Our Blog

Recent:

Selling Your House Your Asking Price Matters More Now Than Ever

While the housing market has calmed down, it doesn't suggest that you should take a step back in selling your house. In fact, there are many benefits for homeowners who want to selltheir current homeand find their dream home. Theimportant thing is getting an accurate understanding of where prices currently stand so you can make more informed decisionsand to alsoavoid any surprises during the process.

Home prices still rise, but they're climbing at a slower rate because of rising mortgage interest rates. This suggests more homes are available and therefore the way you price your house matters even more now as competition among buyers increases for affordable properties.

Why Today’s Housing Market Is Different

The pandemic created an environment where sellers could price their homes higher than normal and still find buyers because the supply was so low. That's not the case this year, we are seeing a shift in the market. This means that we are seeing less buyer demand and sellers need to recognize this change and adjust their approach.

Why Pricing Your House at Market Value Matters

The message you send to potential buyers when pricing your house is crucial. If the price seems too high, it may deter them from buying or making an offer on your property.

When you start lowering the price of your home in an effortto reignite interest from buyers, be aware that this may backfire. Reducing prices too far can signal either overvalued properties or poor-quality control. This may risk prospective buyers to not buy your home!

If you want to avoid the headache of having your price lowered, it's important that from day one, when pricing out real estate, you find an asking price that balances what buyers are looking for with current market trends and demand. There's no perfect solution. When determining what it will take to sell your home, you'll need to balance allthese factors: value in the neighborhood; current trends and buyer demand for home like yours (condition); as well as market conditions. A professional's advice is invaluable during this process. Your Home Sold Guaranteed Realty - The Watson Group knows exactly which aspects matter most when assessing the market value of your home.

Subscribe to Our Newsletter

When you price your house fairly based on market conditions, there's a greater chance that it will sell quickly. You may also receive more offers which leads to the best possible outcome for both parties involved in the process!

The best way to make sure your house sells quickly and at a fair price is by consulting with an experienced real estate agent. We can help you evaluate the current market conditions and offer you the best advice on how much someone is willing to pay for a home like yours, which will increase your chances of getting multiple offers.

Why You Still Have an Opportunity When You Sell Today

You can rest assured that it is still a sellers' market, and you will benefit greatly by planning ahead with the help of an agent to set a price at current market values.

Bottom Line

We know how competitive the housing market is today and we want to help you get your home sold as fast as possible. Contact us at 720-463-0002, so that we can provideexpert guidance on pricing for buyers who are looking at homes like yours!

8-12-2022

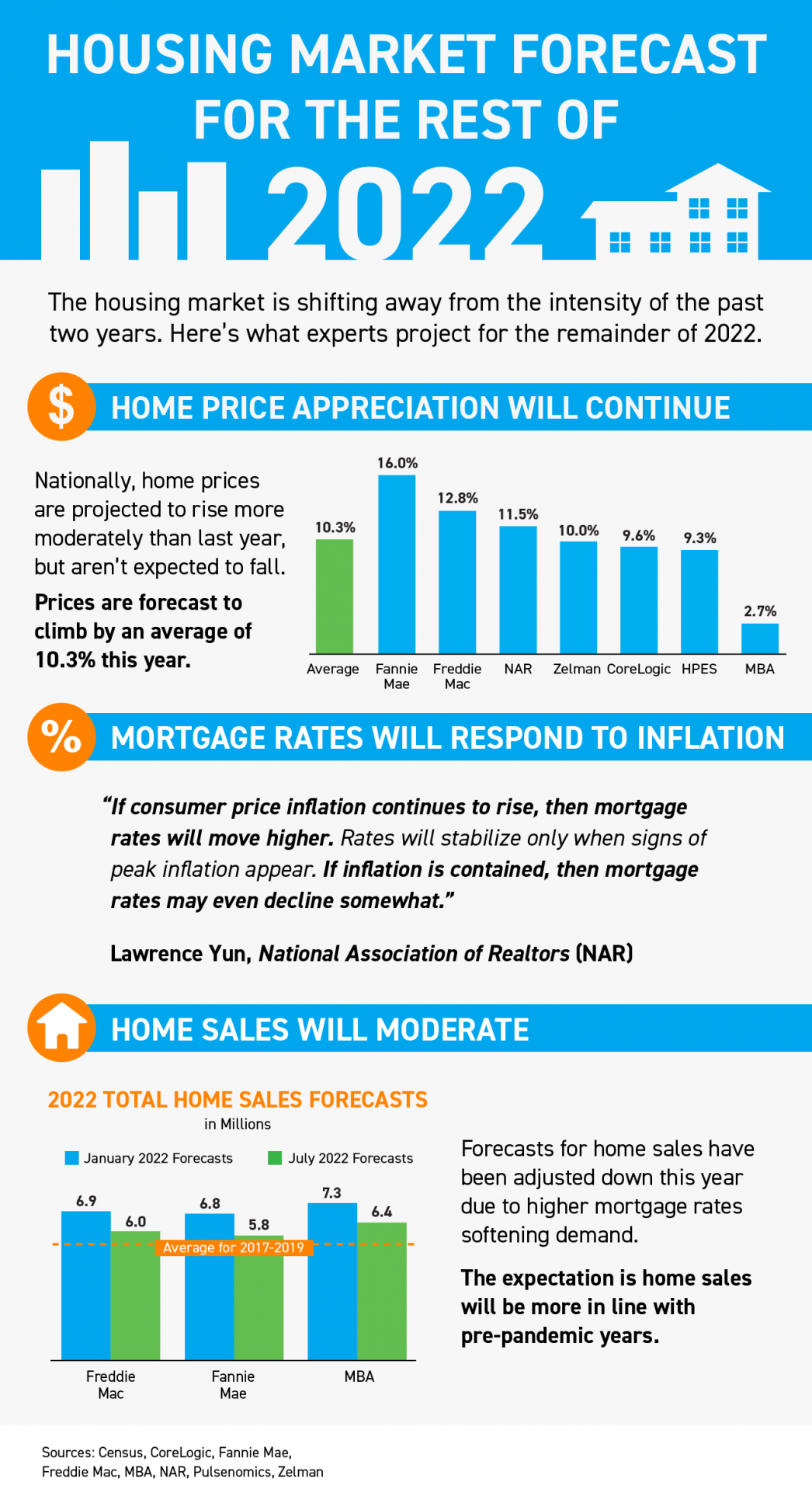

Housing Market Forecast for the Rest of 2022 INFOGRAPHIC

The market will continue to cool down as we move closer to the end of the year. Fewer people are buying and selling homes, so prices are dropping and inventory is rising. This could be a good opportunity for those looking to buy a home, but it's important to do your research and be prepared for a long process.

Some Highlights

- The housing market is shifting away from the intensity of the past two years.

- Home prices are forecast to rise slowly compared to last year. Home sales will become similar to pre-pandemic years and inflation will affect mortgage rates.

- Connect with us to start your move.

8-5-2022

Seller Resources

Your Home Sold Guaranteed Realty understands the effort it takes to sell a house. To make your life easier, we have compiled these valuable resources for you - completely FREE of charge! MORE

Buyer Resources

At Your Home Sold Guaranteed Realty, we are dedicated to making the process of buying a new home stress-free. To ensure your comfort, convenience and peace of mind throughout your search for a property, we have assembled an extensive selection of resources tailored to fit every person's unique needs - all complimentary and without obligations! MORE

Click to see our 5 Star Reviews from our Amazing Fans

Click to see our 5 Star Reviews from our Amazing Fans