ahead with such a major decision. Here are some of the vital monetary points for consideration when aiming to acquire a home.

Establish Your Creditworthiness

Your credit score is a critical component when considering which home loan you may qualify for, as well as the mortgage interest rate. There are many factors that come into play in the application process; however, having a higher credit can drastically reduce your monthly payments in the long run.

Looking for ways to ensure that your credit score is ideal when it's time to purchase? NerdWallet recently revealed some tips on how you can build and enhance your credit. Check out the list below:

- Tracking your credit and disputing any errors that show up on your reports.

- Paying your bills on time. This includes making loan payments and paying down any open lines of credit.

- Keeping your credit card balances low. Paying more than your minimum monthly balance when you’re able can help.

- Take the Guesswork Out of Saving for Your Dream Home: Automate the Process!

Are you curious about how to accumulate the money needed for your down payment? Bankrate has some ideas on how it can be done, from looking into assistance programs to finding other ways of rapidly saving. As they state in their article:

“One of the best ways to save for anything — including a down payment — is to set it and forget it. If you receive a regular paycheck, ask your employer to direct a portion of that payment into a savings account. If you’re a freelance worker or independent contractor, set up a recurring transfer from a checking account to a savings account to establish the routine.”

Subscribe to Our Newsletter

Secure Your Financial Future - Get Pre-Approved Now!

Before you make any major home purchases, it's important to have a good understanding of your budget and how much money can be borrowed for your mortgage. This is where the pre-approval process comes into play. With this step, buyers are able to obtain an accurate assessment of their borrowing power and find out exactly what they qualify for so that they can confidently move forward with their purchase without any financial worries.

Knowing the amount of money you are able to borrow in advance with a lender's pre-approval can prove invaluable when shopping for your dream home. This, coupled with an understanding of your savings, will help guide you towards selecting the best house within your ideal price range.

Now you can begin to peruse homes online and explore the range of properties available in your vicinity at that general price point. This process will help you gain a comprehensive look into all of your possible options, allowing you to start envisioning the home of your dreams!

For personalized, tailored counsel, consider assembling a team of experts.

To ensure you make the right decisions when buying a home, it's essential to engage with trustworthy real estate professionals. These experts can give you invaluable advice throughout the entire process and help steer you towards your dream house – taking into account your budget, goals, and current situation. With their in-depth knowledge of the market dynamics, these advisors will guide you every step of the way!

Final Thoughts

Are you prepared to embark on the journey of purchasing your home? If so, let's connect right away and assemble an experienced team that will have you closing in no time!

12-26-2022

What the Housing Market Has In Store for 2023

Two major factors are influenced the 2022 housing market - inflation and mortgage rates that have accelerated at a remarkable pace. This has caused a certain realignment of this industry, leaving many to wonder what comes next.

As a result of the Federal Reserve's efforts to contain inflation this year, mortgage rates have more than doubled – something never seen before in one calendar year. This had an immense influence on buyer behavior, supply and demand, and eventually home prices. Therefore, some buyers and sellers decided to pause their plans until market conditions became less uncertain.

So, what does all this mean for the upcoming year? Everyone desires to see stability in the market in 2023. To maintain that steadiness, we need to observe a drastic reduction on inflation rates by The Fed and secure it consistently. Let us now move forward with an expert opinion from remarkable housing market analysts about what is likely going to be seen next year!

What Will Mortgage Rates Look Like in 2023?

As we move further into the future, experts are predicting that inflation is still going to remain a key factor. High levels of inflation would lead to high mortgage rates and vice versa. However, there have been some indications recently suggesting that inflation could be easing up - but don't celebrate yet! Inflation should still be monitored in 2023 as it plays an important role in determining mortgage rates.

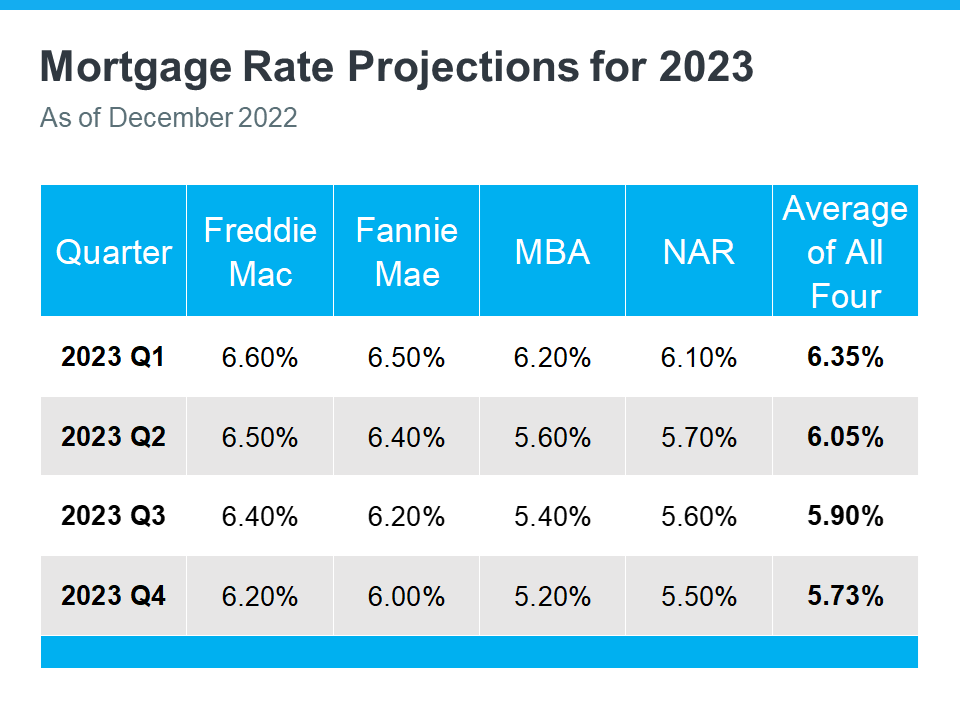

The experts have already begun to factor in all of these components for their mortgage rate predictions for the upcoming year. When we take an average of these estimates, it appears that rates should begin to plateau a bit more during 2023 between 5.5% and 6.5%. It is difficult for even the most experienced analysts to determine precisely where they will settle, yet based on our composite reading, stability seems likely (see chart below):

As a result, we can expect rates to remain stable for the time being. However, if inflationary pressures stay low, there’s potential for further rate declines in 2023. Greg McBride - Chief Financial Analyst at Bankrate - states:

“. . . mortgage rates could pull back meaningfully next year if inflation pressures ease.”

In the coming weeks, anticipate some volatility as rates could very well waver. However, if inflation is kept in check, that would be a fantastic outcome for the housing market.

What Will Home Values Do in the Coming Year?

During the pandemic, it became evident that home prices are largely dictated by supply and demand; as there were more buyers in comparison to available homes, house values went up. This is a case study on how this principle applies in real life - an expected outcome but no less impressive!

This year has been vastly different as home prices have moderated and inventory swelled due to the decrease in buyer demand resulting from higher mortgage rates. These changes are localized, particularly impacting those markets that had already become overheated. What do industry professionals think is ahead for these trends?

Subscribe to Our Newsletter

The graph below illustrates the projected home prices for 2023. As indicated by the colored bars, some specialists predict that house values will increase while others project a decrease. Nevertheless, if we take into account all of these forecasts (highlighted in green), it will give us a better understanding of what to expect next year.

It is likely that home value appreciation will remain static or neutral across the nation in 2023. Lawrence Yun, Chief Economist of NAR (National Association of Realtors), corroborates this assumption as he states:

“After a big boom over the past two years, there will essentially be no change nationally. .. Half of the country may experience small price gains, while the other half may see slight price declines.”

Final Thoughts

A reliable real estate specialist is the key to understanding what mortgage rates are in store for 2023. Throughout the year, inflation will shape how these numbers turn out - but with a trusted advisor by your side, you can keep an accurate estimate on all of this and more. Let's link up so we can stay ahead of market trends together!

12-22-2022

Right Now is the Time to Leverage Your Purchasing Position

Have the heated bidding wars of the last two years discouraged you from searching for a home? Worry not - this year's market has been much more amenable. Both demand andhousing supply have moderated, resulting in less competition among buyers. If you've been holding off on your house search, now may be an opportune time to jump back into it!

With fewer competitors, there are wider possibilities for you! Here are two trends that may be just the news you need to make your comeback in the market.

Sellers Are More Willing To Help with Closing Costs

First, sellers are more willing to negotiate. In a buyer's market like this one, sellers may be more likely to accept an offer that is less than their asking price. This could mean significant savings for you! It also means that you may have some wiggle room when it comes to additional requests, such as repairs or closing cost assistance.

Before the pandemic, it was a common practice for sellers to offer incentives such as covering some of the buyer's closing costs in order to make their deal more attractive. Unfortunately, this strategy wasn't utilized much during the past two years when buyers had an intense obsession with purchasing property.

Realtor.com has conducted a survey which revealed that 32% of sellers are now offering to pay for some or all of the buyer's closing costs, making it an attractive negotiation tool when purchasing a home. It is worth noting however, that limits on such credits will depend upon your lender and can vary from state to state in addition to loan type - so be sure work closely with your loan advisor in order to understand just how much you could benefit from this incentive where you live!

The Return of Contingencies

As the housing market continued to soar in recent years, potential buyers began compromising important steps of their homebuying journey such as appraisals and inspections in order to gain a competitive edge. Fortunately, this pattern is shifting now - making it essential for those entering the real estate industry or looking to purchase a property anytime soon understand best practices before diving into bidding wars.

Subscribe to Our Newsletter

According to the National Association of Realtors' latest data, fewer buyers are forgoing home inspections or appraisals. In addition, according to a realtor.com article, more sellers are opting in and accepting contingencies - further solidifying an already secure market!

“A year ago, sellers were calling all the shots and buyers were launching legendary bidding wars, waiving contingencies, and paying for homes in cash. But now, the shoe is on the other foot, and 92% of home sellers are accepting some buyer-friendly terms (frequently related to home inspections, financing, or appraisals), . . .”

We are not necessarily in a buyers' market, yet you now possess more influence when negotiating with the seller. The days of feeling obliged to waive contingencies or pay an amount beyond the asking price just for your offer to be considered may soon come to an end.

Final Thoughts

As the housing market begins to soften, negotiations are becoming more favorable for buyers and sellers alike. Our area is no different - if you're curious about how this shift impacts our local real estate opportunities, let's chat today!

12-15-2022

Defining Comparative Market Analysis

If you're thinking about putting your home up for sale, you might be wondering how to set a fair price for it. The answer to that is simple: your real estate agent will use a comparative market analysis to determine the right list price.

A comparative market analysis or CMA is a report that a real estate agent puts together when determining a fair market price for a home. Exactly what goes into this report varies from one home to the next, but it always showcases comparative properties that are currently on the market or that have recently sold. A CMA is intended to help sellers get an idea of what their home is worth on the current market while lending social proof to an agent's suggested selling price.

Factors to Consider with a CMA

A CMA will include several factors that will determine a fair market price of a home. These include the age of the home, its location, the size of the property, whether it has any unique amenities, and whether it's been recently renovated. The CMA will also include information about similar properties in the area when determining the value of a home.

Whenever a property goes on the market, it faces competition from all other available homes within its price range. A CMA provides guidance for a property's list price. Since choosing the correct list price for a home is one of the best things that a seller can do to attract interested buyers, a detailed CMA is invaluable when you want to sell your home.

If you are interested in putting your own home on the market and you need a comparative market analysis, contact the Watson Realty Group. We will be happy to take a look at your home and help compile a detailed CMA for you.

And if you choose to sell your home with us, you can benefit from our guarantees! One of which is our Seller Cancellation Guarantee. We are so confident that you will love working with our team that we allow you to cancel your seller agreement with us with no penalties.

12-12-2022

Uncovering the Crucial Insights of Home Prices

With the recent news about home prices, you might be unsure if it's time to put your house on the market. To help make this decision a bit easier, here is what you ought to know regarding how these headlines impact your property’s value.

First, it is important to understand that the United States housing market is cyclical. Prices tend to rise and fall over time as buyers and sellers move in and out of the market. In some areas, prices are rising due to a surge in demand for homes or other factors such as an influx of people moving into the area. Other places may experience decreasing home prices due to fewer buyers or other factors such as an increase in foreclosure rates.

Second, you should also realize that the current national housing market is still made up of local real estate markets. Each area has its own unique market conditions and trends, which can be very different from others. This makes it important for you to consult with a local real estate agent or appraiser to determine the average home prices in your area.

Finally, keep in mind that even if national trends indicate rising prices, this does not necessarily mean that your home will appreciate in value. The condition of your house and the features it offers can also affect its price, so you should take these factors into consideration as well.

Overall, understanding the current home prices in your area can help you make an informed decision when it comes to selling your house. Make sure to do your research and consult with the right professionals before listing your house on the market. With this information at hand, you can take steps towards getting the best price for your home.

How are Home Prices Changing? An In-Depth Look at the Real Estate Market

Have you heard reports concerning the fall of house values or price depreciation? While these quick headlines may generate attention, they don't always present a complete and accurate view. It's essential to keep this in mind when considering such stories.

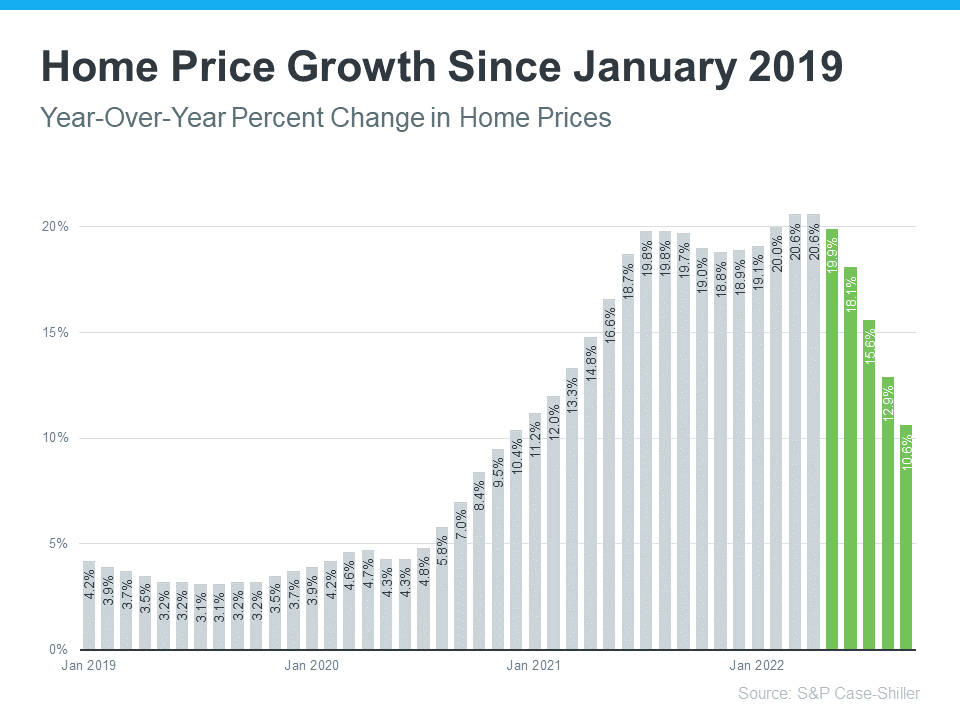

Home prices may be seeing a slight dip when looking month-to-month in some areas, however, there is also an undeniable and positive upswing across the nation on an annual basis. The graph below illustrates this trend using the most recent data from S&P Case-Shiller:

While it is true that the rate of growth for home prices has moderated, as seen in the graph (in green), this decrease follows a spike in mortgage rates which has caused potential buyers to withdraw. This is what news outlets are currently reporting on.

However, it is important to take note of the broader, deeper view. Although home price increases are slowing down month-to-month, the rate of appreciation year over year is still much higher than what we saw in more typical times in the market.

From January 2019 to mid-2020, home prices appreciated by approximately 3-4% annually (see the bars for that period). However, this year's data shows that prices are still close to 10% higher than last year – a clear sign of thriving real estate markets.

Subscribe to Our Newsletter

What Does This Mean for Your Home's Value?

Although you may not experience the 20% growth that occurred in early 2022, even with a 10% increase from last year, your home's value is significantly elevated compared to usual appreciation levels (3-4%). This dramatic gain can have an impact on your finances and overall prosperity.

Here's the most important thing to note: Don't let recent news keep you from executing your selling plans. Over the past two years, it's likely that your home has gained significant equity due to rising prices. Even though market conditions may differ in 2020 and beyond, take advantage of this increased wealth and allow it serve as a motivator for relocating!

As Mark Fleming, Chief Economist atFirst American,says:

“Potential home sellers gained significant amounts of equity over the pandemic, so even as affordability-constrained buyer demand spurs price declines in some markets,potential sellers are unlikely to lose all that they have gained.”

Bottom Line

What this means for sellers is that, while there may be a slight decrease in home prices month-to-month in certain areas, your house is still likely to have gained equity over the past two years. This makes selling now a more advantageous option than waiting. So don't let recent news headlines about falling values keep you from executing your selling plans – market conditions are still incredibly favorable!

If you're curious about what home values are like or where your equity stands in the current market, let's team up and gain access to a professional's knowledge.

12-12-2022

December 2022 Newsletter

In this month's newsletter, you'll discover how to start saving money on your cell phone bill every month - and let's face it, who doesn't want to save a little cash? Every penny counts when it comes to stretching our budgets.

Don't miss out on our tips for purchasing non-brand items instead of name brand, how to avoid errors when packing your kid's lunches, and even ways to introduce peace into your house so you can create the perfect sanctuary. Plus enjoy fun facts, a trivia challenge and plenty more amazing content!

To cap it all off, I'm here for you - don't hesitate to pick up the phone and get in touch if anything comes to mind. Likewise, if a friend or family member is planning on entering the real estate market as either a buyer or seller - they can always rely on me; my expertise combined with compassion guarantees them the best possible outcome!

I truly appreciated your friendship and referrals. Enjoy this issue.

Warmest regards,

Bill Watson

President / Managing Broker

Your Home Sold Guaranteed Realty - The Watson Group

6155 S Main Street, Suite 270

Aurora, CO 80016

720-463-0002

bill@watsonrg.com

www.yourhomesoldguaranteedrealtyco.com

P.S. In the upcoming weeks, if you come across individuals discussing real estate why not inform them about my complimentary consumer resources? That way they can stay informed on all the latest market trends and make smart investments.

SELL YOUR HOME FAST and for TOP DOLLAR! Get this FREE Report that

Reveals 27 Tips to Give You the Competitive Edge! www.Our27Tips.com

Lower Your Cell Phone Bill

As the cost of living continues to rise a lot of us are searching for ways to save money on our monthly bills, including the cell phone bill. Here are a few things to try that might help you lower your cell phone bill for months and years to come:

- Auto pay: A number of wireless carriers reward their customers who opt for automatic bill payment by offering discounts off of their monthly bills. For example, Auto Pay customers receive $10 off at Verizon, $5 off at T-Mobile, and between $5 and $100 at AT&T.

- Make your plan work for you: Take some time to really look at what your plan covers and make sure it’s a right fit for you. For example, if you travel a lot and are crossing international borders, opt for a plan that includes international coverage. On the flip side, if you’re staying closer to home, make sure your plan reflects that.

- Go with prepaid: If you own your phone, prepaid wireless plans may be a fit at a lower cost. Mint Mobile offers data plans ranging from $15 to $30 a month, and Verizon-owned Visible’s unlimited data plan goes for $30. Pay upfront and be done for the year with AT&T’s 12-month, 16GB prepaid plan at $300 for 12 months.

- Just ask: Experts suggest simply asking for a discount. Call your carrier and ask, “What can you do to lower my monthly bill?” You may find that after looking at your plan and asking a few questions the customer service rep will have ways for you to save. Follow up with, “What else can you do to lower my bill?” and you could find yourself saving $30 to $80 monthly.

- Bonus savings: Be sure and take advantage of the bonus savings available through wireless carriers. Verizon offers complimentary subscriptions to Hulu, Discovery Plus, Disney Plus and ESPN Plus for six months for customers on select plans, and T-Mobile includes Netflix, Apple TV Plus, and Paramount Plus streaming for free with select plans.

Subscribe to Our Newsletter

HIGHLINE EAST AT DAYTON TRIANGLE

The Highline East at Dayton Triangle community by Montano Homes offers brand new paired homes that are ideal for people looking to move into a vibrant and dynamic neighborhood. With 3 bedrooms, 3.5 bathrooms, private yards and designer selected finishes combined with their affordable prices starting from the mid $600s, these Colorado Contemporary townhomes make this an incredible place to call home! Plus it's located close to Downtown Denver, DTC shopping centers and parks—what more could you want?

See What Our Amazing Fans Have to Say

Visit www.OurAmazingFans.com

Bring Serenity To Your Home

Our homes should be our sanctuaries year-round – a place in which to escape, recharge, and reenergize for whatever may come our way. Discover a few ways to bring serenity to your home, without breaking the bank:

- “A place for everything, and everything in its place” isn’t just a saying, but a way of living. Reducing clutter in your home alleviates anxiety, helps you sleep better, and encourages a happier environment.

- Carve out some space for a reading nook, whether it’s a comfy chair tucked into a corner, a window seat with fluffy pillows, or a chaise with a throw blanket for a warming embrace. Flip on a nearby lamp and you’re ready to dive into the latest novel for some quiet “you” time.

- Bring the outdoors in with fresh flowers, potted plants, or an armful of tree limbs loosely arranged in a tall vase. Glimpsing these bits of nature within your home will boost your mood, reduce stress, and make for a healthier, happier you.

Find out the value of your home by answering a few simple questions. By providing your address and home description, the system will produce a complete market analysis through a search for similar homes sold and listed in your area.

When It's OK To Buy Off-Brand

If you’re looking for ways to save money, I have an idea for you – consider buying off-brand items instead of brand names, especially when it comes to grocery shopping or stocking up on household items. You may be surprised at just how much money you can save.

It’s been proven that shoppers can save 15 to 30 percent off their grocery store bills when they choose store brands over brand names. What’s more, the FDA requires the same standards of production for many items, regardless of whether they’re brand names, store brands, or generic.

The experts have even gone so far as to declare products that we should always buy generic, including prescription drugs, food storage containers, baking mixes, diapers, and even fresh produce. Check out these tips to hold on to more of your hard-earned money:

- Baking: Opt for the store brands of sugar, flour, salt and spices and you can save up to 400% off name brands on the same shelves, many of which can cost four times as much as the generic.

- Cleaning: Rather than paying more to fund advertising spent by name-brands, choose store brand and generic household cleaners that hold the same punch. Whether it’s oven cleaners, bleach, or detergents, chances are the lower-priced items are just as effective as their higher-priced equivalents.

- OTC Meds: If you’ve got a cold or a headache, the last thing you want to do is worry about getting the best deal. Take comfort in knowing that the FDA requires that all store-brand medications have the same active ingredient dosage and safety measures as the brand-name medicines with which they're up against. Decision made!

- Craft and Gift Supplies: Wrapping paper, gift bags, glue, paint and greeting cards can all cost quite a bit more with a name-brand attached. Generic or store brands are just as good, and gift recipients won’t be looking for a name brand on items like these.

AT MURPHY CREEK

Experience the perfect home at Montano Homes' Elevations at Murphy Creek. This central master-planned community grants easy access to DIA, shopping, and gourmet dining near Southlands Mall. Not only that but it is situated next to one of Colorado's finest golf courses - a links style course! With its 3 bedroom Colorado Contemporary Paired homes, you can definitely call this place your own little paradise. Welcome home to Elevations at Murphy Creek by Montano Homes!

Find out how this changing market has affected your home value! Your home may be worth more than you think.

Visit www.AccurateHousePrice.com or Call Us as 720-463-0002.

This is a FREE service with NO OBLIGATION to list.

Kids' Lunch Box Mistakes

During the school year you set your kids up for success as much as you can–making sure their homework’s finished, helping them get a good night’s sleep, and trying to avoid chaotic mornings. Another way to pave the road to academic success is providing lunches to fuel their school days, but it’s not always easy. Here’s a look at common kids’ lunch mistakes, and simple solutions for a successful lunch for everyone.

1. Stay the course: A school lunch isn’t the time to introduce your kids to new foods. Rather, pack familiar foods that they recognize and that will make them feel comfortable during what can be a crazy and tiring day.

2. Keep it light: There may be a lot of distractions at lunchtime – recess, anyone? Don’t be tempted to pack too much to eat. Instead, choose quick bites that serve as fuel-on-the-go.

3. Pack the protein: Go easy on the carbs and sugars. Whether it’s a PB&J, ham and cheese, hummus, or string cheese, be sure to include protein in your kids’ lunches. Not only will it keep them feeling full, protein will help them stay focused through the afternoon.

Studies have shown your income and wealth are directly related to the size and depth of your vocabulary. Here is this month's word.

dawn chorus (common pronunciation) noun phrase

Meaning: the birdsong at sunrise, especially in spring and summer

Dawn chorus was added to Merriam-Webster in September 2022.

Sample Sentence: I awoke to the lovely sounds of a dawn chorus outside my bedroom window.

Subscribe to Our Newsletter

Not Ready to Sell? Text your address to 720-605-1268 to find out what your home will sell for today. You will not receive a phone call, just a text!

Latest Blog Post

If you're thinking about moving to Colorado, or if you're just curious about what makes our state such a great place to live, you'll want to read this post. We've compiled a list of 10 reasons why we think everyone should love living in Colorado. From our amazing scenery and diverse landscape to our friendly people and endless recreational opportunities, there's something for everyone in this beautiful state!

How To Clean Your Fireplace

As cool temperatures settle in, it’s time to warm up by the fire. Before you strike a match, make sure your gas or wood-burning fireplace is clean and ready for the season.

- If your fireplace is gas, turn off the valve and give the burners time to cool completely.

- If your fireplace is wood-burning, remove burnt wood and any ash that has collected.

- Vacuum up dust and debris from around the fireplace and its vents.

- Clean glass doors with glass cleaner and paper towels.

- Clean pokers and other tools with a scrub brush, dish soap and water.

A Heartfelt Message to our Special Clients and Friends . . .

It is our pleasure to extend a warm welcome to all of the new clients we have had the honor of working with recently, and also offer special thanks to those who referred them. Our business would not be where it is today without your help!

Recently Sold Properties

by The Watson Group

Bel Aire Estates

Highest Closed Price for $1,165,000!

Blackstone

Sold for $1,425,000!

Tallyn's Reach

Sold for $1,015,000!

Real Estate Corner . . .

Q: How can I secure a low mortgage interest rate?

A:Securing a low mortgage interest rate helps make your monthly payment more affordable and saves money over the life of your loan. Besides using a larger down payment, here are three things to do to secure a low mortgage interest rate:

- Compare multiple lendersand meet with your top three. Review the application process and your credit report to start working on any issues you may have. The higher your credit score, the better prospect for a lender you will become. Lenders will review the various loan programs with you.

- Your debt-to-income ratioshould be below 36 percent before you apply for a mortgage. The lower it is, the greater your eligibility for a higher loan amount.

- Don’t make any drastic changessuch as changing jobs or making large purchases on credit cards. You want lenders to see you have a stable job history and ability to make the payments.

Do you have a real estate question you want answered? Feel free to call me at 720-463-0002.

Want to Win a $25 Starbucks Gift Card?

Which object does a male penguin gift to a female penguin to win her over?

(a) Ice Cube (b) Feather (c) Fish (d) Pebble

Call Me at 720-463-0002 or Email Me at bill@watsonrg.com

and You Could Be One of My Next Winners!

12-5-2022

CATEGORIES: Newsletter

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans