Our Blog

Recent:

Unpacking the Truth Behind the Headlines: Rising Foreclosures and the Current State of the Housing Market

While it's true that there's been a surge in foreclosure news recently, it's essential to understand the larger context to properly evaluate today's housing market. If you're contemplating buying a house, a deeper understanding of the facts behind the headlines is vital.

Recent data from ATTOM, a provider of property information, shows that foreclosure filings have risen by 6% quarter-on-quarter and 22% year-on-year. These figures, when isolated, may cause some apprehension, possibly making you second guess your decision to buy a home due to the fear of plummeting prices. However, it's crucial to realize that despite the increase, we are not headed towards a foreclosure crisis, contrary to what some may believe.

Let's provide some context to these statistics by comparing them to previous years.

Contrary to sensational headlines, the surge in foreclosure numbers isn't as dramatic as it may seem.

In the past couple of years, foreclosure rates have hit record lows. This decrease was largely due to homeowner relief options and forbearance programs initiated in 2020 and 2021, which helped many homeowners keep their homes during a challenging economic period. Additionally, increasing home values provided homeowners at risk of foreclosure the chance to leverage their equity and sell their homes instead. As we move forward, equity will remain a key factor in preventing foreclosures.

With the end of the government's foreclosure moratorium, a rise in foreclosures was anticipated. However, an increase in foreclosures does not spell doom for the housing market. Clare Trapasso, Executive News Editor at Realtor.com, notes:

"Fears of a foreclosure surge are premature. Foreclosure filings have edged upwards since the cessation of the federal foreclosure moratorium. Instituted at the onset of the pandemic, this moratorium prevented a potential wave of homeowners losing their properties amidst job losses. Some foreclosure proceedings that should have happened during the pandemic were deferred, explaining part of the recent uptick. It's more a case of playing catch-up."

Indeed, the current foreclosure increase is not indicative of an impending deluge. The rise can be attributed to both the deferred foreclosures and challenging economic conditions. Rob Barber, CEO of ATTOM, points out:

"The upswing in foreclosure trends can be ascribed to factors like escalating unemployment rates, foreclosure filings resuming after a two-year government intervention, and other persistent economic challenges. However, substantial home equity held by many homeowners may serve as a buffer, curbing the escalation of foreclosure activities."

To better illustrate the disparity between the current situation and the housing crash, let's look at a long-term perspective. The graph below shows foreclosure activity since 2005, and it's evident that activity now is far below what it was during the housing crisis.

Today, the housing market is fundamentally different, and foreclosure rates, although on the rise, are nowhere near the levels seen during the housing market crash. This is mainly due to more stringent qualification measures for buyers, reducing the likelihood of loan defaults.

Currently, foreclosures are significantly below the peak levels reported during the housing market collapse.

In Conclusion

Data should always be contextualized to grasp its true implications. The housing market is witnessing a predicted increase in foreclosures, but it's nowhere close to the crisis levels observed during the bursting of the housing bubble. And it certainly won't trigger a crash in home prices.

4-28-2023

Fannie Mae and Freddie Mac Changes May Boost the Market

The housing market is expected to undergo significant changes in 2023 due to new mortgage financing policies from Fannie Mae and Freddie Mac. These updated policies, which will begin in late spring of that year, aim to make it easier for people with lower credit scores or incomes to get loans. Additionally, these changes also involve criteria that can help potential borrowers build their credit by using bank statements to assess income and balance trends as well as giving lenders more options when verifying nontraditional sources of credit. With all this being said, we look forward to seeing how these changes play out come late spring 2023!

The Loan Level Price Adjustments (LLPAs) are based on various factors, including the borrower's credit score and debt-to-income ratio (DTI). Additionally, there may be other factors considered as well. This message is in English language.

The updated policies regarding LLPAs will decrease the expenses associated with having a lower credit score. However, there will still be a difference in costs between individuals with lower and higher credit scores, but it won't be as severe.

Starting on May 1, 2023, loans guaranteed by Fannie Mae or Freddie Mac will have new changes in effect. Although these changes will apply to the majority of loans in the United States, some loans like VA loans or "jumbo loans" from credit unions will remain exempt from these changes.

This announcement follows a previous announcement made earlier this week about changes being made to Fannie Mae's automated underwriting system. The changes involve new criteria for potential borrowers who want to build their credit, using bank statements to assess borrowers' income and balance trends, and giving lenders the option to use an automated system for verifying nontraditional credit sources.

The changes being made aim to help people who have trouble getting loans by making financing more accessible, including giving LLPA waivers to first-time home buyers who earn 100% or less of the Area Median Income. These new policies will begin in late spring and could potentially boost the sluggish housing market.

Overall, the new mortgage financing policies from Fannie Mae and Freddie Mac are expected to have a positive impact on the housing market in 2023. These changes will make it easier for people with lower credit scores or incomes to get loans, which could potentially increase home sales and help boost the sluggish housing market.

Additionally, these updated policies also involve criteria that can help potential borrowers build their credit by using bank statements to assess income and balance trends as well as giving lenders more options when verifying nontraditional sources of credit. With all this being said, we look forward to seeing how these changes play out come late spring 2023!

4-26-2023

Feeling like You No Longer Love Your House

It could be a sign to consider moving!

Are you beginning to tire of the same four walls and feel ready for a change in scenery? Moving might have felt like one step too far but it's important to remember that following up on those doubts is essential to your health and happiness. With over 36 years as a realtor, I've seen many homeowners who struggle with regret after ignoring their intuition when purchasing or sticking around in their homes for longer than necessary. If you're starting to fall out of love with your house - it may be time for a move! It can seem daunting initially, so let me help walk you through all the steps involved; ensuring no detail is forgotten along the way.

The National Association of Realtors' Home Buyers and Sellers Generational Trends Report states that the average person has been living in their current house for ten years. If you've been living in your home for a while, it's worth considering how much your life has changed since you moved in. Even if you initially thought it would be your permanent residence, there is no obligation to stick with it. Consult with a local real estate agent to examine all the available options in today's market before deciding to keep your current home.

A recent survey by Realtor.com found that a significant number of homeowners are contemplating selling their homes because their current homes no longer suffice their needs. According to the report, about one-third of people who plan to sell their homes in 2023 are considering moving for this reason. These findings correlate with the top reasons people cited for selling their homes this year, as per the NAR report, which include downsizing or upsizing due to changes in family situations, retirement, or a job relocation, and moving closer to friends or family.

Identifying Signs That Your House No Longer Fits Your Needs

I've seen it all when it comes to homeowners who have outgrown their homes. Perhaps your family has grown and you need more bedrooms, or maybe you need a bigger yard for your furry friends. Whatever the reason may be, it's important to identify the signs that your house no longer fits your needs. Do you find yourself constantly rearranging furniture to make room for more stuff? Or maybe you're renovating every room to try and make it work better for you. These are both telltale signs that it's time to start considering a new home. As someone who's been in the industry for years, I know that finding the perfect home can be tough. But with the right realtor by your side, you'll be able to find a home that meets all of your needs and then some.

The Financial Benefits of Moving Now

I often get asked about the best time to make the big move. And in today's world, the answer is simple – now! Moving your home or office during these unprecedented times can actually bring you significant financial benefits. With the current low mortgage rates, you can secure unbeatable interest rates on your new home, which translates into savings over the life of your loan. Additionally, moving now means you can take advantage of the current seller's market, allowing you to fetch a higher price for your current property. Don't wait until the market changes – make the move now and reap the benefits!

Finding an Agent Who Can Help You Find The Right Home

Finding the right home can be a daunting task, especially if you're not familiar with the area. That's where a good real estate agent comes in. But with so many agents out there, how do you find the right one for you? A great agent should not only have a deep knowledge of the local market, but they should also take the time to truly understand your needs and wants. Communication is key, so look for someone who is responsive and attentive to your questions and concerns. Ultimately, the right agent is someone you can trust to guide you through the home buying process and help you find your dream home.

Implementing Strategies to Make Moving Easier

Moving to a new home can be a daunting task, but with the right strategies in place, it can be made much easier. One of the most effective methods is to create a detailed plan that outlines each stage of the move, including packing, transportation, and unpacking. This plan should include deadlines for each task, as well as a list of essential packing supplies. Additionally, enlisting the help of friends and family can make the process much smoother. Finally, consider hiring professional movers to handle the heavy lifting and transportation of your items. With these strategies in place, your move can be less stressful and more manageable.

Ways to Maximize the Value of Your Current Home

Your home is likely to be one of the greatest investments you make, and it's essential to maximize its worth. If you're looking for ways to increase the value of your home without breaking the bank, there are several things you can do. First, focus on creating a welcoming environment in your backyard by adding some simple landscaping, comfortable seating, and outdoor lighting, making it a perfect spot to host gatherings. Another option is to upgrade your kitchen or bathroom with new fixtures or appliances, which can make your home more functional and attractive. Finally, it's vital to keep up with regular maintenance, such as replacing outdated plumbing fixtures, repairing any leaks or water damage, and ensuring your home's foundation is in good repair. All of these small changes can make a big difference in your home's overall value.

How to Create a Smooth Transition From Old Place to New Place

Moving to a new place can be exciting, but it can also be a daunting experience. A smooth transition is key to making the experience positive. One of the first things to do is to start early. Begin by packing early enough and making sure everything is sorted out. Once this is done, make sure you have enough supplies such as packing material, boxes, tape, and labels. Create an inventory list to help you keep track of your items. Communicate with family members and let them know what to expect during the move. Finally, don't forget to take breaks during the move to avoid fatigue. By following these tips, you can create a smooth transition from your old place to your new one.

What about the Market?

If your personal situation has undergone alterations, it might be a good idea to consider selling your home. The good news is that the current market conditions make it an ideal time to do so. Since this is a robust seller's market, if you list your house at market value and in good condition, there will be a lot of interest from buyers, and it will sell quickly. Your experienced real estate advisor can assist you with the most effective strategies for preparing your home for sale.

You can use the equity you have in your home to help fund your next move. Due to high levels of price appreciation in recent years, it's likely that you have a significant amount of equity. By selling your current home, you can use the equity to help you purchase your next home. According to NAR's report, 38% of recent buyers used the money from selling their previous home to cover the down payment on their new one. Consulting with a local real estate agent can help you determine how much equity you have and what options are available to you in the current housing market.

Owning a home is an incredible achievement and the found memories that are made in a house can never be taken away. But, life circumstances often change, which may require you to consider moving to another house or relocating altogether. In order to make your transition as seamless as possible it's important to identify when your current home no longer fits your needs. Evaluating the financial benefits of moving now, working with an agent who can find the right home for you, implementing strategies during the move, maximizing the value of your current home and preparing for a smooth transition can help make the experience a positive one. Use Your Home Sold Guaranteed Realty - The Watson Group to get started on understanding the best steps for the next stages in your life and engage professionals who can help you achieve them.

4-24-2023

The Triad of Home Affordability: Rates, Prices, and Wages Explained

Mortgage rates have certainly been a hot topic of conversation recently, especially with the noted increase in their figures since the low points during the pandemic. This rise has led to concerns about housing affordability, but remember, home affordability isn't solely dependent on mortgage rates. It's an amalgamation of various factors - mortgage rates, property prices, and personal income.

Let's delve into the current landscape of each element and see how they influence home affordability.

1. Mortgage Rates

There's no denying that mortgage rates have surged compared to the previous year. However, for the better part of the last eight months, these rates have more or less stayed within the 6% to 7% range (as seen in the graph below):

The graph depicts how mortgage rates have fluctuated over time. It's crucial to note that even a slight alteration in mortgage rates can affect your buying power, which is why it's beneficial to rely on a team of real estate professionals who can provide expert advice and keep you informed about the ongoing market trends. Although it's challenging to predict the future trajectory of mortgage rates, many industry experts believe that the rates are likely to hover around 6%-7% in the immediate future.

2. Property Prices

In the past few years, property prices saw a sharp appreciation, driven by record-low mortgage rates during the pandemic, which fuelled a surge in buyer demand. This rise in demand, paired with a historic shortage of properties for sale, exerted an upward pressure on prices. However, the current higher mortgage rates have put a brake on this rapid price appreciation.

What's more, home price appreciation is not uniform across all markets. While some areas are witnessing slight dips in prices, others are seeing steady growth. According to Selma Hepp, Chief Economist at CoreLogic:

“The variances in home price changes across the U.S. are indicative of the dual nature of housing markets. The depreciation in the West is due to the tech industry slowdown coupled with a critical lack of affordability following decades of undersupply. The South and Southeast's sustained gains are due to robust job markets, migration trends, and relative affordability because of new home construction." For insights about property prices in your local market, it's best to consult with a trusted real estate agent.

3. Personal Income

Perhaps the most optimistic aspect of home affordability at present is the increase in personal income. The following graph, using data from the Bureau of Labor Statistics (BLS), demonstrates the growth in wages over time:

With an upswing in income, affordability is enhanced, as a smaller portion of your earnings is required to meet your mortgage payments. This results in a lower monthly housing cost relative to your paycheck.

The affordability of a home is determined by a combination of rates, prices, and wages. Should you have any queries or wish to learn more, get in touch with a real estate professional who can explain the local trends and how these factors intertwine.

In Conclusion

When you're planning to purchase a home, understanding the key elements that influence affordability is crucial. It helps make an informed decision. To stay in the loop with the most recent updates on these factors, let's connect today.

4-21-2023

Unlocking the Power of Pre-Approval: A Crucial Step in Your Home Buying Journey

As we step into the spring real estate market, aspiring homebuyers may find themselves in a tricky landscape. With a lean supply of homes and increased mortgage rates, it's more critical than ever to have a firm grip on your home purchasing budget. It's also important to be ready to act promptly once you identify the right property. One instrumental step that can significantly help in preparation is securing pre-approval from a lender.

Let's delve into what pre-approval entails. Essentially, pre-approval is a procedure where a lender reviews your financial status and ascertains the amount they're willing to lend you. Following this assessment, the lender issues a pre-approval letter, giving you a clearer understanding of how much money you can borrow.

Financial giant Freddie Mac defines it in the following way:

"Consider pre-approval as a financial green light from your lender to pursue your dream home. But remember, the amount stated in the pre-approval letter is the maximum the lender is willing to offer. You should aim to borrow an amount that aligns comfortably with your repayment capacity."

In simple terms, pre-approval equips you with invaluable insight into your borrowing potential, thereby helping you make more informed decisions. As higher mortgage rates currently test the affordability for many buyers, a robust understanding of your financial capacity is absolutely crucial.

Pre-Approval, Your Badge of Serious Intent

Beyond providing a sense of your financial bandwidth, pre-approval also serves another vital purpose. It manifests your serious intent to buy a house, something sellers highly appreciate. As the spring market is witnessing an upswing in the number of offers, having a strong proposition is crucial when you spot your dream home.

A recent article in the Wall Street Journal (WSJ) elucidates:

"Securing a mortgage preapproval should be a top priority as you kickstart your home hunting expedition. It not only guides you to the right price range but also gives you an edge over other potential buyers."

In Conclusion

Acquiring a pre-approval is an essential initial step in your home-buying journey. It helps you understand your loan capacity and proves your earnestness to sellers. Therefore, reach out to a trusted local real estate professional and a reputable lender to equip yourself with the necessary tools to navigate the present real estate market. Let's make your home ownership dreams a reality!

4-19-2023

Millennial Homeownership: The Motivations Behind the Generations Biggest Investment

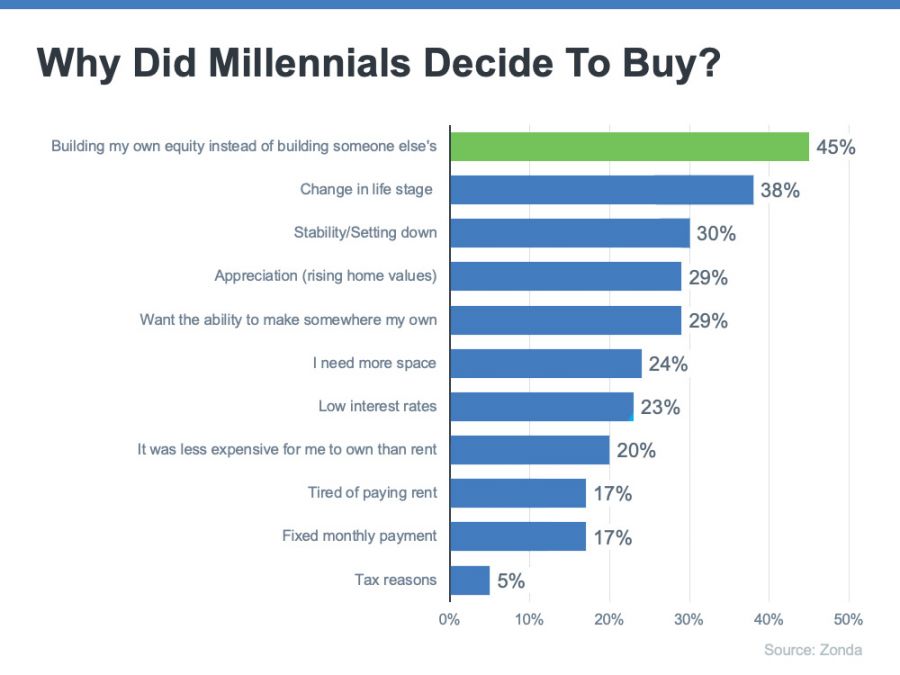

With over 72 million millennials constituting a significant demographic in the United States, the aspirations of this generation hold considerable sway over market trends. The realm of real estate is no exception. If you are a millennial who has ever envisioned homeownership, you're part of the staggering 98%, as per Zonda's data, who share the same aspiration. But what is it that inspires this sentiment? There's a myriad of motivations that could be fueling the millennial home-buying drive. Let's delve into the major reasons drawn from Zonda's 6th annual millennial survey (refer to the graph below):

The graph illustrates the motivations driving millennials to homeownership, revealing equity building, life stage transition, desire for stability, appreciating home values, and the yearning to customize their living spaces as the key reasons. Let's explore each of these factors in greater depth.

Equity Building – Homeownership represents a long-term commitment that promises the growth of personal wealth, expansion of your net worth, and enhanced financial stability. Considering the stark rise in rents over time, it could be a more financially savvy move to invest in a property and build your own equity instead of adding to your landlord's wealth.

Life Stage Transition – As a millennial, you're entering the prime phase of home buying, signaling a time when you might require additional space or a change in location to better align with your evolving lifestyle.

Seeking Stability – This often correlates with reaching career milestones or a more definitive understanding of your life goals. As your vision of life becomes clearer, the desire to establish yourself in a chosen place and create a stable foundation increases.

Appreciating Home Values – Buying a home is an investment in an asset that typically appreciates over time, providing a potentially higher resale value if you decide to move in the future.

Personalization – Owning a home allows for the liberty to personalize it to match your preferences, offering a sense of satisfaction and belonging. You have the freedom to modify and upgrade your living space to create an environment that is uniquely yours.

Key Takeaway

There is a multitude of compelling reasons influencing millennials to venture into homeownership today. If these motivations resonate with your personal aspirations of becoming a homeowner, let's connect and explore the avenues open to you in the current real estate market.

4-17-2023

The Crucial Role of Home Inspections and Appraisals in Your Home Buying Journey

When embarking on your home buying journey, two crucial steps that often come into play are the home inspection and appraisal. Both these procedures serve distinct purposes in the home buying process and understanding their significance is paramount for prospective buyers. Let's delve into the specifics of these two procedures and uncover why they are so vital.

Decoding the Home Inspection

Here lies the central distinction between an inspection and an appraisal. As Bankrate astutely points out:

“While an appraisal aims to shed light on a home's worth, inspections focus on unravelling a home's condition.”

The purpose of a home inspection is to assess the current condition, safety, and overall state of a prospective home before you cement the sale. Any red flags raised during the inspection – perhaps related to the roof's age, the functionality of the HVAC system, or other potential issues – afford you as a buyer, the opportunity to address and negotiate any necessary repairs with the seller before finalizing the transaction. Your real estate agent is an invaluable ally to guide you through this aspect of the process.

The Importance of Home Appraisal

The National Association of Realtors (NAR) highlights:

“The largest investment one often makes is a home purchase. Shield yourself by having your investment appraised! An appraiser will inspect the property, analyze the data, and report their findings to their client. For the standard home purchase transaction, the lender typically orders the appraisal to aid in their decision to grant funds for a mortgage.”

When applying for a mortgage, an impartial appraisal, mandated by the lender, validates the home's value based on the sale price. Regardless of the price you're prepared to pay for a house, if a mortgage is your chosen funding route, the appraisal guarantees that the bank won't lend you more than the property's worth.

This check is particularly important in today's seller-dominant market, where scarce inventory triggers bidding wars, potentially inflating home prices. In such a favourable position, sellers may be tempted to set lofty prices under the presumption that competing buyers will willingly pay more.

However, the lender will cap the loan amount at the appraised value of the home, preventing unchecked price escalation. Should any conflict or discrepancy between the appraisal and the sale price occur, your trusted real estate professional is there to help navigate any additional negotiations.

Final Thoughts

Both the home inspection and appraisal are pivotal junctures in your home buying process. Navigating these steps need not be a solo endeavor. Let's connect today to ensure you have the expert advice needed to steer through the comprehensive home buying process.

4-14-2023

The Role of Access in Selling Your House

Are you ready to sell your house? If so, there are many important decisions that need to be made during the selling process. One of those decisions involves deciding how much access potential buyers will have to view your home. Many homeowners make the mistake of not thinking about this early enough in the process which can lead to unnecessarily delays and frustration in finding a buyer for your property. In this post, I'll break down exactly why having access is such an integral part of selling a house and how it impacts the timeline so you can successfully make it through the sale!

Introduce the Importance of Access - Explain why access to a home is so important when selling and how it can make or break a sale.

Selling your home can be a stressful process, but it’s important to keep the importance of access in mind for potential buyers. When deciding how much access to provide to your home, you want to ensure you don’t create any additional hurdles that could prevent a sale. Not having sufficient access can affect perceived value as buyers may not be able to do their own or professional inspections and viewings, which can contribute to low offers and other complications. The more access people have to your house, the better because it gives them the full picture of what they’re buying and allows them peace of mind during their decision-making process. Make sure you have ample access available so that potential buyers feel they have greater control over their purchase.

Highlight the Benefits of Convenient Access - Discuss how convenient access allows potential buyers to view your home without feeling rushed or overwhelmed.

Providing convenient access to your home for potential buyers is a key factor in finding the perfect buyer. Knowing that buyers can come into your home without feeling rushed or overwhelmed allows them to truly appreciate the features of your house and visualize themselves living there. With an experienced realtor, you can have the peace of mind that everything will be done with respect for both parties, all while keeping safety in mind. Convenient access really helps make the selling process smoother so that everyone involved enjoys a successful experience.

Consider the Challenges of Limited Access - Explore some of the challenges that come with restricted access, such as having to coordinate multiple visits from different potential buyers.

As you begin to prepare your home for sale, it is important to be cognizant of the access buyers will require in order to view the premises. Restricted access may make the process time consuming and difficult, as buyers need time to tour and explore the home. Unavailable times may mean having to coordinate multiple visits from different potential buyers – a challenging task! Ultimately, it’s a decision that needs thoughtful consideration for both seller and buyer. So as your realtor, I’ll help guide you through each step of this process, ensuring comfortable visits for all those considering purchasing your home.

Outline Your Preferred Level of Access - Create an outline for potential buyers that outlines what days and times they have access to view your house, if any at all.

As a seller, it’s incredibly important to create an outline of your preferred level of access when potential buyers wish to view your home. You and I will then be able to provide this information to those interested individuals. Of course, any days and times that you list as available are, ultimately, up to you; all we need to know is how open or restricted you would like your home’s access. That being said, I highly recommend personalizing the experience for the people who have booked an appointment – after all, their time is valuable too! Let’s sit down and discuss what type of access might make sense for both parties in this situation.

Provide Tips for Making Your Home Visitor Friendly - Suggest tips for making your home as friendly and inviting as possible in order to encourage potential buyers to purchase it.

When it comes to making your home visitor friendly and inviting to potential buyers, there are a few tips that can help. A great way to make your home inviting is by sprucing up the front of your house with landscaping and decorations, such as bright flowers and a splash of color on the door. Additionally, when buyers come to view your home, make sure all areas are organized and clean so they get an accurate impression of the house. This includes dusting off shelves and clearing kitchen counters of excess items. Lastly, if you allow potential buyers in, consider removing any personal photos or décor items that wouldn’t otherwise stay in the house. Small touches like this will create a lasting impression on potential buyers and give them the final push towards buying your beloved home!

Summarize the Benefits of Open Access - Summarize the benefits of allowing open access during showings, such as helping them get a good feel for the property quicker than if they had limited access.

When it comes to showings, there are a few options when it comes to allowing potential buyers access to your home. Giving buyers open access allows them the opportunity to view all of your home's features at once, giving them an overall feel for the property quicker than if their access was limited. Allowing open access helps them envision themselves in their potential new home which can lead to them considering an offer sooner - which should always be the ultimate goal!

In conclusion, access to a home is an important part of the home-selling process. Having convenient and ample access allows potential buyers to view your home at their own pace and gives them an excellent opportunity to explore the property and imagine what it would be like to live in the house. On the other hand, having limited or no access can create issues for potential buyers and make them feel like they’re not getting enough time to decide if this is really the house for them. That’s why it’s important to consider what type of access you want to provide as well as any limitations when selling your home. Providing open access during showings will help potential buyers get a better understanding of the property quickly, potentially increasing your chances of making a successful sale. Additionally, making sure your house is visitor friendly with cleanliness, minimal clutter and good lighting will help create a positive impression among potential buyers from the very first showing. Taking these tips into consideration when deciding how much access to give during showings will help increase your chances of finding a buyer in no time!

4-12-2023

Decoding the Housing Market: Is it Time to Buy or Wait?

The ebb and flow of the housing market can be complex, leaving potential buyers pondering the ideal time to make their move. Recent trends indicate a dip in home prices since their peak in June last year, sparking whispers of an impending price crash. This might lead some to postpone their buying decisions, in the hopes of a significant price reduction. However, this strategy may not be as fruitful as it appears.

In a recent study by Zonda, it was revealed that 53% of millennials are choosing to continue renting, anticipating a further drop in home prices. However, the actual scenario might be different. Current statistics suggest that home prices have found their footing and are slowly beginning to ascend again. Selma Hepp, the Chief Economist at CoreLogic, highlights:

"February witnessed a 0.8% hike in U.S. home prices, which indicates that most markets have likely witnessed the lowest point in prices." This shift is not an isolated observation. Data from Black Knight also echoes a similar sentiment. The chart below juxtaposes the home price trends from November with those from February:

Thus, the question arises: Should one continue to wait for home prices to plummet further? According to expert analysis and data trends, it may not be wise to do so. In contrast to a decrease, we're observing a price augmentation in a considerable portion of the country. Further, the latest predictions from the Home Price Expectation Survey foresee home prices climbing steadily and reverting to more conventional levels of appreciation post-2023. To gain a comprehensive understanding of the local real estate trends, it's advisable to collaborate with a local real estate expert who can offer valuable insights and professional advice.

Key Takeaway

Postponing your home-buying plans in the hopes of a drastic price drop may not be the most beneficial course of action. Understanding the nuances of our local housing market can help make a more informed decision. Let's connect to delve deeper into what's transpiring in our real estate scene, and ensure you're well-equipped to make the right call.

4-10-2023

Embracing the Spring Surge: A Fresh Outlook on the Real Estate Market

As the spring sun thaws the winter chill, the real estate landscape, too, begins to bloom with fresh possibilities. A blossoming influx of buyers, previously held at bay by escalating mortgage rates, is a promising omen for those planning to sell their homes. According to the latest insights from Realtor.com, the sprouting of new leaves mirrors the growing interest of buyers, albeit with a slightly lower intensity compared to the same season the previous year.

Mortgage application statistics provide a valuable lens to assess this rising trend. What is a mortgage application, you ask? As stated by Investopedia, a mortgage application is a formal request submitted to a lending institution when a buyer decides to finance their home purchase.

So, why does an increase in mortgage applications signify an uptick in buyer interest? Simply put, the more the applications, the higher the number of prospective homebuyers. Interpreting these numbers, Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association (MBA), indicates that application activity witnessed a surge as mortgage rates began to dip in March.

In the grand scheme of things, mortgage rates and applications exhibit a see-saw effect. As rates escalated sharply last year, applications took a nosedive, as visually demonstrated in the graph below.

The recent revival in mortgage applications, complemented by a downward trend in mortgage rates, paints a favorable picture for sellers. A growing number of buyers are casting their nets wide in search of their dream homes.

The Impact on You

Spring is traditionally the peak season for real estate transactions, and this year, the market looks promising for those contemplating selling. Realtor.com suggests that if you're a homeowner contemplating a 2023 sale, it's high time to set the gears in motion.

Maximizing your home's appeal and listing it at the perfect price point requires expertise - an asset best found in a local real estate agent. By aligning with an agent, you can ensure your home is spruced up and priced right to catch the eye of the increasing buyer population this spring.

The Key Takeaway

Spring is ushering in a vibrant climate in the real estate market. If you've been toying with the idea of selling your house, this resurgence in buyer activity is a sign you might want to seriously consider making your move. Let's tap into this opportune moment together, and make your real estate dreams a reality.

4-7-2023

April 2023 Newsletter

Asking for financial advice can be uncomfortable, so here is an alternative! Here are five fantastic resources that will aid you in bettering your money management skills no matter what age or stage of life. In this newsletter, learn about how these helpful guides will broaden your knowledge and make a real difference in the way you manage finances!

In addition, you'll uncover why wearing the wrong shoes can cause more destruction than just sore feet, discover common mistakes that novice landlords make and how to evade them, as well as learn useful tips for mastering a new language even if you're an adult. Not to mention fascinating facts about foreign places, amazing trivia challenges and much more!

I am here and ready to listen whenever you need me. My door is always open! If you or anyone else in your life needs a trustworthy and knowledgeable real estate professional for buying or selling, don’t hesitate to call me.

Your friendship is deeply valued, and I'm truly grateful for your referrals. I hope you enjoy this issue!

Warmest regards,

Bill Watson

President / Managing Broker

Your Home Sold Guaranteed Realty - The Watson Group

6155 S Main Street, Suite 270

Aurora, CO 80016

720-463-0002

bill@watsonrg.com

www.yourhomesoldguaranteedrealtyco.com

P.S. In the upcoming weeks, if you spot conversations about real estate, let them in on my complimentary consumer information! Sharing this invaluable resource can be a great help to anyone interested in real estate.

Don't despair if you've struggled to sell your home in the past. Check out this report for "10 tips to help you quickly sell your home and get the best price". If anyone else would benefit from these essential insights, please don't hesitate to share my contact information with them!

SELL YOUR HOME FAST and for TOP DOLLAR! Get this FREE Report that

Reveals 27 Tips to Give You the Competitive Edge! www.Our27Tips.com

Improve Your Financial Literacy

Financial literacy may feel like an unreachable goal if you’re not an accountant, but it’s easier than ever to enhance your own financial knowledge and money management skills—regardless of what stage of life you’re in.

Here are five ways you can build your personal finance know-how:

- Browse thepersonal finance bookssection of your local library or bookstore. Check out Business Insider’s picks (businessinsider.com/personal-finance/best-personal-finance-books) for the best personal finance books of 2023.

- Plug into afinancial podcast. There are many to choose from, geared toward people at different financial life stages. This US News list (money.usnews.com/money/personal-finance/saving-and-budgeting/articles/best-personal-finance-podcasts-to-listen-to) of finance podcasts breaks their picks down so you can find the one for you.

- Take afinancial literacy class. Some employers offer free seminars on personal finance (and other topics) for employees, and community colleges often have similar non-credit courses available. There are even online classes you can take—some of which are free, like the finance section of Khan Academy (khanacademy.org/economics-finance-domain/core-finance).

- Check out thefederal government’s online educational tools. The Consumer Financial Protection Bureau’s website (consumerfinance.gov/consumer-tools) has guides on financial goals, like paying for college and saving for retirement. And on the Financial Literacy and Education Commission’s site (mymoney.gov), you’ll find financial planning information for major life events (like the birth of a child) as well as tools such as budgeting worksheets.

- Hire aprofessional financial advisor. Even if you don’t want to outsource this part of your money management permanently, hiring a financial coach to get started can give you the tools you need to confidently manage your own finances in the long run. Their advice is tailored specifically to your financial situation and goals, and you’ll have plenty of opportunities to ask questions along the way.

Subscribe to Our Newsletter

HIGHLINE EAST AT DAYTON TRIANGLE

The Highline East at Dayton Triangle community by Montano Homes offers brand new paired homes that are ideal for people looking to move into a vibrant and dynamic neighborhood. With 3 bedrooms, 3.5 bathrooms, private yards and designer selected finishes combined with their affordable prices starting from the mid $600s, these Colorado Contemporary townhomes make this an incredible place to call home! Plus it's located close to Downtown Denver, DTC shopping centers and parks—what more could you want?

See What Our Amazing Fans Have to Say

Visit www.OurAmazingFans.com

Are Shoes Ruining Your Feet?

When it comes to diagnosing what’s causing sore feet, there are a few things that might seem obvious. High heels, for instance, are famously bad for our feet. By concentrating most of your body weight on the ball of your foot, high heels can cause painful bunions and ingrown toenails.

But, perhaps surprisingly, there are also foot problems to contend with at the other end of the shoe spectrum, too. Without proper arch support, even a comfy pair of slippers or sneakers can lead to a condition like plantar fasciitis.

Whatever type of shoes you prefer, it’s important to understand what those shoes might be doing to hurt—or help—your whole body. When choosing footwear, consider:

- Arch support:The right insoles help alleviate foot pain and keep your whole skeletal structure aligned. If your feet aren’t aligned well, every bone above it is off kilter. You can buy orthotic insoles if your shoes don’t have any arch support built in.

- Shoe size:You probably haven’t had your shoe size checked since you were a kid, but it’s worth checking again—especially if you’re experiencing foot pain. Our foot size and shape can change over time.

- Toe box:Forcing toes into narrow or pointed toes can cause long-term structural damage to the bones in your feet. Look for shoes with a wider toe box to more accurately accommodate the natural position of your toes.

Some barefoot activity is generally agreed to strengthen feet, like yoga or workouts on a mat. Most experts agree that it’s still best to wear supportive shoes most of the time.

Talk to a podiatrist or an orthopedist about exercises you can do to strengthen your feet and help them recover from any footwear-related injuries you may already have.

Find out the value of your home by answering a few simple questions. By providing your address and home description, the system will produce a complete market analysis through a search for similar homes sold and listed in your area.

3 Common Landlord Mistakes

Rental property investments can be financially rewarding. But they can also open the door to a long list of potential problems for new landlords.

Here are three mistakes new landlords often make, and how to avoid them:

- Skipping the screening process.Running a credit check on potential tenants helps you avoid what could be costly surprises down the line. You may also want to run background checks. Either you or the potential renter will need to pay for these reports, but it’s a small price to pay for peace of mind.

- Assuming you’ll always have tenants.Even in high-demand markets, there’s always some time between when a person moves out and a new one moves in, and that’s time when you’re not receiving rent payments. Experts suggest having a savings account with about three months’ worth of rent in it to cover these gaps.

- Getting the wrong insurance.If the insurance you have on your rental property is inadequate or, worse, entirely the wrong kind of coverage for a rental, you’ll be in hot financial waters when faced with property damage. Talk with your insurance agent to be sure you have the appropriate types of coverage for a rental.

- Also, be sure to learn about what tenant qualification criteria are prohibited under the Fair Housing Act:

hud.gov/program_offices/fair_housing_equal_opp/fair_housing_act_overview

AT MURPHY CREEK

Experience the perfect home at Montano Homes' Elevations at Murphy Creek. This central master-planned community grants easy access to DIA, shopping, and gourmet dining near Southlands Mall. Not only that but it is situated next to one of Colorado's finest golf courses - a links style course! With its 3 bedroom Colorado Contemporary Paired homes, you can definitely call this place your own little paradise. Welcome home to Elevations at Murphy Creek by Montano Homes!

Find out how this changing market has affected your home value! Your home may be worth more than you think.

Visit www.AccurateHousePrice.com or Call Us at720-463-0002.

This is a FREE service with NO OBLIGATION to list.

Language Study Tips for Adults

While tackling a new language as an adult may seem challenging, it turns out that adults can become fluent in a foreign language about as quickly as children do. (And that’s good news, because there’s evidence that learning a language as an adult may help delay the onset and severity of dementia.)

A 2018 study concluded that although we’re more apt to reachnative-levelfluency if we start young, adults are just as capable of mastering a new language. It might take a decade or more for adults to achieve native-level fluency, but we can reach incredibly high levels of comprehension in as little as 1-3 years of language learning. What’s more, adults may even be better at certain aspects of language learning than kids are, since our attention spans are longer and our ability to focus is greater.

Community colleges often have language classes, which are a great way to get started. Interacting with instructors in person gives you valuable feedback you can’t get from an app or website. Conversation groups and language exchanges are extremely useful for building and practicing your skills. Look atMeetUp.comto find conversation groups in your area, or check language exchange sites likeitalki.com,TalkAbroad.com, andHelloTalk.comto get one-on-one video call time with a fluent speaker of the language you’re learning.

Studies have shown your income and wealth are directly related to the size and depth of your vocabulary. Here is this month's word.

impugn(pronounced im-PYOON) verb

Meaning:to dispute or challenge the validity of something; to question

Sample Sentence:He impugned my ability to handle the new job responsibilities in front of our boss, probably because he was angry he hadn’t gotten the job.

What does a house wear?

Address

Subscribe to Our Newsletter

Not Ready to Sell? Text your address to 720-605-1268 to find out what your home will sell for today. You will not receive a phone call, just a text!

Transform Your Dream of Homeownership into a Reality

A recent Harris Poll survey revealed that8 out of 10 Americansconsider buying a home to be an essential goal, with 28 million even aiming to purchase within the next year. It's easy to see why as homeownership offers both financial and nonfinancial rewards alike - making it desirable for many people. . .

Repurpose Old Sweaters

If a beloved sweater gets too worn to wear anymore, it can still be useful with a needle, thread, buttons, and a little creativity. Here are a few ways to give your old knits new life.

- Make a cozy pillowcase out of the body of a sweater, sewing arm and neck holes closed and stuffing with a pillow insert.

- Reinforce the cut end of each sleeve to quickly turn them into leg or arm warmers.

- Fill sewn-closed sweater squares with rice, then heat in the microwave or keep in the freezer for a homemade heat or ice pad.

A Heartfelt Message to our Special Clients and Friends . . .

It is our pleasure to extend a warm welcome to all of the new clients we have had the honor of working with recently, and also offer special thanks to those who referred them. Our business would not be where it is today without your help!

Recently Sold Properties

by The Watson Group

Blackstone

Sold for $1,425,000!

Murphy Creek

Sold for $665,000!

Cross Creek

Sold for $449,999!

Mesa

Sold for $500,000!

Rowley Downs

Sold for $621,900!

Cottonwood

Sold for $501,400!

Real Estate Corner . . .

Q: How do I find the right house for me?

A:Make a wish list of everything you would like to have in a new house.Then make a list of everything you don’t like in your current home.These two lists will give you a good idea of where to start, and help you analyze your needs.

Buying a home requires making some compromises. You may not get everything you want, but make sure to get what you need. For example, when buying a home, the neighborhood should be your main consideration. Is the house in a neighborhood that you like and feel safe? Will you have a reasonable commute to work? Does it have a good school system? (Not only is this important if you have children; it will impact the resale value of your home down the road.) Does the area have the amenities that you’re looking for (parks, stores, and library) within a few miles?

Want to learn more? Ask for my Free Consumer Report called“3 Secrets For Saving Thousands When Buying.”I’ll send a copy right over to you.

Do you have a real estate question you want answered? Feel free to call me at720-463-0002. Perhaps I’ll feature it in my next issue!

Want to Win a $25 Starbucks Gift Card?

Last month's trivia question answer.

Which is the loudest animal on earth?

(a) Lion (b) Hyena (c) Whale(d) Cicada

The answer is (b) Whale. The clicks made by whales have been recorded at 230 decibels (dB). A loud rock concert is about 115 dB, and the sounds from a whale are two-and-a-half times as loud!

Now for this month's trivia question!

What award-winning actress was nominated for a "Worst New Star" Golden Raspberryfor her very first feature film role?

(a) Helen Mirren (b) Kristin Scott Thomas(c) Maggie Smith (d) Judy Dench

Call Me at 720-463-0002 or Email Me at bill@watsonrg.com

and You Could Be One of My Next Winners!

4-5-2023

CATEGORIES: Newsletter

What is the Reason for the Home Prices Not Crashing

Last year, mortgage rates rose to historic highs and home prices peaked after several years of rapid price appreciation. So why aren't we seeing a crash in the market like what most people expected? With so many external forces pushing against it, how is the real estate market able to remain steady during this tumultuous period? In this blog, we'll analyze all the possible causes for why there isn't a dramatic drop in home values—and explore whether it’s good news or bad news for homeowners. Keep reading to learn more about what's really going on in the world of housing today!

Recently, there have been significant changes in the housing market. The rise in mortgage rates over the past year has affected many people's ability to purchase homes. Also, the market experienced a peak in home prices last summer after rapid price appreciation in previous years. This situation generated headlines speculating that prices would eventually crash.

Although the buyer frenzy that caused an increase in home values during the pandemic has ended, national home prices have remained relatively stable. Lawrence Yun, the Chief Economist at the National Association of Realtors, predicts that this trend will continue and that there will only be a slight alteration to the national median home price.

Some people may expect sellers to reduce prices in the current market to attract buyers. However, low inventory is also a significant factor. According to Yun, low inventory is preventing prices from dropping too much. Although some markets may experience price declines, a repeat of a 30 percent price decline is unlikely due to insufficient inventory. The graph below shows that inventory levels have been at or near record lows for several years.

The shortage of homes for sale is causing prices to increase. Bankrate explains that this is the reason buyers have to offer more money to buy a home and it also means that prices are unlikely to decrease anytime soon due to the law of supply and demand.

What's driving the current market - an analysis of mortgage rates and trends

The current state of the market is a topic that is on the forefront of many people's minds. Mortgage rates and trends are key drivers of this market and are worth examining in closer detail. Overall, mortgage rates have been steadily increasing over the past few years, and this has had a noticeable impact on the housing market. First-time homebuyers are finding it more difficult to secure a mortgage, which has caused a slowdown in house sales across the country. However, with interest rates still near historic lows, many are finding that now is still a good time to buy. It's clear that mortgage rates and trends will continue to play a significant role in shaping the market, and it will be interesting to see how they evolve over the coming years.

According to industry expert Rick Sharga, if more homes don't become available on the market, prices will not decrease significantly due to a lack of supply. Unfortunately, inventory is not expected to increase significantly this year and low inventory is expected to continue affecting the housing market through 2023.

Due to their substantial amount of equity at present, sellers don't feel compelled to relocate. This equity provides a safeguard for homeowners, minimizing the likelihood of distressed sales such as foreclosures and short sales. Additionally, with many homeowners tied into low mortgage rates, this equity safeguard is expected to continue.

In the current market where there are limited homes for sale, it is vital to collaborate with a reliable real estate agent who has knowledge about the local area and can navigate through fluctuations in the market.

The impact of changing consumer preferences - exploring how millennial buyers are influencing the market

The world of commerce is constantly evolving, and in recent times, the driving force of these changes has been shifting consumer preferences. And at the forefront of this shift is a generation that makes up a significant portion of the population - millennials. As they begin to enter the market, their buying habits have begun to greatly impact the market, forcing businesses to adapt or risk being left behind. No longer content with just the product or service, millennials want brands that align with their values and are willing to pay a premium for it. Companies that prioritize sustainability, ethical sourcing, and social responsibility stand to gain this generation's loyalty. The influence of millennials on the consumer market is a force to be reckoned with, and it is only set to grow stronger in the coming years.

Examining global economic dynamics - why overseas investors are still drawn to American real estate

In a constantly evolving global economy, overseas investors have been drawn to American real estate for decades. Despite fluctuations in the economy and political turmoil, the U.S. property market consistently proves to be an attractive option for foreign buyers. Some reasons for this include the stability of the U.S. government and its regulatory systems, as well as the country's continued cultural and economic influence. Additionally, American real estate offers investors a relatively low-risk investment with the potential for high returns. With its diverse market and stable demand, it's no surprise that foreign investors continue to look towards the U.S. for real estate opportunities.

What this means for buyers and sellers in 2020 and beyond - projecting where the market is headed in the near future

The real estate market is always in a state of flux, with ups and downs that can affect both buyers and sellers. As we look ahead to 2024 and beyond, it's important to understand where the market is headed, and how these projections will impact you. For buyers, this could mean a shift towards more affordable options as the market stabilizes, or a continued focus on properties with long-term potential in up-and-coming neighborhoods. For sellers, it could mean adapting to new market trends and finding creative ways to attract buyers in a competitive market. Whatever your situation, staying informed about the evolving real estate landscape can make all the difference.

Due to insufficient houses available for sale, contrary to what many expected, prices are not dropping this year despite low buyer demand. If you plan to relocate this spring, feel free to reach out to us.

4-5-2023

Reasons to Consider Selling Your House

Are you considering selling your current house and entering the housing market again? There are plenty of valid reasons to take this step, from situational changes to economic benefits. As a homeowner, it's important to weigh both sides of this decision thoroughly before taking action. In this blog post, we'll discuss two compelling reasons why you should consider selling your home: increasing property values and adjusting lifestyle needs. Let’s explore each in more detail so you can make an informed decision that is right for you and your family!

Before making a decision, consider your motivation for moving. According to a recent survey by realtor.com, the top two reasons homeowners are thinking about selling their houses this year are listed below in the graphic.

Let's examine each of those reasons in detail and see how they could possibly relate to you.

Analyzing the Current Market - understand how the current market conditions could play into your decision to sell and take advantage of potentially higher profits

The current market conditions are an essential factor that every seller should consider carefully. Understanding the market trends, the competition, demand, and supply can help you make an informed decision and maximize your profits. With the right strategy, you can leverage the market's strengths and avoid its pitfalls to sell your products or services successfully. That is why it is crucial to analyze the current market and evaluate your options thoroughly. You must be aware of the factors that impact your industry and plan accordingly. Whether you decide to wait for a better market or enter now, keeping a close eye on the market can help you stay ahead of the game.

If you are thinking of selling your house, you may be wondering how much profit you can make. Fortunately, the latest data shows that sellers can expect a good return on their investment. According to ATTOM, the average profit on a median-priced home sale in 2022 was $112,000. This represents a return on investment of 51.4% compared to the original purchase price, which is a higher return than last year (44.6%) and even more than in 2020 (32.8%).

While some housing markets have seen a small drop in prices, overall homes are still significantly more expensive than they were a few years ago. To get a better understanding of the current value of your home and what's happening in your local market, it's recommended that you consult with a real estate professional. They can provide you with the most accurate information on how much you stand to gain if you decide to sell your home this year.

Evaluating Your Home’s Needs - assess how well your home meets your family’s needs and if it can no longer provide the space or amenities you need

Evaluating your home's needs is a crucial step in ensuring your family's comfort and satisfaction. By taking the time to properly assess your current living situation, you can determine if your home is still capable of meeting your family's needs. Are you outgrowing the space? Is the layout causing inconvenience? Are there necessary amenities missing? These are important questions to consider, as they can greatly impact your day-to-day life. It's important to be detailed in your evaluation and take note of any areas that may require improvement. Whether it be a renovation or a move, by understanding your home's strengths and weaknesses, you can make an informed decision to better suit your family's needs.

It's been found that on average, people remain in their homes for up to ten years. Considering the changes that may have transpired since moving in, such as an increase in family size, shift in preferences or a new job, your home may no longer meet your needs. Should this be the case, it might be time to collaborate with a real estate agent to discover a more suitable living arrangement.

Calculating Expenses - calculate what expenses might be associated with selling your house (e.g., realtor fees, closing costs, etc.)

When it comes to selling your house, it's important to calculate all the expenses that will be incurred during the process. This includes realtor fees, which can range from 5-6% of the sale price, as well as closing costs, appraisal fees, and title insurance. You'll also want to factor in any repairs or updates that need to be made before listing your home, as they can impact the final sale price. And don't forget about moving costs, which can add up quickly. By taking the time to calculate all of these expenses upfront, you can ensure that you're financially prepared for your home sale and avoid any unwanted surprises along the way.

Researching Potential Buyers - research potential buyers to determine who is most likely to make an offer that fits within your budget

If you are buying a home, researching potential buyers is an essential step in the process. By focusing your efforts on those who are most likely to make an offer that fits your budget, you can save yourself valuable time and energy. But how do you go about identifying these potential buyers? It all starts with understanding your target market, including factors like their income level, employment status, and age. You can also use tools like online surveys and social media to gather information about your ideal buyer persona. Once you have a solid understanding of who you're targeting, you can start tailoring your marketing efforts to reach them more effectively. By taking the time to research potential buyers, you'll be well on your way to finding the perfect buyer for your home.

Identifying a New Home - identify a new home that meets all of your family’s requirements and has the potential for investment gains in the future

Whenidentifying a new home for your family, it's important to be thorough and consider all of your requirements. Start by determining your budget and preferred location, taking into account factors like schools, safety, and proximity to amenities. Think about the size and layout of the home, as well as any specific features you may need, such as a home office or outdoor space. Once you've narrowed down your options, it's a good idea to consult with a real estate agent who can provide expert guidance and insights into potential investment gains in the area. Ultimately, finding a new home that satisfies your family's needs and has the potential to appreciate in value over time requires careful research and consideration.

Calculating Moving Costs - calculate how much it will cost to move out of your current home and into a new one

Moving can be exciting, but it can also be stressful with all the packing, cleaning, and organizing involved. One of the biggest concerns people have when moving is how much it will cost. It’s important to calculate your moving costs before you start so you can budget accordingly. You’ll need to consider factors like the distance of your move, the size of your home and how many belongings you have, whether you’re hiring professional movers or doing it yourself, and other expenses like packing supplies, insurance, and utility fees. Taking the time to calculate your moving costs will help you avoid surprises and ensure a smoother transition to your new home.

Making the choice to move can be a stressful and difficult decision. However, with a certain set of criteria in place, such as analyzing the current market, evaluating your house's needs, calculating expenses, researching potential buyers, identifying a new home and calculating moving costs, you will be better equipped to make an informed decision on whether it is the right time to relocate. Take your time weighing each aspect of the relocation process and know that if now isn't the ideal time for you and your family then taking some extra time to gather more information may provide more clarity in the future. Once you have done sufficient research and feel confident about making the investment in relocation you will be one step closer towards creating an improved lifestyle for yourself and family.

If you're considering selling your house, chances are you have a specific goal in mind. Contact us so we can work together to achieve that goal this year.

4-3-2023

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans